Get the free Colorado forms DR0158-F (2014)

Show details

8 Sep 2014 ... the official Colorado Taxation Website. Account Number ... income must file a Colorado income tax return if it is required to file a federal income tax ... Colorado .gov/RevenueOnline

We are not affiliated with any brand or entity on this form

Instructions and Help about colorado forms dr0158-f 2014

How to edit colorado forms dr0158-f 2014

How to fill out colorado forms dr0158-f 2014

Instructions and Help about colorado forms dr0158-f 2014

How to edit colorado forms dr0158-f 2014

To edit Colorado Form DR 0158-F, you can utilize pdfFiller, which provides tools that allow you to modify text, add your signature, or insert additional information as required. Follow these steps:

01

Upload your original form to the pdfFiller platform.

02

Select the editing tools to adjust text or format.

03

Save your changes before downloading the edited form.

How to fill out colorado forms dr0158-f 2014

Filling out Colorado Form DR 0158-F requires careful attention to detail to ensure compliance. Follow these steps for completion:

01

Begin by entering your personal identification details, such as your name and address.

02

Provide your tax identification number if applicable.

03

Clearly state the amounts for payments and any deductions.

04

Review the form for accuracy before submission.

Latest updates to colorado forms dr0158-f 2014

Latest updates to colorado forms dr0158-f 2014

As of 2023, it is essential to check the Colorado Department of Revenue for any changes to Form DR 0158-F. Keeping up-to-date ensures compliance with state tax laws.

All You Need to Know About colorado forms dr0158-f 2014

What is colorado forms dr0158-f 2014?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About colorado forms dr0158-f 2014

What is colorado forms dr0158-f 2014?

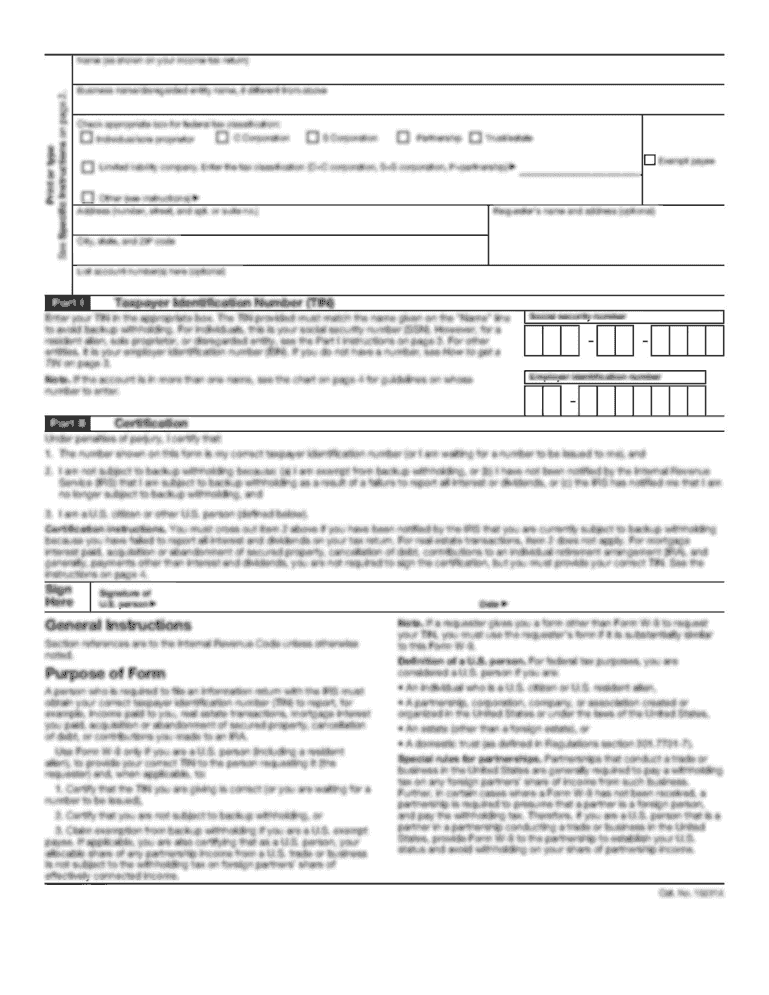

Colorado Form DR 0158-F is a tax form used in the state of Colorado to report certain types of payments made during the tax year. It's typically associated with various credits, refunds, and adjustments to comply with state tax regulations.

What is the purpose of this form?

The primary purpose of Form DR 0158-F is to report tax credits claimed and facilitate the correct calculation of income tax refunds. It helps the Colorado Department of Revenue track payments and ensure proper credit is applied to filers' accounts.

Who needs the form?

Taxpayers who have claimed specific tax credits or who are requesting refunds may need to complete Colorado Form DR 0158-F. It is primarily used by individuals and businesses who meet the criteria for reporting these payments.

When am I exempt from filling out this form?

You may be exempt from filling out Colorado Form DR 0158-F if you do not have any reportable payments or if your total income is below the threshold exempting you from state tax obligations. Additionally, certain tax-exempt organizations do not need to submit this form.

Components of the form

Colorado Form DR 0158-F includes sections for personal identification, payment details, tax credits claimed, and summary totals. Each component is essential to provide a complete and accurate report of your tax situation.

Due date

The due date for submitting Colorado Form DR 0158-F typically aligns with the federal tax deadline of April 15. However, be sure to check with the Colorado Department of Revenue for any specific extensions or changes applicable to your situation.

What are the penalties for not issuing the form?

Failure to file Colorado Form DR 0158-F can result in penalties, including fines or delays in processing your tax refunds. It may also lead to additional scrutiny from the Colorado Department of Revenue regarding your tax compliance status.

What information do you need when you file the form?

When filing Colorado Form DR 0158-F, you will need to have your personal identification information, details of your income, any payments made, and documentation supporting any claimed tax credits. Accurate records help ensure a smooth filing process.

Is the form accompanied by other forms?

Depending on your tax situation, Colorado Form DR 0158-F may need to be submitted alongside other forms, such as the federal tax return or state-specific forms related to deductions and credits. Always verify requirements based on your individual circumstances.

Where do I send the form?

Completed Colorado Form DR 0158-F should be sent to the address specified by the Colorado Department of Revenue based on your filing method (electronic or paper). Ensure that you verify the correct submission address to avoid processing delays.

See what our users say