Get the free Arizona Form 221 - taxhow

Show details

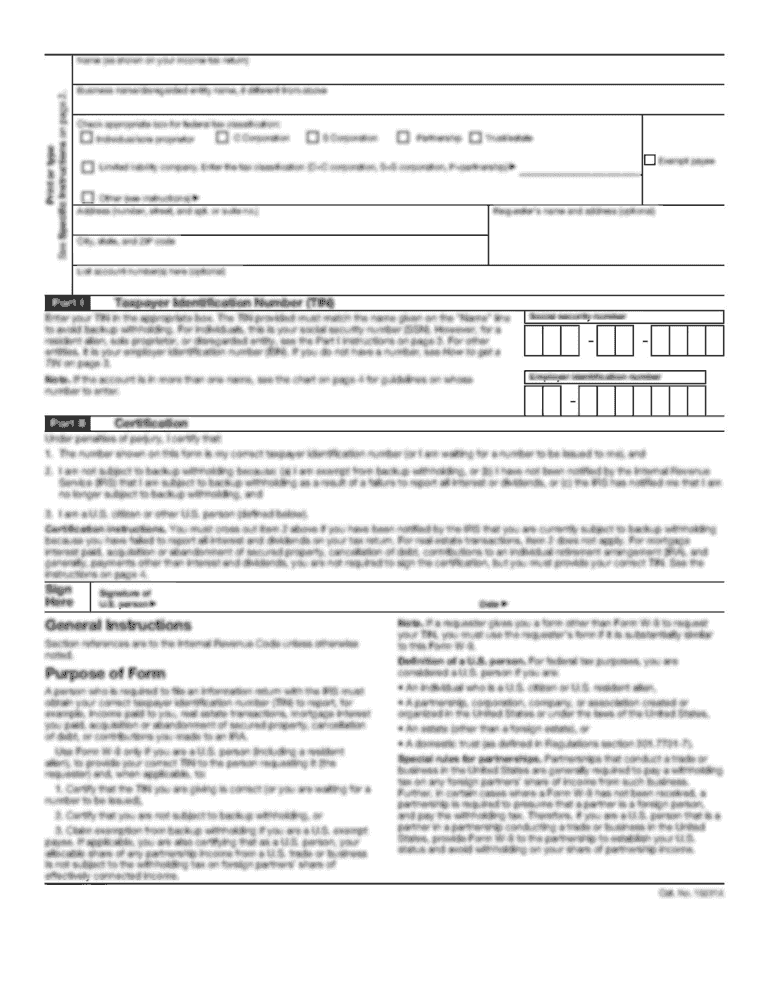

ARIZONA FORM 221 Underpayment of Estimated Tax by Individuals 2012 Attach to your return. Name (first, middle initial, last) If joint return, also give spouse s name and middle initial. Social Security

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 221

How to edit arizona form 221

How to fill out arizona form 221

Instructions and Help about arizona form 221

How to edit arizona form 221

To edit arizona form 221, you can utilize pdfFiller's online tools. Upload the PDF version of the form to your pdfFiller account. Once uploaded, use the editing tools to add, remove, or modify the necessary fields before saving your changes.

How to fill out arizona form 221

To fill out arizona form 221 accurately, follow these steps:

01

Download the form from the official Arizona Department of Revenue website or access it through pdfFiller.

02

Gather all required information, including taxpayer identification numbers and relevant financial details.

03

Carefully fill in the required fields, ensuring all information is correct and complete.

04

Review the form for accuracy before submitting it.

Latest updates to arizona form 221

Latest updates to arizona form 221

Check the Arizona Department of Revenue website for the most recent updates to arizona form 221. Staying informed about any changes ensures compliance with current tax regulations.

All You Need to Know About arizona form 221

What is arizona form 221?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 221

What is arizona form 221?

Arizona form 221 is a tax form utilized by individuals and businesses in the state of Arizona for reporting certain types of income and tax credits. It is part of the Arizona Department of Revenue's documentation to facilitate tax compliance and revenue reporting.

What is the purpose of this form?

The primary purpose of arizona form 221 is to report specific income adjustments and claim tax credits. Understanding its purpose helps filers ensure they are correctly reporting their financial information to the state.

Who needs the form?

Individuals or entities required to declare specific types of income and credits in Arizona must complete arizona form 221. This includes taxpayers who have claimed specific deductions or tax credits in previous filings.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out arizona form 221 if their income does not involve the types of transactions or deductions reported by the form. Check with a tax professional or the Arizona Department of Revenue for specific criteria regarding exemptions.

Components of the form

Arizona form 221 includes sections for taxpayer identification, income reporting, and applicable credits. Each section must be completed with accurate data to ensure compliance with state tax laws.

What are the penalties for not issuing the form?

Failing to file arizona form 221 when required can result in penalties imposed by the Arizona Department of Revenue. These penalties may include fines, interest on unpaid taxes, and potential legal action for non-compliance.

What information do you need when you file the form?

To file arizona form 221, you will need your Social Security number or Employer Identification Number (EIN), details of income being reported, and any relevant tax credit information. Having this information ready helps streamline the filing process.

Is the form accompanied by other forms?

Arizona form 221 may require accompanying forms, depending on the specific circumstances of the taxpayer. It is important to check for any required additional documentation before submission.

Where do I send the form?

Completed arizona form 221 should be submitted to the Arizona Department of Revenue at the designated address provided on the form. Ensure the form is sent to the correct location to avoid processing delays.

See what our users say