Get the free Single Service Manufacturer Audit Fee

Show details

This form is used to apply for an audit fee for single service manufacturers in accordance with Massachusetts regulations. It requires detailed information about the business, ownership, and required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single service manufacturer audit

Edit your single service manufacturer audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single service manufacturer audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing single service manufacturer audit online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit single service manufacturer audit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single service manufacturer audit

How to fill out Single Service Manufacturer Audit Fee

01

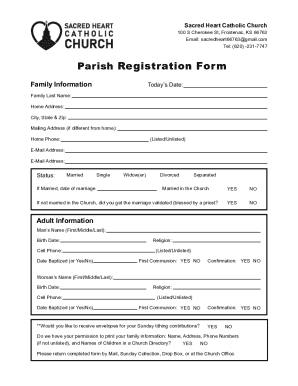

Obtain the Single Service Manufacturer Audit Fee form from the relevant authority.

02

Read the instructions carefully to understand the requirements.

03

Fill in your company's name and address in the designated fields.

04

Provide the contact information of the person responsible for the audit.

05

Indicate the type of service or manufacturing process that will be audited.

06

List any required attachments or supporting documents that accompany the application.

07

Double-check all entered information for accuracy and completeness.

08

Submit the form along with the appropriate fees via the specified method (online, mail, etc.).

Who needs Single Service Manufacturer Audit Fee?

01

Manufacturers who provide single services and are required to undergo compliance audits.

02

Companies seeking certification for their manufacturing processes.

03

Businesses applying for regulatory approval in specific industries.

04

Organizations aiming to ensure adherence to quality and safety standards.

Fill

form

: Try Risk Free

People Also Ask about

How to charge an audit fee?

There are two bases for computation of fee: a) Time-based. Time management is essential in ensuring efficiency in audit performance while time recording is an integral part of the documentary evidence of work performed. b) Value-based. (i) Gross Turnover or Total Assets Basis. (ii) Total Operating Expenditure Basis.

How much does an audit fee cost?

The Institute of Chartered Accountants of India (ICAI) has proposed a range of charges for audit and certification services, ranging from Rs. 2000 to Rs. 80,000 as minimum amount and which can go up to any level as per the complexity of work.

How much does a CPA charge for an audit?

The average CPA rate for audit services is anywhere between $200 and $400 per hour, but some larger CPA firms may charge as much as $800 per hour. The average cost of an audit in the US is now more than $2.2 million, but fees will vary wildly depending on the size of your business and its revenue.

How much does a simple audit cost?

A simple audit can cost less than one thousand dollars and a highly complex audit of multiple sites could cost tens of thousands of dollars.

How much should a CPA audit cost?

Audit services Each business has its own unique issues, needs, and goals. The average CPA rate for audit services is anywhere between $200 and $400 per hour, but some larger CPA firms may charge as much as $800 per hour.

How much does Big 4 charge for an audit?

In 2022, PwC had the highest average of S&P 500 audit fees out of the Big Four. This amounted to roughly 12.6 million U.S. dollars. Deloitte were second on the list with an average of almost 11.4 million U.S. dollars per audit.

What is the cost of audit fees?

For a B2C company accruing revenue between ₹1 crore and ₹5 crores, the range of audit fees at this stage is typically ₹3 lakhs to ₹6 lakhs. For a B2B company with a similar scale in terms of revenue, the range could be ₹2 lakhs to ₹5 lakhs.

Do small companies need to disclose audit fees?

All companies, other than those that qualify as small, are required to disclose the fees payable to the auditor for the audit of their financial statements. Small and medium-sized companies are exempt from the requirements relating to disclosures for other services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Single Service Manufacturer Audit Fee?

The Single Service Manufacturer Audit Fee is a charge imposed on manufacturers of single-service products to cover the costs of regulatory audits and compliance checks.

Who is required to file Single Service Manufacturer Audit Fee?

Single Service Manufacturers that produce items intended for one-time use must file the Single Service Manufacturer Audit Fee.

How to fill out Single Service Manufacturer Audit Fee?

To fill out the Single Service Manufacturer Audit Fee, manufacturers must complete the designated form with accurate details about their operations, production volume, and any associated compliance information, and then submit it along with the payment.

What is the purpose of Single Service Manufacturer Audit Fee?

The purpose of the Single Service Manufacturer Audit Fee is to ensure that manufacturers comply with health and safety standards, and to finance the auditing process that monitors such compliance.

What information must be reported on Single Service Manufacturer Audit Fee?

The information that must be reported includes the manufacturer's business details, product types, production volumes, and any relevant compliance information required by regulatory authorities.

Fill out your single service manufacturer audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Service Manufacturer Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.