Get the free APPLICATION FOR TRAVEL COSTS REFUND

Show details

This document is intended for experts to apply for the refund of travel costs incurred while attending a meeting, requiring signatures from both the expert and the meeting secretary.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for travel costs

Edit your application for travel costs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for travel costs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for travel costs online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for travel costs. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for travel costs

How to fill out APPLICATION FOR TRAVEL COSTS REFUND

01

Obtain the APPLICATION FOR TRAVEL COSTS REFUND form from the relevant website or office.

02

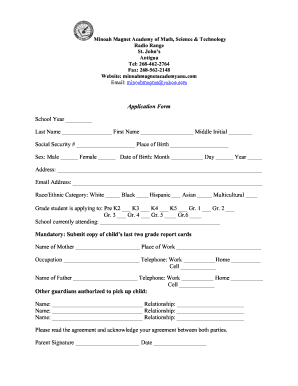

Fill in your personal details, including your name, address, and contact information.

03

Provide the details of the travel dates, destination, and purpose of travel.

04

Attach any required documentation, such as travel tickets, receipts, and proof of expenses.

05

Sign the application form to confirm that the information provided is accurate.

06

Submit the completed application form and attachments to the designated office or online portal.

Who needs APPLICATION FOR TRAVEL COSTS REFUND?

01

Individuals who have incurred travel expenses for work-related purposes and seek reimbursement.

02

Employees required to travel for business and need to claim back costs from their employer.

03

Students or participants traveling for educational purposes who are eligible for travel cost refunds.

Fill

form

: Try Risk Free

People Also Ask about

How do I ask for travel expenses reimbursement?

You should simply contact the person (or people) who is responsible for travel and expense reimbursements and ask them if there is anything that you can do to assist in processing your expense report.

What are the IRS rules for travel reimbursement?

What is the IRS rule for expense reimbursement? To be reimbursed for travel expenses, you must be traveling outside your tax home for longer than a workday, and the trip must require rest to continue working. Your tax home is your main place of work, not necessarily where you live.

How do you treat travel expenses in accounting?

Report travel expenses on Schedule C (Form 1040) under the following lines: Line 24a: travel (includes transportation, lodging, and other related costs). Line 24b: meals (remember, only 50% of eligible business meals are deductible).

How to write travel expenses?

To write a travel expense report, list all expenses incurred during the trip, including dates, descriptions, and amounts. Attach relevant receipts for each expense and ensure all details align with your company's travel expense policy.

How to write off travel expenses?

You can deduct a portion of the travel if you are self-employed and the travel was necessary for your job. The IRS allows you to deduct expenses that are ``ordinary'' and ``necessary'' for your job. If it is ordinary and necessary for you to take the trip for your work, then the travel expenses are deductible.

What is travel reimbursement form?

A travel expense reimbursement form is used to record the expenses an employee incurs during business trips or other work-related travel. The employee then submits the form in order to be reimbursed.

How do you record travel expenses?

How do you record travel expenses? Record travel expenses by documenting all costs related to travel, such as transportation, lodging, and meals. Use receipts and a travel expense form to track and categorize these expenses in your accounting system.

How to write a mail for travel reimbursement?

I recently incurred some travel expenses while working and am submitting my expenses claim here. I've kept all receipts and attached them to this message. The expenses all relate to a trip I had to take for (insert reasons why). My manager approved the trip (insert manager's name and copy them into the email).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR TRAVEL COSTS REFUND?

APPLICATION FOR TRAVEL COSTS REFUND is a form used to request reimbursement for travel expenses incurred during a business trip or official duties.

Who is required to file APPLICATION FOR TRAVEL COSTS REFUND?

Employees or individuals who have incurred travel costs while performing duties for their employer, organization, or government are typically required to file this application.

How to fill out APPLICATION FOR TRAVEL COSTS REFUND?

To fill out the APPLICATION FOR TRAVEL COSTS REFUND, complete all required fields with accurate information regarding travel dates, destinations, purpose, and a detailed account of expenses incurred.

What is the purpose of APPLICATION FOR TRAVEL COSTS REFUND?

The purpose of this application is to secure reimbursement from an employer or organization for legitimate travel expenses that were necessary for work-related activities.

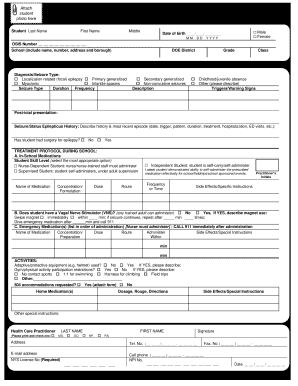

What information must be reported on APPLICATION FOR TRAVEL COSTS REFUND?

The application must report information such as the traveler's name, dates of travel, destination, purpose of the trip, and a detailed breakdown of all expenses incurred, along with receipts when applicable.

Fill out your application for travel costs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Travel Costs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.