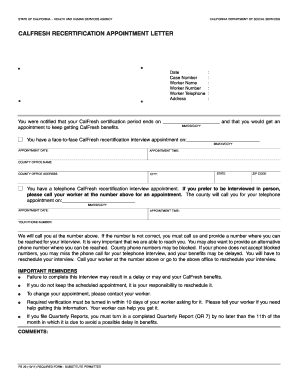

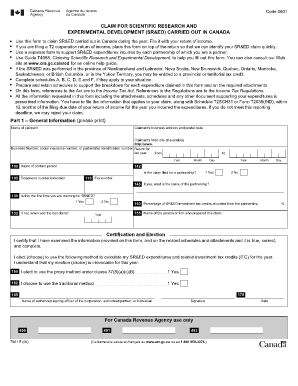

Nelnet Forbearance Application 2010-2026 free printable template

Show details

Dear Valued Customer: Thank you for contacting Telnet. The second page of this document contains the forbearance application. Please know that until your forbearance request is approved and processed,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign student loan removal letter template form

Edit your nelnet dispute letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dispute letter for student loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ferpa student loan deletion template online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nelnet dispute letter sample form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student loan deletion letter form

How to fill out Nelnet Forbearance Application

01

Gather necessary information such as your loan details and personal identification.

02

Visit the Nelnet website and navigate to the Forbearance Application section.

03

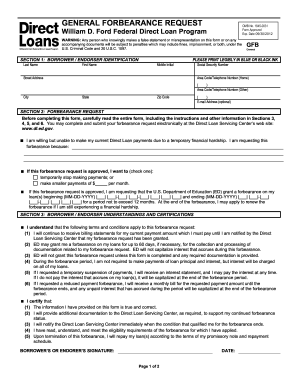

Select the type of forbearance you are applying for (temporary or general).

04

Fill out the application form with accurate personal and loan information.

05

Provide documentation to support your forbearance request, if required.

06

Review your application for any errors or missing information.

07

Submit the application online or print it out and send it to Nelnet via mail.

Who needs Nelnet Forbearance Application?

01

Borrowers experiencing temporary financial hardship.

02

Students currently enrolled in school who need to pause their loan repayment.

03

Individuals facing unemployment or extended medical issues.

04

People needing to manage unexpected expenses impacting their ability to pay.

Fill

student loan deletion letter template

: Try Risk Free

People Also Ask about student loan letter of deletion

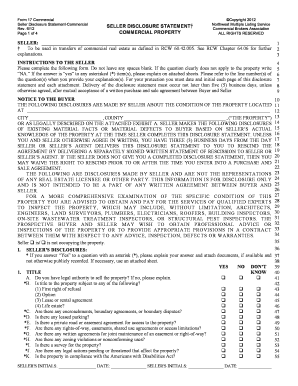

What is a 611 letter?

The 611 credit dispute letter is a follow-up letter when a credit agency replies that they have verified the mentioned information. It requests the agency's verification method of the disputed information and refers 611 Section of the Fair Credit Reporting Act.

What is a Section 611 credit repair?

A 611 credit disputing letter is sent after a credit agency confirms that the information mentioned in the letter has been verified. It asks the credit bureau to provide the method of verification used to verify a disputed item.

How do I write a letter to remove late payments?

Based on my otherwise spotless payment history, I would like to request that you apply a goodwill adjustment to remove the late payment mark from my credit report. Granting this request will help me improve my overall credit history and demonstrate my consistency as a creditworthy borrower.

How to write a letter asking for deletion of missed student loan payments?

I truly believe that it doesn't reflect my creditworthiness and commitment to repaying my debts. It would help me immensely if you could give me a second chance and make a goodwill adjustment to remove the late [payment/payments] on [date/dates]. Thank you for your consideration, and I hope you'll approve my request.

Do 609 letters really work?

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

What is a letter to remove student loans?

A goodwill letter is a letter you send to your loan servicer to request that, in an act of goodwill, it remove any late or missed student loan payments from your credit report. Since late payments are a major red flag, your credit score could tank if you don't make on-time payments.

How do I legally delete student loans?

You cannot remove a student loan from your credit report without paying if the entry is accurate. You can, however, file a dispute with the three major credit bureaus – Experian, Equifax, and TransUnion – to correct fraudulent or false student loan account information on your report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit student loan dispute letter sample on an iOS device?

Create, modify, and share how to write a letter for student loan forgiveness using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete sample letter to remove student loan from credit report pdf on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your student loan removal letter, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete nelnet forbearance form on an Android device?

On Android, use the pdfFiller mobile app to finish your mohela dispute letter. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is Nelnet Forbearance Application?

The Nelnet Forbearance Application is a request form that allows borrowers to temporarily reduce or pause their student loan payments due to financial hardships or other qualifying circumstances.

Who is required to file Nelnet Forbearance Application?

Borrowers experiencing financial difficulties, unemployment, or other eligible situations that impede their ability to make regular loan payments are required to file the Nelnet Forbearance Application.

How to fill out Nelnet Forbearance Application?

To fill out the Nelnet Forbearance Application, borrowers should complete the provided form with their personal information, loan details, and a description of their financial situation, and then submit it to Nelnet for review.

What is the purpose of Nelnet Forbearance Application?

The purpose of the Nelnet Forbearance Application is to provide borrowers the opportunity to temporarily postpone their loan payments without risking default, allowing them to regain financial stability.

What information must be reported on Nelnet Forbearance Application?

The Nelnet Forbearance Application must report personal information such as the borrower's name, address, Social Security number, loan details, the reason for forbearance, and any relevant financial information that supports the request.

Fill out your Nelnet Forbearance Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ferpa Student Loan Deletion Template Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to late payment removal letter pdf

Related to student loan forgiveness letter template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.