Get the free Form 23

Show details

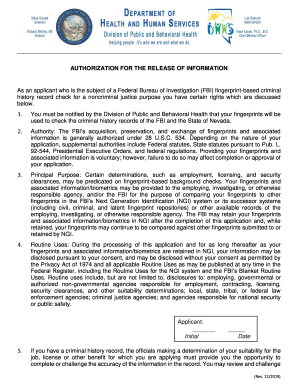

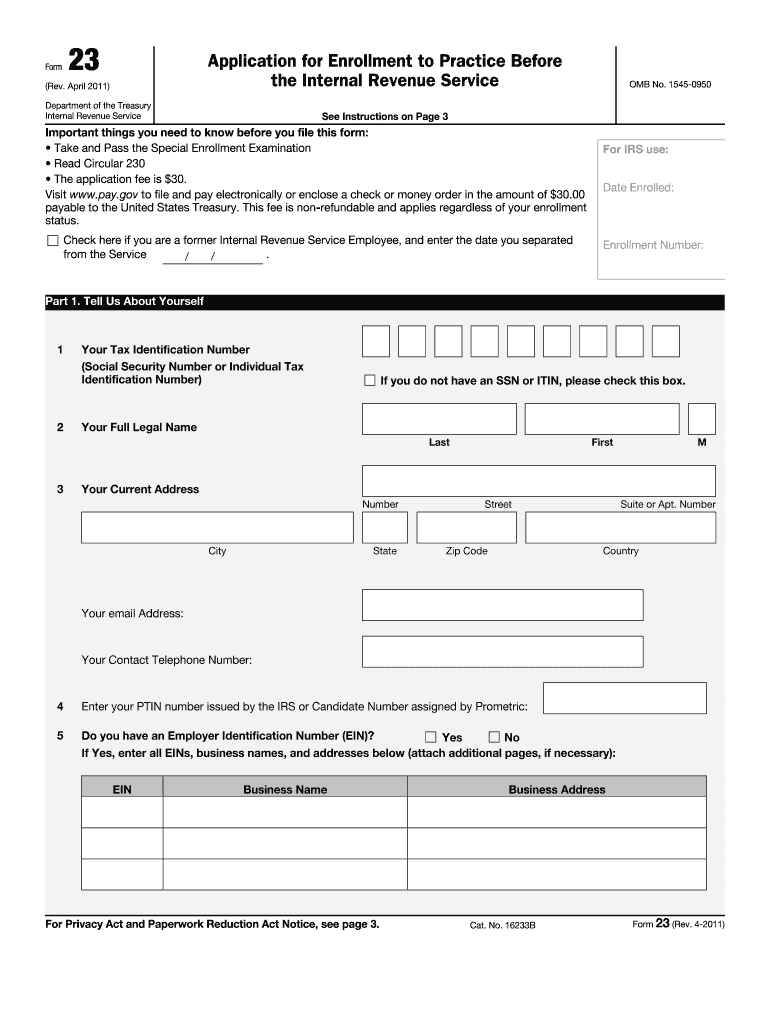

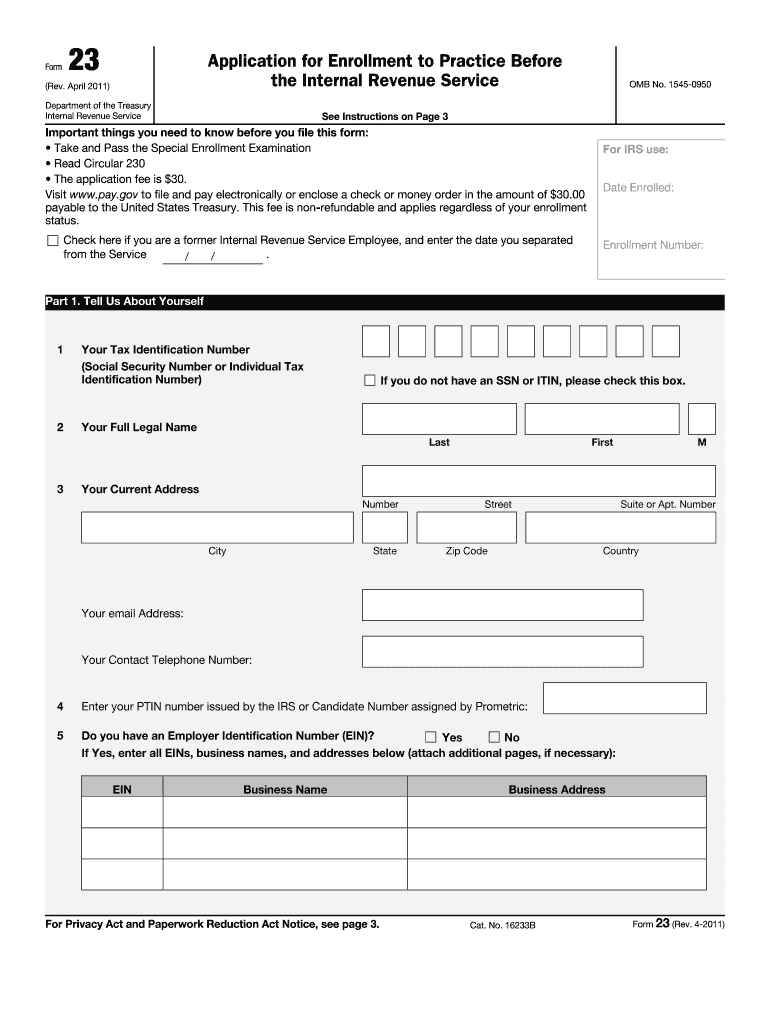

This form is used to apply for enrollment to practice before the IRS, requiring the applicant to meet certain criteria such as passing the Special Enrollment Examination and providing personal information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 23

Edit your form 23 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 23 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 23 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 23. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 23

How to fill out Form 23

01

Obtain a copy of Form 23 from the relevant authority.

02

Read the instructions carefully before starting to fill out the form.

03

Write your full name in the designated section.

04

Provide your contact information, including address and phone number.

05

Fill in the date of the request or application.

06

Complete any required sections related to your specific circumstance.

07

Review the form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form to the appropriate office, either in-person or by mail.

Who needs Form 23?

01

Individuals filing an initial application or request for a specific service.

02

Organizations submitting documentation for regulatory compliance.

03

Anyone required to provide information as part of a legal or formal process.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for Form 1023 to be approved?

If you file Form 1023, the average IRS processing time is 6 months. Processing times of 9 or 12 months are not unheard of. The IRS closely scrutinizes these applications, as the applicants are typically large or complex organizations.

Can I file Form 1023 electronically?

Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Note. You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption.

What happens if I use Form 1023-EZ and bring in more than $50,000?

