Get the free APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROP...

Show details

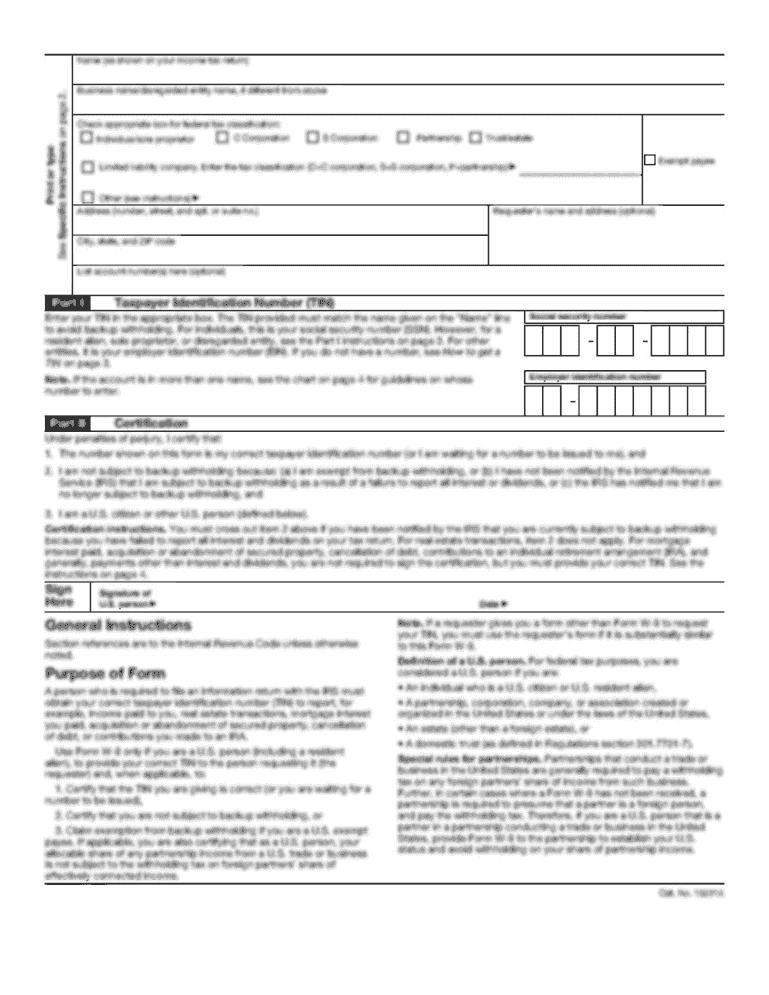

This document is an application form for property owners seeking an exemption based on owner-occupancy for properties with three units or less in Santa Monica.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for exemption on

Edit your application for exemption on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for exemption on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for exemption on online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for exemption on. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for exemption on

How to fill out APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY

01

Obtain the APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY form from your local tax assessor's office or website.

02

Carefully read the instructions provided with the application to understand the eligibility criteria.

03

Fill in your personal information, including your name, address, and contact details.

04

Indicate the property details, including the property address and the type of property (three-unit or less).

05

Provide documentation that proves you occupy the property as your primary residence, such as utility bills or a driver's license.

06

Complete any additional sections that require information about property use or occupant details.

07

Review the entire application for accuracy and completeness.

08

Sign and date the application where indicated.

09

Submit the completed application to your local tax assessor's office by the specified deadline.

Who needs APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY?

01

Homeowners who reside in a property that consists of three units or less may need to apply for this exemption.

02

Individuals looking to reduce their property tax burden by proving they occupy the property as their primary residence.

03

Property owners who meet the eligibility criteria set by local laws regarding owner-occupancy exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for property tax exemption in California for seniors?

Eligibility Requirements: Homeowners must be age 55 or better (For married couples, only one spouse must be 55 or better to qualify.) Homeowners must have sold their former residence within 2 years of purchasing the replacement property. Both the former and replacement properties must be the owner's primary residence.

Who is usually exempt from property taxes?

A property tax exemption provides relief from property taxes for eligible individuals and groups, including religious organizations, governmental entities, seniors, veterans and homeowners with disabilities.

Who is exempt from paying local property taxes?

LPT exemptions that are available in both valuation periods Properties used by a charity or public body providing special needs accommodation. Registered nursing homes. Properties unoccupied for an extended period due to illness of the owner. Properties bought, adapted or built for use, by incapacitated persons.

What information do I need to file a homestead exemption?

To file a homestead exemption, you'll need to provide information about yourself, including your name, birth date and marital status, as well as information about your home, including the address and your purchase date.

Who can go exempt on taxes?

Who should be filing exempt on taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

Who is exempt from paying property taxes in USA?

Common property tax exemptions include Veteran, Disabled Veteran, Homestead, Over 65 and more. Depending on where you live, you may be able to claim multiple property tax exemptions. Not all Veterans or homeowners qualify for these exemptions. Exemptions can vary by county and state.

How do I qualify for property tax exemption in Washington state?

Qualifying activity: Own and occupy a primary residence in the State of Washington; have enough equity to secure the interest of the State of Washington in the property; and have a combined disposable income equal to or less than the Deferral Threshold for your county. See income thresholds.

Who qualifies for homeowners exemption in Illinois?

Most homeowners are eligible for this exemption if they own and occupy the property as their principal place of residence. Once this exemption is applied, the Assessor's Office auto-renews it for you each year. This exemption provides savings by reducing the equalized assessed value of an eligible property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY?

The APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY is a form that property owners use to apply for property tax exemptions based on their status as owner-occupants of properties with three units or fewer. This exemption can provide financial relief by lowering property taxes for eligible homeowners.

Who is required to file APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY?

Property owners who live in a residential property comprised of three units or fewer and wish to claim an exemption on their property taxes must file this application. It is mandatory for those seeking the exemption to complete the application to qualify.

How to fill out APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY?

To fill out the application, property owners should provide their personal details such as name, address, and contact information, along with information about the property including its address, number of units, and proof of owner occupancy. Supporting documents may be required to validate the application.

What is the purpose of APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY?

The purpose of the application is to allow eligible homeowners to reduce their property tax burden by qualifying for tax exemptions based on the owner-occupancy status of their property. This aims to support homeowners and help maintain affordable housing.

What information must be reported on APPLICATION FOR EXEMPTION ON THE BASIS OF OWNER-OCCUPANCY OF THREE-UNIT-OR-LESS PROPERTY?

The application must report owner information, property details including its address and type, occupancy status, and any other documentation that proves the property is owner-occupied. Additionally, income information may be required to assess eligibility for the exemption.

Fill out your application for exemption on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Exemption On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.