Get the free Form 593

Show details

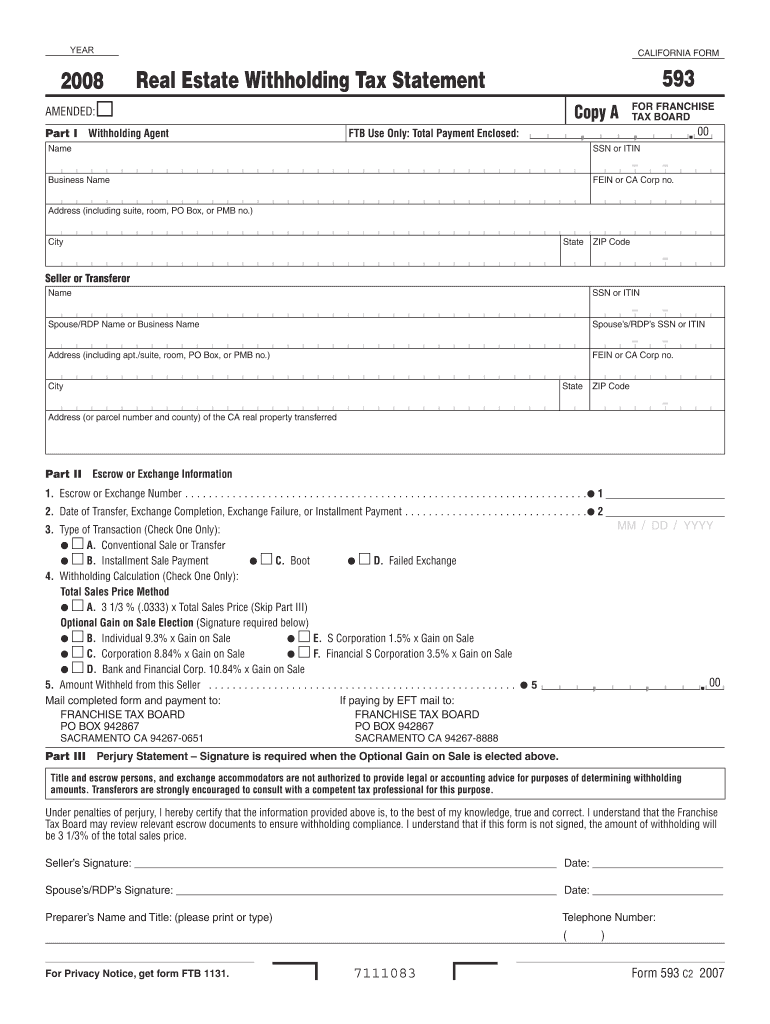

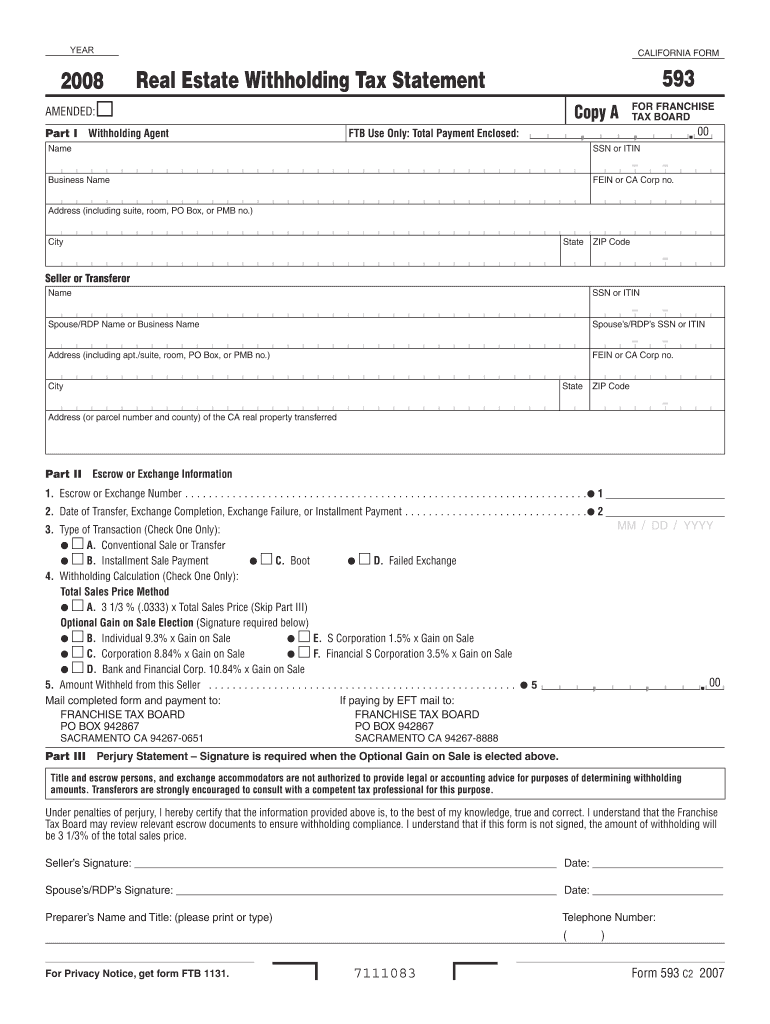

This form is used to report real estate withholding on sales closing in 2008, on installment payments made in 2008, or on exchanges that were completed or failed in 2008.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 593

Edit your form 593 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 593 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 593 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 593. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 593

How to fill out Form 593

01

Gather necessary personal and financial information.

02

Ensure you have the correct version of Form 593.

03

Start with Section A, providing your name and address.

04

Fill out your Social Security Number or Taxpayer Identification Number in Section B.

05

Proceed to Section C, where you must provide details about the real estate transaction.

06

Complete Section D by indicating the amount of withholding, if applicable.

07

If any exemptions apply, fill out Section E accordingly.

08

Review the form for accuracy and completeness.

09

Sign and date the form at the designated area.

10

Submit the completed Form 593 to the appropriate tax authority.

Who needs Form 593?

01

Individuals or entities selling real estate in California who are subject to withholding requirements.

02

Real estate agents or brokers handling the sale of property.

03

Buyers who are required to complete the withholding form due to certain conditions.

Fill

form

: Try Risk Free

People Also Ask about

What is the withholding rate for Form 593?

The buyer/transferee is not required to sign Form 593 when no exemptions apply. Otherwise, the REEP must withhold the full 3 1/3% (. 0333) of the sales price or the alternative withholding calculation amount shown on line 37, Amount Withheld from this Seller/Transferor.

How much tax do I pay when selling a house in California?

In California, capital gains from the sale of a house are taxed by both the state and federal governments. The state tax rate varies from 1% to 13.3% based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as ordinary income) or long-term (based on the tax bracket).

What is a 593 form used for?

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

