Get the free ST-120 - lib store yahoo

Show details

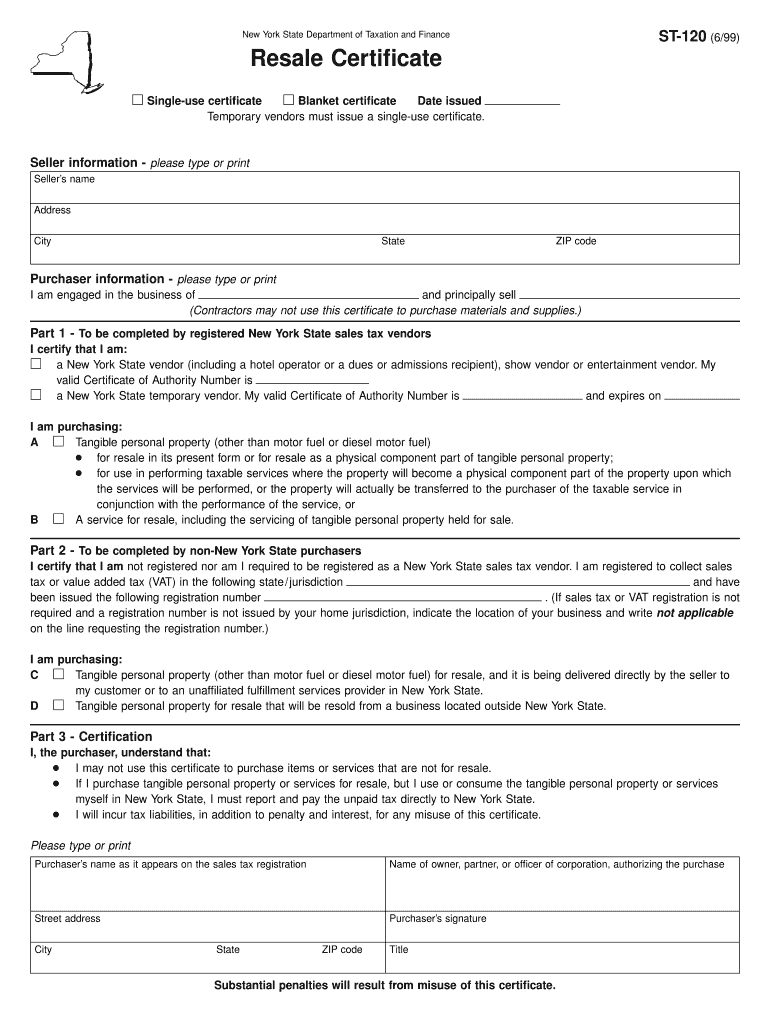

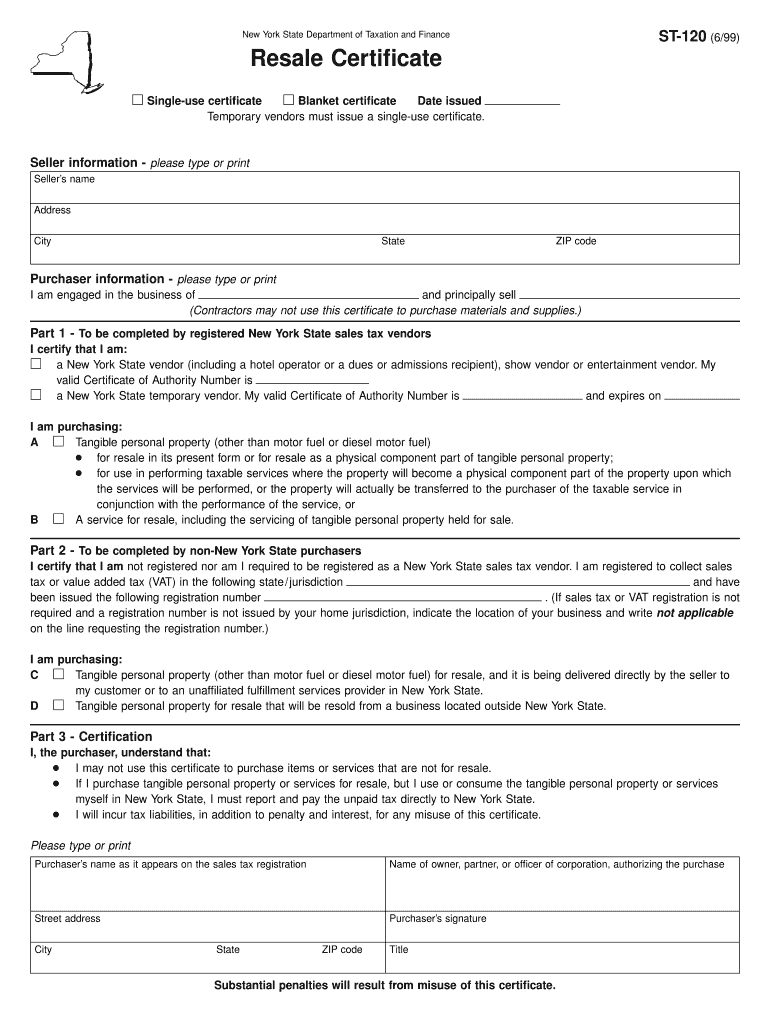

This form is used as a sales tax exemption certificate for purchasers who are registered as New York State sales tax vendors or are not required to be registered, allowing them to buy tangible personal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-120 - lib store

Edit your st-120 - lib store form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-120 - lib store form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st-120 - lib store online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st-120 - lib store. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-120 - lib store

How to fill out ST-120

01

Begin by downloading the ST-120 form from the appropriate state tax website.

02

Fill in your name, address, and business information in the designated sections.

03

Provide the date of the purchase and the vendor's information.

04

Identify the type of products being purchased and include a detailed description.

05

Indicate the reason for the tax exemption under the appropriate categories.

06

Sign and date the form to certify the information provided is accurate.

07

Submit the completed ST-120 form to the vendor at the time of purchase.

Who needs ST-120?

01

Individuals or businesses purchasing exempt items in certain states.

02

Retailers required to obtain tax exemption certificates from their customers.

03

Organizations such as non-profits that are exempt from sales tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a single purchase exemption request and a blanket purchase exemption request?

In contrast with a single purchase certificate, a blanket sales tax exemption allows a purchaser to give a seller one certificate that covers all similar purchases rather than separate certificates for each purchase.

Why would someone have a tax exemption?

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

What is a blanket certification?

Blanket Certification or "Blanket" means an exemption from the requirement to obtain an individual Water Quality Certification for certain activities deemed insignificant effect on water quality and may be issued to Section 404 nationwide or regional general permits.

What is a single purchase certificate?

Create a single use exemption certificate when a customer provides you with a certificate that applies only to a specific transaction, job, or contract. Use these certificates for temporary relief from taxes or regulations for a specific purpose, such as a special event, trade show, or brief project.

What is the difference between a single purchase certificate and a blanket certificate?

