Get the free Application for Lost Securities Bond

Show details

Esta es una solicitud para la obtención de un bono debido a la pérdida de valores, que permite a los propietarios reclamar sus derechos sobre valores perdidos.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for lost securities

Edit your application for lost securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for lost securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for lost securities online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for lost securities. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

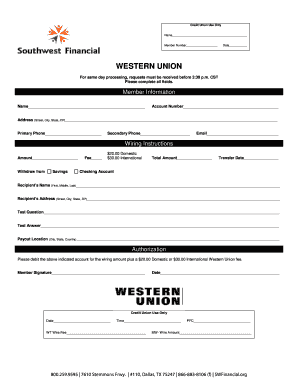

How to fill out application for lost securities

How to fill out Application for Lost Securities Bond

01

Obtain the Application for Lost Securities Bond form from the appropriate authority or website.

02

Fill in your personal details, including name, address, and contact information.

03

Provide details about the lost securities, such as the type of bond, account number, and any other relevant information.

04

Indicate the reason for requesting a lost securities bond.

05

Sign and date the application form.

06

Attach any required documentation, such as proof of identity or ownership of the securities.

07

Submit the completed application form to the designated office or authority.

Who needs Application for Lost Securities Bond?

01

Individuals or entities that have lost physical certificates of securities, such as bonds, and need to replace them.

02

Investors who require a legal declaration to initiate the process of claiming their lost securities.

03

Beneficiaries or heirs of a deceased individual who need to claim lost securities held by the deceased.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $200 000 bond cost?

The standard fee is 10% of the total bail amount. So, for a $200,000 bail, you would typically pay $20,000 to a bail bondsman. This fee is non-refundable, even if the charges are dropped or the defendant is found not guilty. However, it's important to consider additional costs that might arise.

How much does a $5000 surety bond cost?

$5,000 surety bonds typically cost 0.5–10% of the bond amount, or $25–$500.

How much does a $2000 surety bond cost?

In general, the premium you pay for any commercial bond primarily depends on the amount of the bond. For example, a bonding company might decide to charge you a 1% surety bond premium. That means a $2,000 bond would cost $20, and a $10,000 bond would cost $100 annually.

What is a bond application form?

The bond form is a legal document and must be accepted by all parties to the agreement. The bond form states the terms that the principal must adhere to. A commercial bond form will usually state the general terms of the bond and may also reference corresponding legal statutes.

What is the bond for a lost stock certificate?

The owner must buy an indemnity bond to protect the corporation and the transfer agent against the possibility that the lost certificate may be presented later by an innocent purchaser. The bond usually costs between two or three percent of the current market value of the missing certificates; and.

How does a lost instrument bond work?

Financial institutions often require lost instrument bonds before issuing a duplicate of a misplaced financial certificate. A lost instrument bond guarantees that if the original lost instrument shows up in the future the bonded party will not be able to cash it.

How much does a lost instrument bond cost?

A fairly typical cost guideline is $20 for every $1,000 of value of the lost instrument. If a promissory note for $50,000 was lost, you would probably have to pay in the neighborhood of $1,000 to the surety company to purchase a bond covering the amount of the certificate.

What is a lost securities bond?

A lost instrument bond or lost security bond is a type of surety bond required when you lose a financial document that represents a financial asset with real value and you want the document (and underlying asset) replaced.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Lost Securities Bond?

An Application for Lost Securities Bond is a legal document used to request a replacement for lost or stolen securities, such as bonds or stocks, typically involving a surety bond to protect the issuer from potential claims.

Who is required to file Application for Lost Securities Bond?

The registered owner of the lost securities or their legal representative is required to file an Application for Lost Securities Bond.

How to fill out Application for Lost Securities Bond?

To fill out the Application for Lost Securities Bond, one must provide detailed information including the description of the lost securities, the circumstances of the loss, personal identification information, and any supporting documentation as required by the issuer.

What is the purpose of Application for Lost Securities Bond?

The purpose of the Application for Lost Securities Bond is to legally establish the loss of the securities and to facilitate the issuance of a replacement while protecting the issuer from potential fraud or claims related to the lost securities.

What information must be reported on Application for Lost Securities Bond?

The information that must be reported on the Application for Lost Securities Bond includes the type and number of securities, details on how and when they were lost, the owner's contact information, and a declaration regarding the loss.

Fill out your application for lost securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Lost Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.