Get the free Rev. Proc. 80-27 - irs

Show details

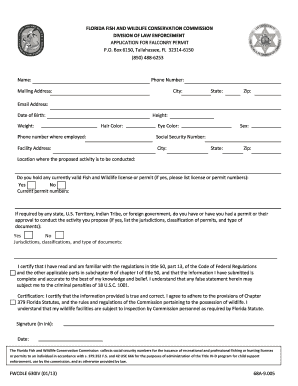

This revenue procedure sets forth updated procedures for obtaining recognition of exemption from federal income tax on a group basis for subordinate organizations affiliated with a central organization,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 80-27

Edit your rev proc 80-27 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 80-27 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rev proc 80-27 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rev proc 80-27. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 80-27

How to fill out Rev. Proc. 80-27

01

Obtain a copy of Rev. Proc. 80-27 from the IRS website or relevant sources.

02

Review the guidelines outlined in the procedure to understand the requirements for eligibility.

03

Gather all necessary documentation required to support your application.

04

Complete the required forms accurately, ensuring all information is provided as requested.

05

Double-check your entries for any errors or omissions.

06

Submit the completed forms and documentation to the IRS according to the instructions provided in the Rev. Proc. 80-27.

07

Retain copies of your submission for your records.

Who needs Rev. Proc. 80-27?

01

Taxpayers who wish to obtain a private letter ruling regarding tax issues covered by Rev. Proc. 80-27.

02

Individuals or entities seeking clarification on specific tax positions.

03

Professionals advising clients on potential tax benefits or obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is an IRS exemption code?

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

What is a group exemption letter from the IRS?

A group exemption letter is a ruling or determination that is issued to a central or parent organization (generally, a state, regional, or national organization) which holds that one or more subordinate organizations (usually a post, unit, chapter, or local) are exempt from federal income tax by virtue of being

What is rev proc 80 11?

The purpose of this revenue procedure is to provide individual taxpayers guidance on reporting dividends on restricted stock that is not substantially vested within the meaning of section 83 of the Internal Revenue Code.

What is a tax exemption letter?

LETTER OF EXEMPTION. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local taxing authority, except for local real or personal property tax.

What is the 4 digit group exemption number?

A group exemption number (GEN) is a four-digit number assigned by the IRS to the central/parent organization of a group with a group exemption letter. Only organizations that are included in a group exemption receive the GEN from the IRS.

What groups get tax exemptions?

Exempt organization types Charitable organizations. Churches and religious organizations. Private foundations. Political organizations. Other nonprofits.

Does rev proc 84 35 still apply?

Revenue Procedure 84-35 is not obsolete and continues to apply. The reference to section 6231(a)(1)(B) contained in the revenue procedure is a means by which to define small partnerships for the purpose of the relief provided by the revenue procedure.

How to find IRS group exemption number?

The group exemption number (GEN) is a number assigned by the IRS to the central/parent organization of a group that has a group ruling. Contact the central/parent organization to ascertain the GEN assigned.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rev. Proc. 80-27?

Rev. Proc. 80-27 is an internal revenue procedure that provides guidance on certain tax matters, specifically related to the automatic renewal of certain tax exempt organizations' status.

Who is required to file Rev. Proc. 80-27?

Organizations that are applying for recognition of exemption under section 501(c)(3) of the Internal Revenue Code are required to file Rev. Proc. 80-27.

How to fill out Rev. Proc. 80-27?

To fill out Rev. Proc. 80-27, organizations must follow the instructions provided in the revenue procedure document, including providing necessary information about their structure, activities, and purpose.

What is the purpose of Rev. Proc. 80-27?

The purpose of Rev. Proc. 80-27 is to simplify and clarify the process for organizations seeking tax exemption under section 501(c)(3) and to provide a standard procedure for application.

What information must be reported on Rev. Proc. 80-27?

Organizations must report information including their name, address, organizational structure, purpose, and the nature of their activities, along with any other relevant data as specified in the procedural guidelines.

Fill out your rev proc 80-27 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 80-27 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.