What is the tax withholding on a house sale in California?

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price.

What is the withholding on a house sale in California?

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price.

Who is responsible for sales tax buyer or seller in California?

As a seller, you owe the sales tax and are responsible for paying the correct amount to the CDTFA. If you do not pay the correct amount, you are subject to additional tax charges plus applicable penalties and interest charges.

What is the federal withholding tax on the sale of real property in California?

Buyers must withhold 3 1/3 percent of the gross sales price on sales of California real property interests from both individuals (e.g., "natural" persons) and non-individuals (e.g., corporations, trusts, estates) and pay this amount to the Franchise Tax Board (FTB).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 593?

Form 593 is a tax form used in California to report withholding on the sale of real estate. It is primarily used by buyers and agents to report the amount withheld for state income tax purposes.

Who is required to file Form 593?

Form 593 must be filed by buyers of real estate in California when they purchase property from a seller who is not a resident of California. Additionally, real estate agents or escrow companies may also have a duty to file the form on behalf of the buyer.

How to fill out Form 593?

To fill out Form 593, you need to provide the buyer's and seller's information, the property address, the amount of the sale, and the withholding amount. You must also ensure all required signatures are obtained and that the form is submitted to the appropriate tax authority.

What is the purpose of Form 593?

The purpose of Form 593 is to ensure that California collects state income tax from non-resident sellers of real estate. It helps facilitate proper reporting and withholding of taxes during property transactions.

What information must be reported on Form 593?

Form 593 requires the reporting of the buyer's name and address, seller's name and address, property details, the total sale price, the withholding amount, and any applicable exemptions. It also needs dates and signatures from both the buyer and the seller.

Fill out your form 593 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 593 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.