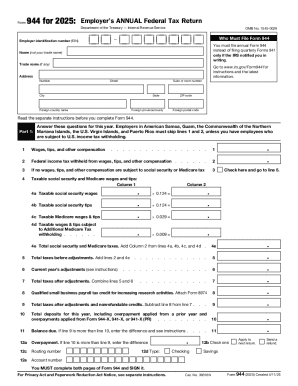

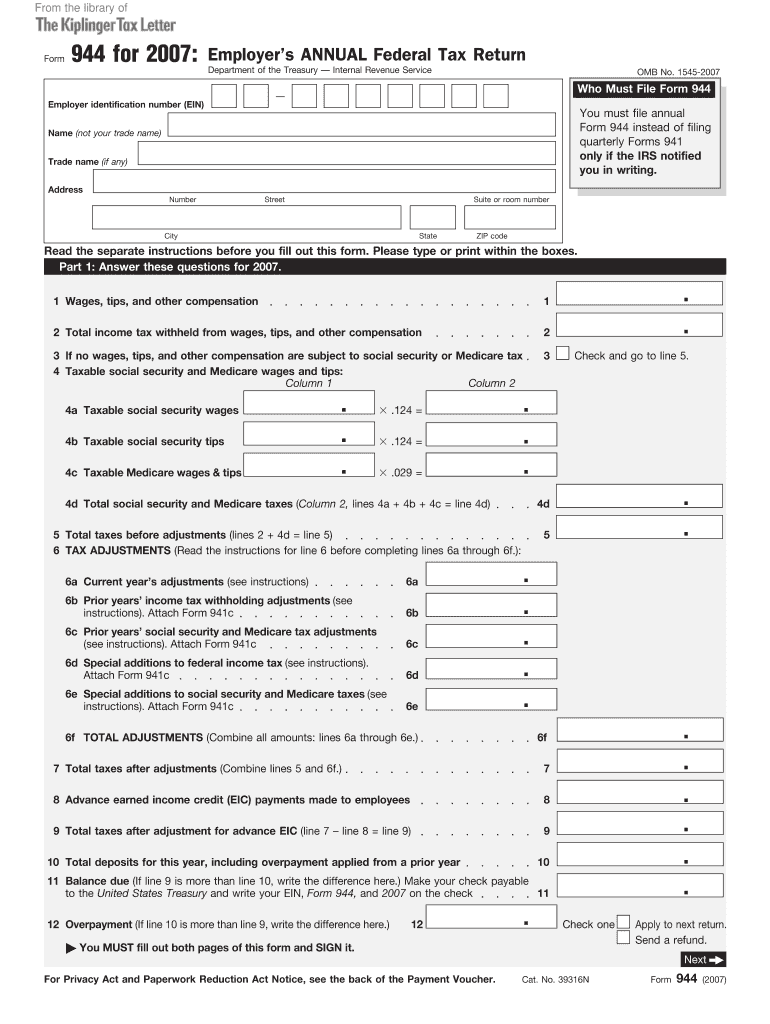

IRS 944 2007 free printable template

Instructions and Help about IRS 944

How to edit IRS 944

How to fill out IRS 944

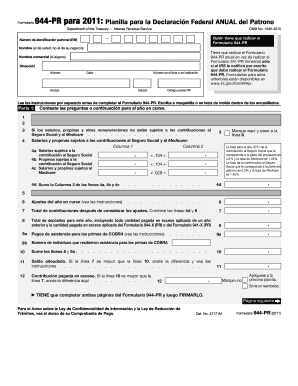

About IRS previous version

What is IRS 944?

Who needs the form?

Components of the form

What information do you need when you file the form?

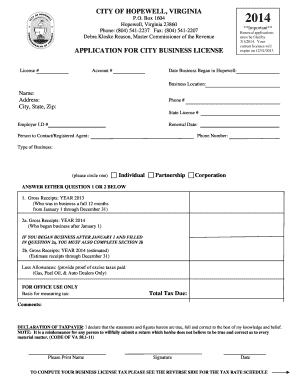

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

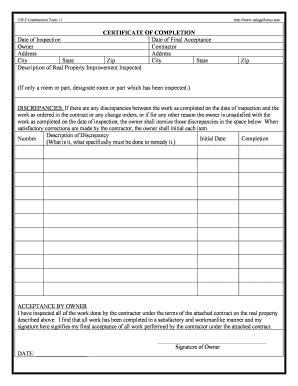

Is the form accompanied by other forms?

FAQ about IRS 944

What should I do if I need to correct an error after filing the 2007 2014 IRS form?

If you've filed the 2007 2014 IRS form and realize there's an error, you'll need to submit an amended return. It's essential to clearly mark the amended form as such and include any necessary explanations. Make sure to keep a copy of the original and amended forms for your records.

How can I track the status of my submitted 2007 2014 IRS form?

To track the status of your 2007 2014 IRS form, you can use the IRS's online tools or contact their support for updates. If you e-filed, you might also encounter specific rejection codes that provide insights into any issues with your submission. Always ensure you monitor these tools closely after submission.

Are there any special considerations for nonresidents filing the 2007 2014 IRS form?

Nonresidents filing the 2007 2014 IRS form should be aware of specific tax obligations that differ from residents. They may need to provide additional documentation related to income sourcing and may also require the assistance of an authorized representative or power of attorney to ensure compliance.

What common errors should I avoid when submitting the 2007 2014 IRS form?

When submitting the 2007 2014 IRS form, ensure that all figures are accurate and that you've included all necessary information. Common mistakes include incorrect Social Security Numbers or missing signatures. It's useful to double-check your entries against documentation to minimize issues.

What should I do if I receive an audit notice after filing the 2007 2014 IRS form?

If you receive an audit notice after filing the 2007 2014 IRS form, you should respond promptly, gathering all relevant documents and records related to your filing. It’s advisable to consult with a tax professional who can guide you through the audit process effectively and help you prepare the necessary documentation.

See what our users say