Purchasers apply for exemption certificates and provide them to sellers at checkout. In the case of a blanket certificate, it's not necessary to use a new certificate for each purchase, as long as the qualifying factors are the same and the certificate is valid.

How to fill out st-120 form pdf?

How to fill out Form ST-120? Open Form ST-120 in the PDF editor. Fill in your name, address, and sales tax registration number in the appropriate fields. Complete the seller's information if applicable. List the items being purchased for resale. Sign the form electronically. Download the completed form to your device.

What is NY ST-120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid.

Who needs a tax-exempt certificate?

Anyone who qualifies under state guidelines, which typically include nonprofit organizations, educational institutions, government agencies, and businesses intending to resell the purchased goods. Specific qualifications can vary significantly from one state to another.

What is a blanket certificate?

Under a blanket certificate issued pursuant to section 7(c) of the Natural Gas Act, a natural gas company may undertake a restricted array of routine activities without the need to obtain a case-specific certificate for each individual project.

Why do I need a tax exemption certificate?

A sales tax exemption certificate is a valuable tool for eligible businesses and organizations. It helps reduce costs by avoiding unnecessary tax payments, thus providing more resources for business growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-120?

ST-120 is a form used in New York State for purchasers of tangible personal property or services to claim exemption from sales tax when the purchase is made for resale.

Who is required to file ST-120?

Businesses that purchase goods or services for resale and wish to avoid paying sales tax on those purchases are required to file ST-120.

How to fill out ST-120?

To fill out ST-120, applicants need to provide their name, address, and sales tax identification number, indicate the type of property or service being purchased, and sign the form to certify that the purchase is for resale.

What is the purpose of ST-120?

The purpose of ST-120 is to allow eligible purchasers to claim a tax exemption on purchases intended for resale, thereby preventing double taxation.

What information must be reported on ST-120?

ST-120 must include the purchaser's name, address, sales tax ID number, the type of property or services being purchased, and a signature certifying the accuracy of the information provided.

Fill out your st-120 - lib store online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-120 - Lib Store is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.