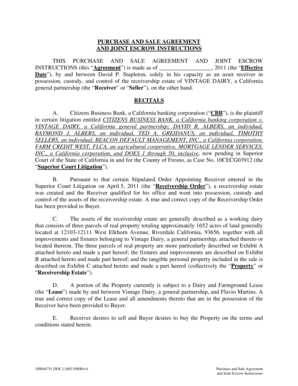

Get the free Credit Application Corporate Account

Show details

An application form for establishing a corporate credit account with Coco Brooks, collecting necessary business and contact information, and signature authorization for credit checks.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application corporate account

Edit your credit application corporate account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application corporate account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application corporate account online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit application corporate account. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

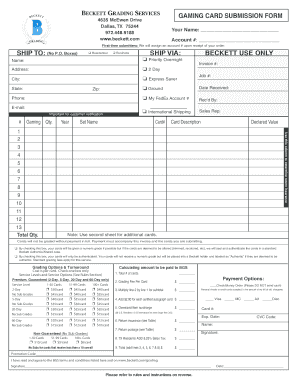

How to fill out credit application corporate account

How to fill out Credit Application Corporate Account

01

Begin by downloading the Credit Application form from the lender's website.

02

Fill in the business details, including the legal name, address, and type of business.

03

Provide the Tax Identification Number (TIN) or Employer Identification Number (EIN).

04

Include information about the owner(s) or principal(s) of the business, such as names and titles.

05

Enter the business's financial information, including annual revenue and any existing debts.

06

Specify the credit amount being requested and the purpose of the credit.

07

Review all information for accuracy and completeness.

08

Sign and date the application form.

09

Submit the application along with any required supporting documentation as instructed.

Who needs Credit Application Corporate Account?

01

Businesses looking to establish or expand their credit lines.

02

Companies that require financing for operational expenses or purchases.

03

Corporations wanting to streamline purchasing through credit arrangements.

04

Entities seeking to improve their cash flow management.

Fill

form

: Try Risk Free

People Also Ask about

What does type of account mean on a credit application?

Revolving, open-end and installment are the three main types of credit accounts. Each type of credit account can impact credit differently. But when they're managed responsibly, they can improve your credit scores. Credit cards are an example of revolving credit.

Does corporate credit affect personal credit?

If you are a corporate credit cardholder, your credit will likely not be affected. The issuer may check your credit before your company gives you a card, but the activity on the card (the outstanding balance and payments) is reported on the organization's credit report.

What personal credit score is needed for business credit?

Cards designed for excellent credit typically start around the 700 to 750 range. If your credit score falls between 580 and 669, you may still qualify for certain business cards, but they usually offer more basic capabilities. These cards often come with higher interest rates, lower credit limits, and fewer perks.

What is a corporate credit application?

A business credit application is a formal document that a company submits to a creditor when applying for a line of credit. This application provides essential information about the business and its finances, helping the creditor evaluate the company's creditworthiness and ability to repay the debt.

Who is eligible for a corporate credit card?

There are strict requirements for a business to qualify for a corporate credit card account. Companies will typically need to have annual revenue above $4 million, a minimum of $250,000 in annual expenses, and at least 15 authorized cardholders to be approved. The business will also need to have a good credit score.

What is the fastest way to build credit for an LLC?

1 – Establish and Register a Legal Business Entity. 2 – Set up the Business Phone Number and Address. 3 – Apply for an EIN from the IRS. 4 – Apply for a DUNS Number. 5 – Optimally Raise Venture Capital. 6 – Apply for Vendor Credit Accounts. 7 – Apply for Business Credit Cards. 8 – Make Timely Payments.

What is a company credit application?

A business credit application is a formal document provided to a creditor when applying for a line of credit. This application provides essential information about the business and its finances, helping the creditor evaluate the company's creditworthiness and ability to repay the debt.

What does corporate credit mean?

Corporate Credit, or Business Credit, is credit that is earned and assigned to a corporation or business rather than an individual person. This credit is essential in establishing and maintaining business or banking relationships with potential creditors, vendors, business partners, or even clients.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Application Corporate Account?

A Credit Application Corporate Account is a formal request made by a corporation to establish a credit account with a creditor, particularly when seeking to engage in financial transactions or purchase on credit terms.

Who is required to file Credit Application Corporate Account?

Typically, it is the corporation or business entity seeking credit that is required to file a Credit Application Corporate Account.

How to fill out Credit Application Corporate Account?

To fill out a Credit Application Corporate Account, a corporation needs to provide detailed information, including its legal business name, address, federal tax ID, contact details, financial statements, and credit references.

What is the purpose of Credit Application Corporate Account?

The purpose of a Credit Application Corporate Account is to assess the creditworthiness of the corporation, allowing creditors to evaluate the financial stability and reliability of the business before extending credit.

What information must be reported on Credit Application Corporate Account?

The information that must be reported typically includes the legal name of the corporation, address, nature of business, financial statements, bank references, trade references, and the names of company officers or owners.

Fill out your credit application corporate account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application Corporate Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.