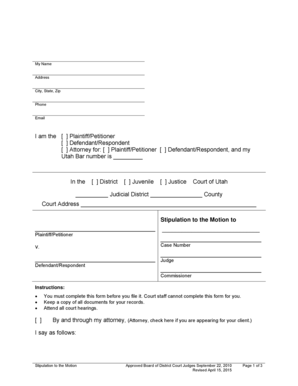

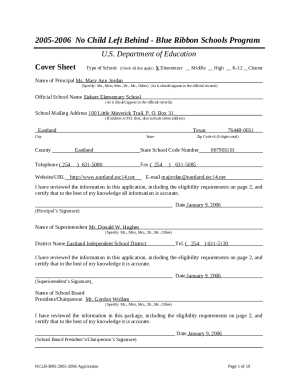

Get the free APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN

Show details

If approved forward the completed form to Qualified Benefits Inc. Suite 100 21021 Ventura Blvd. Woodland Hills CA 91364 or FAX to 818 887-3048 Attention Maria Mojarro/Karen Tancredi.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for participant loan

Edit your application for participant loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for participant loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for participant loan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for participant loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for participant loan

How to fill out APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN

01

Obtain the APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN form from your plan administrator or website.

02

Read the instructions carefully provided with the form.

03

Fill out your personal information including your name, address, and Social Security number.

04

Specify the amount you wish to borrow from your 401(k) account.

05

Indicate the purpose of the loan, such as personal expenses or emergencies.

06

Choose the repayment terms by indicating the duration and frequency of payments.

07

Sign and date the application to verify accuracy and consent to the terms.

08

Submit the completed application to your plan administrator for processing.

Who needs APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN?

01

Individuals who are current participants in a 401(k) plan and need funding for personal financial needs.

02

Employees looking to borrow from their retirement savings in times of financial hardship.

03

Those who have exhausted other borrowing options and wish to access funds directly from their retirement plan.

Fill

form

: Try Risk Free

People Also Ask about

How much can I borrow from my individual 401k?

401(k) Loan Basics The loan amount you can borrow tax-free from your 401(k) depends on your vested balance. You can borrow whichever is less of: The greater of $10,000 or 50% of your vested account balance; or. $50,000.

What is the maximum 401k loan allowed?

“You're paying yourself back with interest and avoiding the 10% early withdrawal penalty. This also retains the tax benefits and keeps your retirement plan on track.” The maximum 401(k) loan amount is $50,000 or 50% of the account's vested value.

What is a 401k participant loan?

A participant loan is when an eligible employee of a plan removes money from their 401(k) account, with a promise to pay it back with interest, within a specified time period.

Is there a max amount you can withdraw from a 401k?

With a Solo 401k loan, you can borrow up to 50% of your account's value, up to a maximum of $50,000. You cannot get a loan over $50,000 no matter how much you have in your account. Let's look at a few examples: If you have $10,000 in your account, you can borrow $5,000.

Who is considered a participant in a 401k plan?

If your plan is a 401(k) plan, active participants include those individuals who are employed at any time during the year in question and are eligible to participate in the plan even if they elect not to make contributions to the plan. Do not include participants who terminated employment in prior years.

What is the maximum amount a participant can take in a loan from their 401k?

The maximum amount that the plan can permit as a loan is (1) the greater of $10,000 or 50% of your vested account balance, or (2) $50,000, whichever is less. For example, if a participant has an account balance of $40,000, the maximum amount that he or she can borrow from the account is $20,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN?

The APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN is a form that allows employees to request a loan from their 401(k) retirement savings plan, utilizing their accumulated funds as collateral.

Who is required to file APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN?

Any participant in a 401(k) plan who wishes to obtain a loan against their account balance is required to file the APPLICATION FOR PARTICIPANT LOAN.

How to fill out APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN?

To fill out the APPLICATION FOR PARTICIPANT LOAN, participants should provide personal information, specify the loan amount requested, state the purpose of the loan, and agree to the terms and conditions set by the plan.

What is the purpose of APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN?

The purpose of the APPLICATION FOR PARTICIPANT LOAN is to formalize the request for a loan from the 401(k) plan, ensuring that the loan is in compliance with plan rules and federal regulations.

What information must be reported on APPLICATION FOR PARTICIPANT LOAN - 401(k) PLAN?

The APPLICATION FOR PARTICIPANT LOAN must report information such as the participant's name, account number, loan amount requested, purpose of the loan, repayment terms, and participant's signature.

Fill out your application for participant loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Participant Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.