Get the free FTB 3549-A

Show details

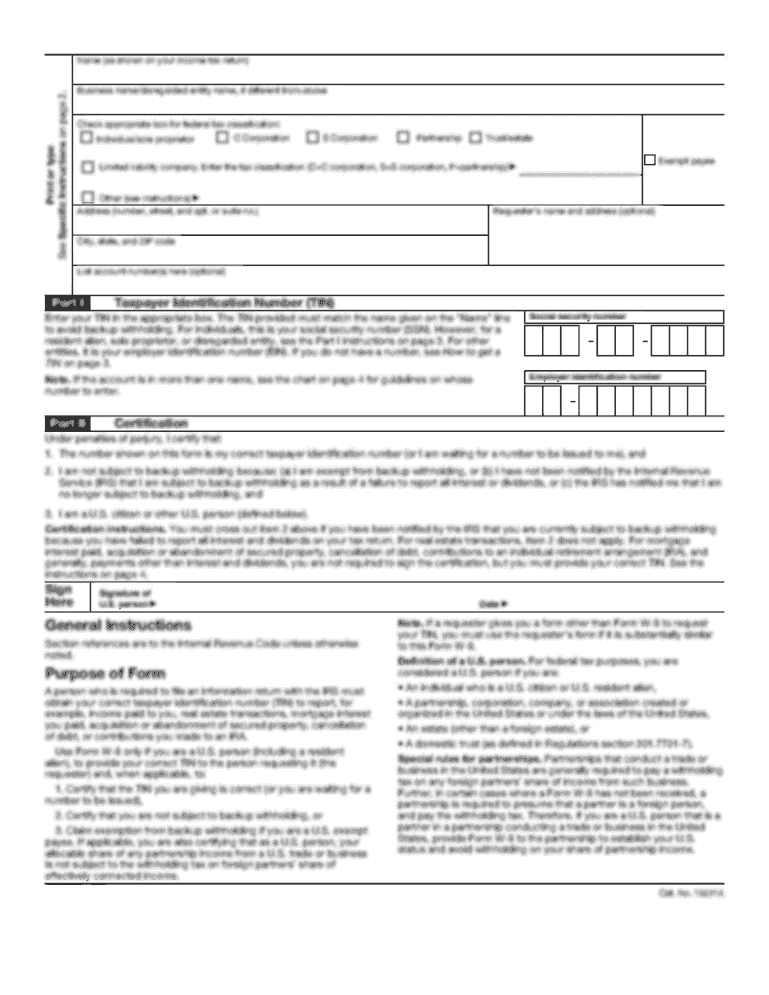

This form is used by sellers and buyers to apply for the New Home or First-Time Buyer tax credits available in California for qualified principal residences purchased within specified timeframes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftb 3549-a

Edit your ftb 3549-a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 3549-a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb 3549-a online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ftb 3549-a. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftb 3549-a

How to fill out FTB 3549-A

01

Gather all necessary tax documents and information.

02

Download or obtain a copy of FTB 3549-A from the California Franchise Tax Board website.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Indicate the tax year for which you are filing.

05

Follow the instructions in each section carefully, providing accurate financial details as required.

06

Review your completed form for any errors or missing information.

07

Sign and date the form at the bottom.

08

Submit the form by the specified deadline, either electronically or via mail.

Who needs FTB 3549-A?

01

Individuals or entities who have underreported their income or had tax withheld incorrectly.

02

Taxpayers who need to report adjustments or changes to their tax situation.

03

Anyone who has received a notice from the California Franchise Tax Board regarding their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

Why is the Franchise Tax Board charging me?

We charge penalties and interest, if you: Meet income requirements but do not file a valid tax return. Do not provide the information we request. Provide false information.

Why did I get a bill from the Franchise Tax Board?

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Why did I get a letter from the FTB?

These notices request additional information to help validate the taxpayer's identity and confirm their refund. ing to FTB, the letters are not the result of any altered processes, and there has been no change in the number of notices that have gone out compared to previous years.

How long does the FTB have to collect a debt?

Collection – Ten Years IRS, Twenty Years FTB The IRS has 10 years. The date that the collection authority ends is called the “CSED” (Collection Statute Expiration Date). The ten-year clock can be tolled by any of several events: bankruptcy, offer in compromise, or collection due process hearing.

Why did the Franchise Tax Board charge me?

There are a number of reasons you may receive a bill from the Franchise Tax Board. You filed your tax returns late. This is by far the most common reason you may still owe money. People don't realize that late filing, even by one day, will incur a late filing penalty.

How do I fight the Franchise Tax Board?

Taxpayers may appeal an assessment or refund claim denial originating from the Franchise Tax Board (FTB) or the California Department of Tax and Fee Administration (CDTFA). You must file an appeal with OTA through the Office of Tax Appeals Portal (OTAP).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FTB 3549-A?

FTB 3549-A is a form used by the California Franchise Tax Board to report income and calculate tax obligations for specific types of income earned by partnerships.

Who is required to file FTB 3549-A?

Partnerships that have income sourced to California or that have California partners are required to file FTB 3549-A.

How to fill out FTB 3549-A?

To fill out FTB 3549-A, applicants must provide accurate income figures, identify the sources of income, and ensure all partner information is correctly entered. Detailed instructions are included with the form.

What is the purpose of FTB 3549-A?

The purpose of FTB 3549-A is to collect information about the income earned by partnerships and to assess tax liability for that income within California.

What information must be reported on FTB 3549-A?

FTB 3549-A requires reporting of total income, specific line items for different types of income, partner information, and deductions related to partnership income.

Fill out your ftb 3549-a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb 3549-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.