Get the free Application for Long Term Disability Conversion Insurance

Show details

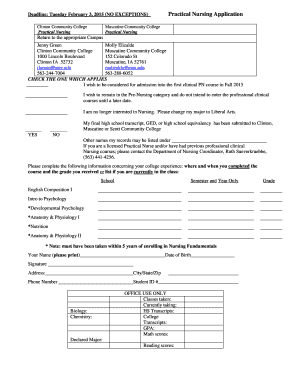

This document provides instructions for applying for Long Term Disability Conversion Insurance offered by Standard Insurance Company. It outlines the Right to Convert, eligibility criteria, application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for long term

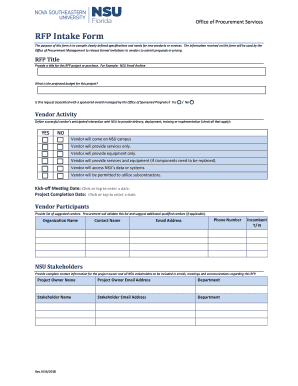

Edit your application for long term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for long term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for long term online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for long term. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for long term

How to fill out Application for Long Term Disability Conversion Insurance

01

Obtain the Application for Long Term Disability Conversion Insurance form from your insurance provider.

02

Read through the instructions carefully to understand the requirements.

03

Fill in your personal details, such as name, address, and contact information in the designated fields.

04

Provide information about your current long term disability insurance policy including policy number and type.

05

Complete the section detailing your medical history and current health status, ensuring accuracy for your eligibility.

06

Indicate the reasons you are applying for the conversion of your insurance.

07

Review your application for completeness and accuracy before submission.

08

Submit the completed application form to your insurance provider by the specified method (mail, online upload, etc.).

Who needs Application for Long Term Disability Conversion Insurance?

01

Individuals who have an existing long term disability insurance policy and wish to convert it to a different or new policy.

02

Those who are nearing the end of their current long term disability coverage and want to maintain their insurance.

03

Employees who are transitioning out of a job but need long term disability insurance during the conversion period.

04

Individuals with ongoing health issues seeking to ensure continuous coverage.

Fill

form

: Try Risk Free

People Also Ask about

How to write a successful appeal letter for long term disability?

A well-written appeal letter should include several key elements: A clear statement of your intent to appeal the denial. The policy number and claim number. A brief overview of your medical condition and how it prevents you from working. A point-by-point rebuttal of the reasons for denial.

What not to say when applying for long-term disability?

Talk about your disability as much as you want but never discuss a family member's illness. You don't want the disability claim examiner to assume you need time off work to care for someone else or that you are caring for anyone else including grandchildren.

What is the long-term disability transition benefit?

If your condition persists past this initial coverage period, you may be able to transition to Long Term Disability (“LTD”) benefits if offered. LTD benefits can provide coverage for an extended period—sometimes until you reach your Social Security Retirement Age.

How long do most long-term disability benefits last?

The average duration of a long term disability is 2.5 years2, but remember – that's just an average. Some disabilities are shorter, but many are longer, so a 2-year benefit may not provide the reassurance you're looking for.

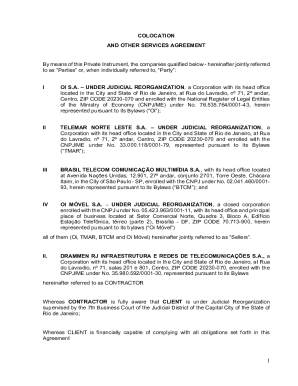

What is a LTD conversion?

The conversion coverage allows you to convert your group LTD insurance provided by your former employer. Benefits and amounts of insurance under the LTD conversion coverage may differ from those under your former employer's group LTD policy. You are responsible for payment of all LTD conversion coverage premiums.

Can you convert disability insurance?

The conversion coverage allows you to convert your group LTD insurance provided by your former employer. Benefits and amounts of insurance under the LTD conversion coverage may differ from those under your former employer's group LTD policy.

What is long term disability conversion?

If an employee separates from state service or takes a leave of absence, they may convert their LTD coverage to an individual disability plan provided they have been enrolled in LTD for at least 12 months and they are not disabled from performing the duties of their occupation at the time they separate or take a leave

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Long Term Disability Conversion Insurance?

The Application for Long Term Disability Conversion Insurance is a form used by individuals to apply for a conversion policy that allows them to continue their long-term disability insurance coverage after leaving an employer or when their group policy ends.

Who is required to file Application for Long Term Disability Conversion Insurance?

Typically, individuals who are transitioning from group long-term disability insurance to an individual policy are required to file the Application for Long Term Disability Conversion Insurance.

How to fill out Application for Long Term Disability Conversion Insurance?

To fill out the Application for Long Term Disability Conversion Insurance, applicants need to provide personal information, details regarding their current disability status, and information about their prior coverage. It's important to follow the instructions provided on the form carefully.

What is the purpose of Application for Long Term Disability Conversion Insurance?

The purpose of the Application for Long Term Disability Conversion Insurance is to allow individuals to extend their disability coverage beyond their employment or group insurance, ensuring continued financial protection in the event of a long-term disability.

What information must be reported on Application for Long Term Disability Conversion Insurance?

The information that must be reported includes personal identification details, the specifics of previous group disability coverage, current health status, employment history, and any relevant medical information pertaining to the disability.

Fill out your application for long term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Long Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.