Get the free Form 9 - ca9 uscourts

Show details

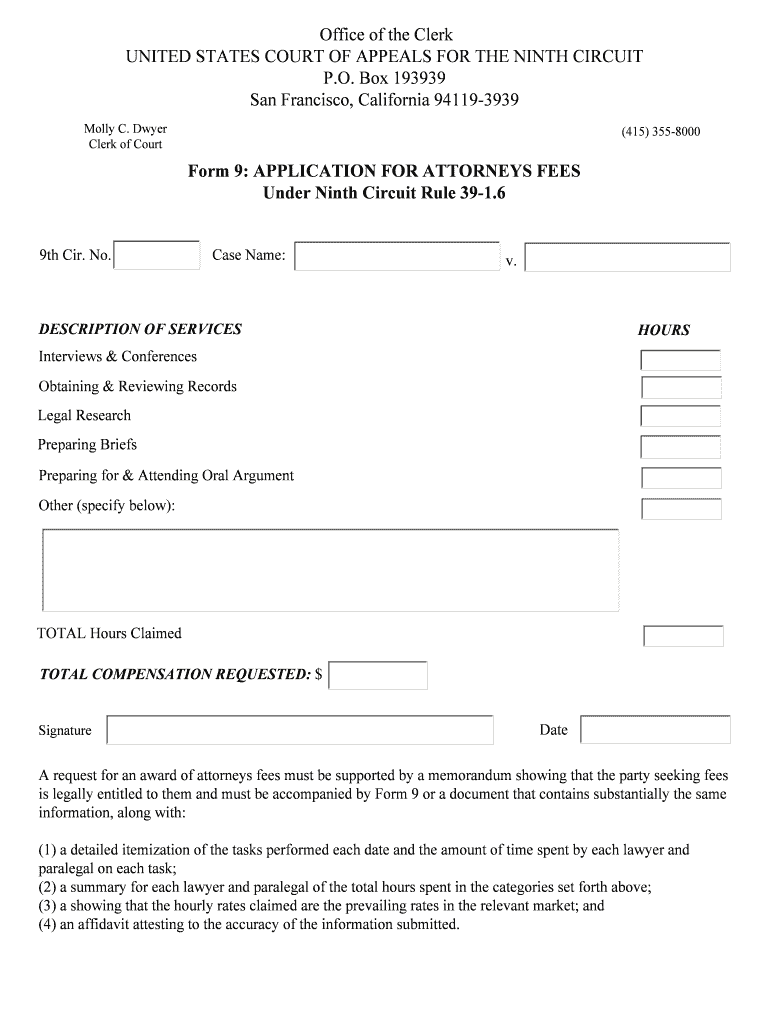

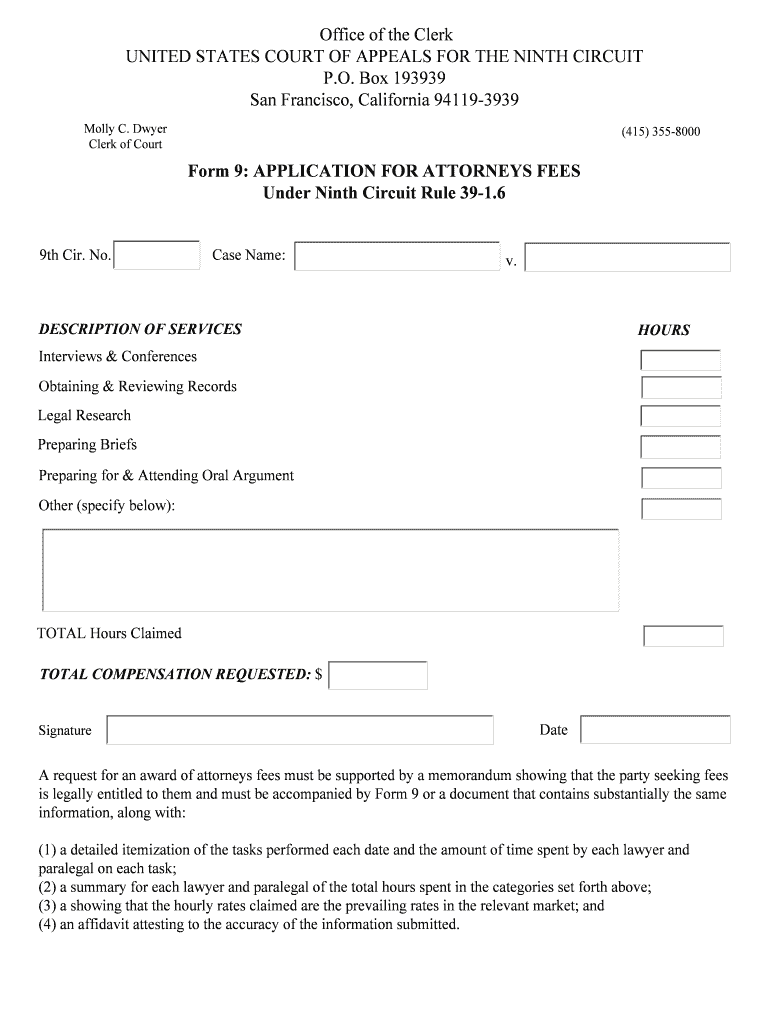

Este formulario se utiliza para solicitar la concesión de honorarios de abogados bajo la regla 39-1.6 del Noveno Circuito. El solicitante debe describir los servicios realizados, el número de horas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 9 - ca9

Edit your form 9 - ca9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 9 - ca9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 9 - ca9 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 9 - ca9. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 9 - ca9

How to fill out Form 9

01

Gather necessary personal information such as your name, address, and contact details.

02

Obtain Form 9 from the relevant authority or download it from the official website.

03

Carefully read the instructions provided with the form to understand the requirements.

04

Fill out each section of the form, ensuring accuracy and completeness.

05

Review the filled form for any errors or omissions.

06

Attach any required documentation as specified in the form instructions.

07

Submit the completed Form 9 to the designated office or through the specified submission method.

Who needs Form 9?

01

Individuals who are required to report specific information as mandated by the relevant authority.

02

Organizations or entities seeking to comply with regulatory requirements.

03

Those applying for permits, licenses, or other government services that require Form 9.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of form 9?

Form 9, also known as the Property Register Extract, is a document issued by the Gram Panchayat that provides details about the property, including the name of the owner, the extent of the property, and its use (residential, commercial, agricultural, etc.).

Why would someone need a W9 from you?

Why would a customer ask for a W9? A W9 is generally requested by someone whose business needs to make a payment and needs to know exactly what legal entity they are making a payment to. Without a W9, they may need to withhold 24% of the amount they're paying you and give it to the IRS.

What does form 9 mean?

I-9, Employment Eligibility Verification. Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States. This includes citizens and aliens.

Who is required to fill out a W9?

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or “freelancer.” Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

