Get the free Micro Loan Application

Show details

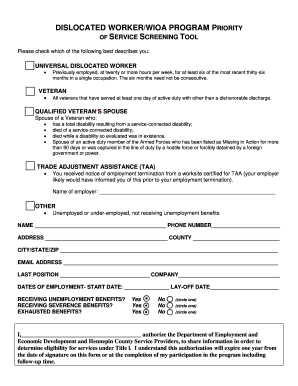

This document serves as an application package for individuals seeking a Micro Loan from CF Boundary, providing guidelines, eligibility criteria, and sections for personal, business, and financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign micro loan application

Edit your micro loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your micro loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing micro loan application online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit micro loan application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out micro loan application

How to fill out Micro Loan Application

01

Gather necessary documents including identification, proof of income, and business plan.

02

Download or obtain the Micro Loan Application form from the lender's website or office.

03

Fill out general information fields such as name, address, and contact information.

04

Provide detailed information about your business, including its structure, type, and purpose.

05

State the amount of the loan you are requesting and how you plan to use the funds.

06

Include personal and business financial information such as income statements, balance sheets, and cash flow projections.

07

Review the application for completeness and accuracy.

08

Submit the application along with any required supporting documents to the lender.

Who needs Micro Loan Application?

01

Small business owners seeking funding for startup costs or expansion.

02

Entrepreneurs requiring capital to invest in their business initiatives.

03

Individuals lacking access to traditional banking services needing financial support.

04

Non-profit organizations looking to fund community projects or initiatives.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of micro loan?

A Microloan is a small loan offered by financial institutions to low-income individuals or small businesses. It is designed to provide financial support for starting or expanding businesses, managing daily expenses, or meeting urgent financial needs.

How to write loan application in English?

By following these steps, you can ensure that your request is well-received and considered favourably. Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Assure the Lender of Repayment. Highlight Your Creditworthiness. Include Any Collateral (If Applicable)

Are micro loans a good idea?

It is a way to further diversify your income, and microloans generate cash flow returns. Microloans can often have higher rates of returns compared to other fixed-income investments. The downside to microloans is they may be riskier depending on the borrower's creditworthiness.

What is the meaning of micro loan in English?

mi·cro·loan ˌmī-krō-ˈlōn. plural microloans. : a small loan typically for financing entrepreneurial projects by impoverished individuals and groups especially in poor or developing regions.

What credit score do you need for a micro loan?

Unlike most other kinds of SBA loans, SBA Microloans have somewhat less stringent credit requirements, with a minimum credit score of between 620-640 typically required. Microloans can be issued in amounts up to $50,000, and, while the credit requirements might be less strict, collateral is still required.

What is another name for a micro loan?

Microfinance, also called microcredit, is a type of banking service provided to low-income individuals or groups who otherwise wouldn't have access to financial services. While institutions participating in microfinance most often provide lending — microloans can range from as small as $50 to under $50,000.

Are microloans hard to get?

Availability is limited: Since SBA microloans are offered by nonprofit intermediary lenders, these loans can be harder to find. These lenders don't have the resources and staff that larger lenders have, so these loans might not be available in your area.

What is an example of microloan?

Microloans come in all shapes and sizes, just like the businesses they support. Here are a few examples: Inventory Microloans: Let's say you run a thriving boutique and you've got a big sale coming up. An inventory microloan can help you stock up, ensuring you're ready to meet the demand and maximize your profits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Micro Loan Application?

A Micro Loan Application is a formal request for a small loan typically offered to low-income individuals or small businesses that require financial assistance to start or expand their operations.

Who is required to file Micro Loan Application?

Individuals or small businesses seeking financial support can file a Micro Loan Application, especially those who may not qualify for traditional loans due to limited credit history or income.

How to fill out Micro Loan Application?

To fill out a Micro Loan Application, applicants must provide personal or business information, financial details, the purpose of the loan, and any additional documentation required by the lender.

What is the purpose of Micro Loan Application?

The purpose of a Micro Loan Application is to facilitate access to financial resources for those who may lack sufficient capital to grow their businesses or improve their financial situation.

What information must be reported on Micro Loan Application?

The information that must be reported typically includes personal identification details, business information, income and expense statements, loan amount requested, and the intended use of funds.

Fill out your micro loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Micro Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.