Get the free Extended Repayment Plan Form

Show details

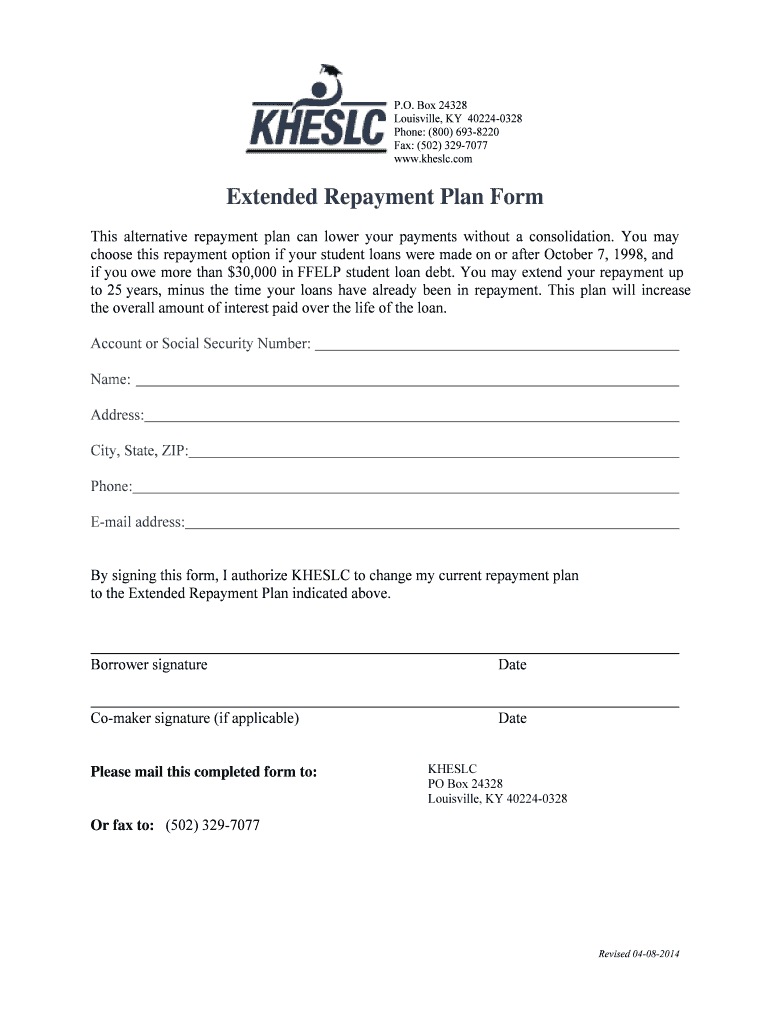

This form is used to apply for an Extended Repayment Plan for student loans, allowing for lower payments and extended repayment terms for eligible borrowers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extended repayment plan form

Edit your extended repayment plan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extended repayment plan form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing extended repayment plan form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit extended repayment plan form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extended repayment plan form

How to fill out Extended Repayment Plan Form

01

Obtain the Extended Repayment Plan Form from your loan servicer's website or customer service.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your loan information, including account numbers and loan types.

04

Select the desired repayment period that fits your financial situation.

05

Indicate your income and monthly expenses to help determine eligibility.

06

Review the terms of the Extended Repayment Plan and agree to the terms.

07

Sign and date the form to certify the information provided is accurate.

08

Submit the completed form to your loan servicer as instructed.

Who needs Extended Repayment Plan Form?

01

Borrowers with federal student loans who are looking for an extended repayment option due to financial difficulties.

02

Students graduating or recent graduates who want to manage their student loan payments over a longer period.

03

Individuals whose income is not sufficient for standard repayment but who still want to avoid defaulting on their loans.

Fill

form

: Try Risk Free

People Also Ask about

What type of repayment plan is best?

Repayment plans based on your income are a smart choice to lower your payment. The lower your income — or the larger your family size — the less you'll pay each month. If you don't pick a repayment plan, your loan servicer will place you on the Standard Repayment Plan (a 10-year fixed payment repayment plan).

What happens if I don't recertify my IDR?

If you don't recertify your income by the annual deadline, you'll remain on the same IDR plan, but your monthly payment will no longer be based on your income.

What is the problem with extending a student loan repayment term to receive a lower monthly payment?

Some of these plans can increase the total amount you ultimately owe because you're still accruing interest on your overall balance, even though each individual payment is lower.

Does the extended repayment plan qualify for loan forgiveness?

With consistent payments on the Extended Repayment Plan, any remaining loan balance may be forgiven after 25 years This payment plan can mean paying less in monthly payments, offering flexibility for borrowers.

What are some reasons for switching from the standard repayment plan to an extended plan?

If you need to make lower monthly payments over a longer period of time than under plans such as the Standard Repayment Plan, then the Extended Repayment Plan may be right for you.

What is the downside of an extended repayment plan?

The Extended Repayment Plan can give you more time to pay off your federal student loans if needed. But there are drawbacks, such as higher interest charges and the fact that you'll remain in debt longer than you would on many other repayment plans.

What are the pros and cons of the extended repayment plan?

The Extended Repayment Plan can give you more time to pay off your federal student loans if needed. But there are drawbacks, such as higher interest charges and the fact that you'll remain in debt longer than you would on many other repayment plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Extended Repayment Plan Form?

The Extended Repayment Plan Form is a document that allows borrowers to apply for a repayment plan that extends the repayment period of their loans, resulting in lower monthly payments.

Who is required to file Extended Repayment Plan Form?

Borrowers with federal student loans who wish to change their repayment plan to an extended repayment plan are required to file the Extended Repayment Plan Form.

How to fill out Extended Repayment Plan Form?

To fill out the Extended Repayment Plan Form, borrowers need to provide their personal information, loan details, and the desired repayment term. Accurate financial information should also be included to support the request.

What is the purpose of Extended Repayment Plan Form?

The purpose of the Extended Repayment Plan Form is to provide a structured way for borrowers to apply for an extended repayment plan that can make their student loan payments more manageable by lowering monthly payment amounts.

What information must be reported on Extended Repayment Plan Form?

The information that must be reported includes the borrower's name, Social Security number, loan identification numbers, the type of loans, the requested repayment term, and financial information to verify eligibility.

Fill out your extended repayment plan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extended Repayment Plan Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.