What is the W9 form used for?

The W-9 is an Internal Revenue Service (IRS) form in which a taxpayer provides their correct taxpayer identification number (TIN) to an individual or entity (Form W-9 requester) who is required to file an information return to report the amount paid to a payee, or other amount reportable on an information return.

What is an I-9 form and what is its purpose?

What is the purpose of the Form I-9? Federal law requires employers to verify the identity and employment authorization of new employees and, in certain instances, to reverify that the employee is still authorized to work. Employers must use an electronic or paper Form I-9 to do this.

What's the difference between W9 and 1099?

The main differences between W-9 and 1099 tax forms are that a W-9 is filled out by the supplier or independent contractor to provide their tax and payment information to the payer, whereas 1099 forms are provided by the payer to document the supplier or contractor's gross earnings and any backup withholding after

How will a W9 affect my taxes?

Payments earned by a contractor who completes a W-9 form aren't subject to IRS withholding, meaning it's the payee's responsibility to report the income and pay the self-employment taxes, which is calculated at a rate of 15.3 percent as of 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 9?

Form 9 is a document used by various jurisdictions for different purposes, commonly relating to tax reporting, business registration, or legal declarations.

Who is required to file Form 9?

Typically, individuals or entities that engage in specific activities outlined by the relevant authority must file Form 9. This may include businesses, taxpayers, or organizations depending on local regulations.

How to fill out Form 9?

Filling out Form 9 usually involves providing personal or business information, financial data, and any relevant declarations as required by the form's instructions.

What is the purpose of Form 9?

The purpose of Form 9 is to collect necessary information for regulatory compliance, tax assessment, or to provide official documentation for various administrative processes.

What information must be reported on Form 9?

Information reported on Form 9 generally includes identification details, financial information, activity descriptions, and any other relevant data required by the jurisdiction completing the form.

Fill out your form 9 - ca9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 9 - ca9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.