Get the free PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS

Show details

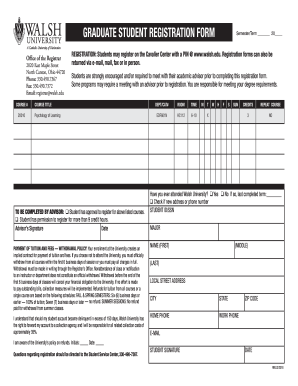

Este documento es una solicitud para la renovación del seguro de responsabilidad profesional para firmas de abogados, que incluye secciones sobre la información de la firma, el perfil de los abogados,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional liability insurance renewal

Edit your professional liability insurance renewal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional liability insurance renewal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional liability insurance renewal online

To use our professional PDF editor, follow these steps:

1

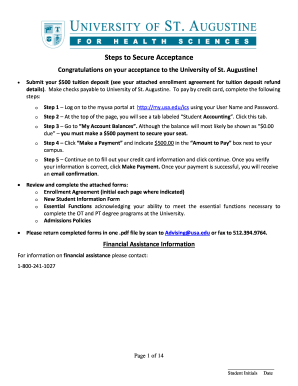

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit professional liability insurance renewal. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional liability insurance renewal

How to fill out PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS

01

Gather necessary documents: Collect previous policies, claims history, and any risk management materials.

02

Review coverage needs: Assess any changes in practice areas, client base, or potential risks since the last application.

03

Complete the application form: Accurately fill out all sections of the Professional Liability Insurance Renewal Application, including firm details, services offered, and prior claims.

04

Disclose claims history: Provide a detailed account of any claims or incidents that may affect coverage.

05

Provide financial information: Include necessary financial statements or any requested documentation regarding the firm's financial health.

06

Review and double-check: Ensure all information is complete and accurate before submitting.

07

Submit the application: Send the completed application to your insurance provider or broker along with any required payments or documentation.

Who needs PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS?

01

Law firms seeking to maintain or update their professional liability insurance coverage.

02

Solo practitioners who want to protect themselves against potential claims.

03

New law firms that are starting their practice and need to establish insurance coverage.

04

Firms that have undergone changes in practice areas or business structure since the last renewal.

Fill

form

: Try Risk Free

People Also Ask about

How much does PL cost?

On average, small business owners can expect to pay around $39 per month* for Public Liability insurance. Public Liability insurance is one of the most popular types of insurance for businesses. Public Liability insurance can cover a wide range of industries and occupations, and the cost of it can vary greatly.

What is typical professional liability coverage?

Professional liability policies typically cover legal defense costs associated with defending against claims of professional negligence. These costs can include attorney fees, court costs, and expert witness fees.

How do I file a professional liability claim?

How to make a professional liability claim What are the steps for filing a professional liability claim? Contact your insurance agent or provider. Review your policy and details of the professional liability claim. Keep detailed records of the incident. Consult with an attorney. Consider your options and next steps.

What is a good price for liability insurance?

Liability insurance costs an average $69 per month nationwide. But you can find cheap liability insurance for around $43 per month or less. Liability-only insurance is the cheapest coverage you can get. It must include at least the minimum coverage required by your state.

What is the average cost of a professional liability policy?

Professional liability insurance covers claims against a business asserting that it made mistakes in professional services, even if the claim has no merit. The average cost of professional liability insurance is $61 per month. Professional liability insurance is also called errors and omissions insurance.

What documents do I need to apply for professional liability insurance?

Professional liability insurance application Financial information. General business information. Potential business entanglements. Client contract information. Your insurance and claims history.

How much does professional liability insurance typically cost?

What is the average cost of professional liability insurance? Small businesses pay an average premium of $61 per month, or about $735 annually, for professional liability insurance. Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies.

What is professional liability insurance for law firms?

Lawyers professional liability insurance helps protect legal professionals against claims of negligence, errors or omissions that cause financial harm to another person or party. As a legal professional, you may be committed to your clients, but they may not always return the favor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS?

The Professional Liability Insurance Renewal Application for Law Firms is a document that law firms must complete to renew their professional liability insurance, providing updates on the firm's operations, risk management practices, and any changes that may affect their coverage.

Who is required to file PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS?

Typically, any law firm seeking to renew its professional liability insurance is required to file this application, which can include solo practitioners, partnerships, and larger law firms.

How to fill out PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS?

To fill out the Professional Liability Insurance Renewal Application, law firms should provide accurate and detailed information about their legal practice, including the number of attorneys, areas of practice, claims history, risk management measures, and updates on any previous responses in their last application.

What is the purpose of PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS?

The purpose of the application is to assess the law firm’s current risk exposure and to determine the appropriate terms and conditions for the renewal of professional liability insurance, ensuring adequate coverage against potential claims or lawsuits.

What information must be reported on PROFESSIONAL LIABILITY INSURANCE RENEWAL APPLICATION FOR LAW FIRMS?

Required information typically includes firm details (name, address, and type), attorney details (number and experience), areas of practice, client demographics, claims history, risk management policies, and any changes in the firm's business structure or operations since the last application.

Fill out your professional liability insurance renewal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Liability Insurance Renewal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.