Get the free CERTIFICATE OF FUEL TAX EXEMPTION

Show details

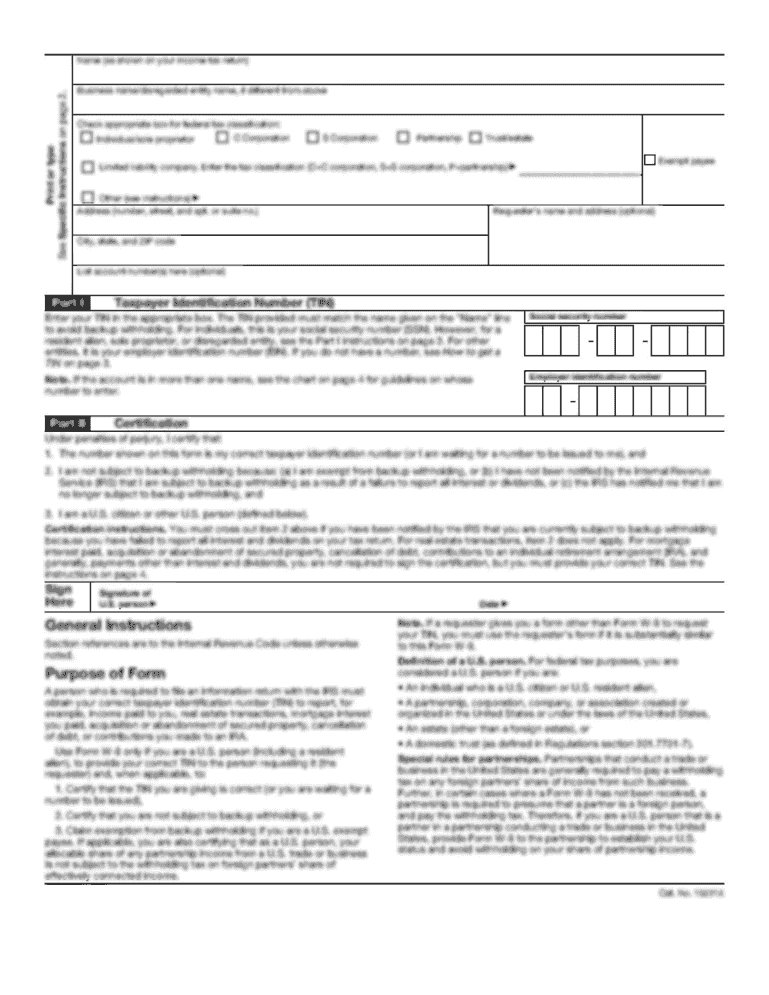

This document serves as a certificate for exempt sales of gasoline and undyed diesel fuel in Wisconsin, allowing eligible parties to make tax-exempt purchases for specific uses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of fuel tax

Edit your certificate of fuel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of fuel tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of fuel tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate of fuel tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of fuel tax

How to fill out CERTIFICATE OF FUEL TAX EXEMPTION

01

Obtain the CERTIFICATE OF FUEL TAX EXEMPTION form from the appropriate agency or download it from their website.

02

Fill in your complete legal name or the name of your business in the designated section.

03

Provide your business address, including city, state, and zip code.

04

Include your phone number and email address for contact purposes.

05

Indicate the type of entity (individual, corporation, etc.) and provide any relevant identification numbers, such as a tax ID.

06

Specify the purpose of exemption, detailing how the fuel will be used within the exempt categories.

07

Sign and date the form to certify that the information is accurate and true to the best of your knowledge.

08

Submit the completed form to the appropriate tax authority or agency as instructed.

Who needs CERTIFICATE OF FUEL TAX EXEMPTION?

01

Businesses or individuals who use fuel for exempt purposes, such as agricultural activities, certain non-profit organizations, or government entities.

02

Transportation companies that operate vehicles primarily for exempt use.

03

Any entity that qualifies under state or federal laws for fuel tax exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax form for gas expenses?

The Form SCGR-1 and all related schedules must be completed and submitted to our office within three (3) years from the date of gasoline purchase before a refund can be considered. Schedules A and B/C are required with all claims for refund. Schedule D is required for claims utilizing the inventory method.

Who qualifies for fuel tax credit?

Businesses get a refundable credit for fuel used in a specific work-related activity with the Fuel Tax Credit. To qualify, you must: Own or operate a business. Meet certain requirements, such as running a farm or purchasing aviation gasoline.

What is a 720 form for fuel tax?

At its core, IRS Form 720 is a Quarterly Federal Excise Tax Return. It's a reporting mechanism for businesses paying excise taxes on specific goods and services, like gasoline, tires, and indoor tanning services.

Who is exempt from federal excise tax on fuel?

In order to qualify for tax-free treatment, the state or local government must purchase the fuel for its own exclusive use. State and local government entities may benefit from Internal Revenue Code Section 4221(a)(4). This section exempts these entities from the Federal motor fuel excise taxes.

Can I get a tax write-off for gas?

Yes, if you're self-employed or a small business owner, you can write off gas used for business purposes on your tax return. You can deduct gas in one of two ways: Actual expenses. Keep your receipts and detailed records of your gas purchases.

Who qualifies for the fuel tax credit form 4136?

In general, only the “ultimate user” of a fuel is eligible for a credit for untaxed use. In other words, if you weren't the one who burned the fuel, then you usually can't claim the credit.

Can I get a tax write-off for gas?

Yes, if you're self-employed or a small business owner, you can write off gas used for business purposes on your tax return. You can deduct gas in one of two ways: Actual expenses. Keep your receipts and detailed records of your gas purchases.

What is the tax exempt form for fuel?

Use Form 4136 to claim: A credit for certain nontaxable uses (or sales) of fuel during your income tax year. The alternative fuel credit. Aa credit for blending a diesel-water fuel emulsion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CERTIFICATE OF FUEL TAX EXEMPTION?

The Certificate of Fuel Tax Exemption is an official document that allows eligible entities to claim an exemption from fuel taxes for specific uses, such as agricultural, commercial, or governmental purposes.

Who is required to file CERTIFICATE OF FUEL TAX EXEMPTION?

Entities such as farmers, governmental bodies, and certain non-profit organizations that use fuel for qualifying purposes are required to file the Certificate of Fuel Tax Exemption.

How to fill out CERTIFICATE OF FUEL TAX EXEMPTION?

To fill out the Certificate of Fuel Tax Exemption, the applicant must provide their details, the type of fuel being exempted, the purpose of its use, and any relevant identification numbers required by the tax authority.

What is the purpose of CERTIFICATE OF FUEL TAX EXEMPTION?

The purpose of the Certificate of Fuel Tax Exemption is to identify and authorize tax-exempt transactions for eligible users, thereby reducing their fuel costs for qualifying uses.

What information must be reported on CERTIFICATE OF FUEL TAX EXEMPTION?

The information that must be reported includes the name and address of the exempt entity, the type and quantity of fuel, the intended use of the fuel, and relevant signatures to certify the accuracy of the information provided.

Fill out your certificate of fuel tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Fuel Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.