In either case, your organization will be on the IRS radar, and it could lose its exempt status entirely. Remember too, you are signing the application under penalty of perjury. If you have any expectation of more than $50,000 in revenue, you would be far wiser to file the full Form 1023 now.

How long does it take for form 23 to be approved?

Form 23, Application for Enrollment to Practice Before the IRS - generally takes 60 days for processing (90-120 days for former IRS employees).

What is a 23 form?

The purpose of the Form 23 is to give the requesting department or agency a chance to indicate: 1. The requestor has a clearly defined Scope, Funding Source and Estimate for the project. 2. The requestor understands the Resources and Requirements needed to properly undertake the project for themselves.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 23?

Form 23 is a statutory form used in various jurisdictions, typically by companies, to provide information about specific corporate actions, such as changes in directors, registered office address, or other significant company details.

Who is required to file Form 23?

Companies that undergo changes in their corporate structure or details, such as changes in directors or registered office, are required to file Form 23 with the relevant regulatory authority.

How to fill out Form 23?

To fill out Form 23, the company must provide detailed information including the company's name, registration number, the specific changes to be reported, and any relevant dates. It is important to follow the instructions provided with the form carefully.

What is the purpose of Form 23?

The purpose of Form 23 is to ensure transparency and compliance with corporate governance laws, allowing regulatory authorities and the public to be informed of any significant changes within a company.

What information must be reported on Form 23?

Form 23 typically requires information such as the name and registration number of the company, details of the changes being made (like new directors or changes in the address), effective dates, and signatures of authorized representatives.

Fill out your form 23 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 23 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.