Canada Form EXT 1466 2006-2026 free printable template

Show details

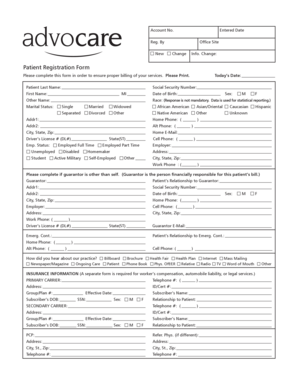

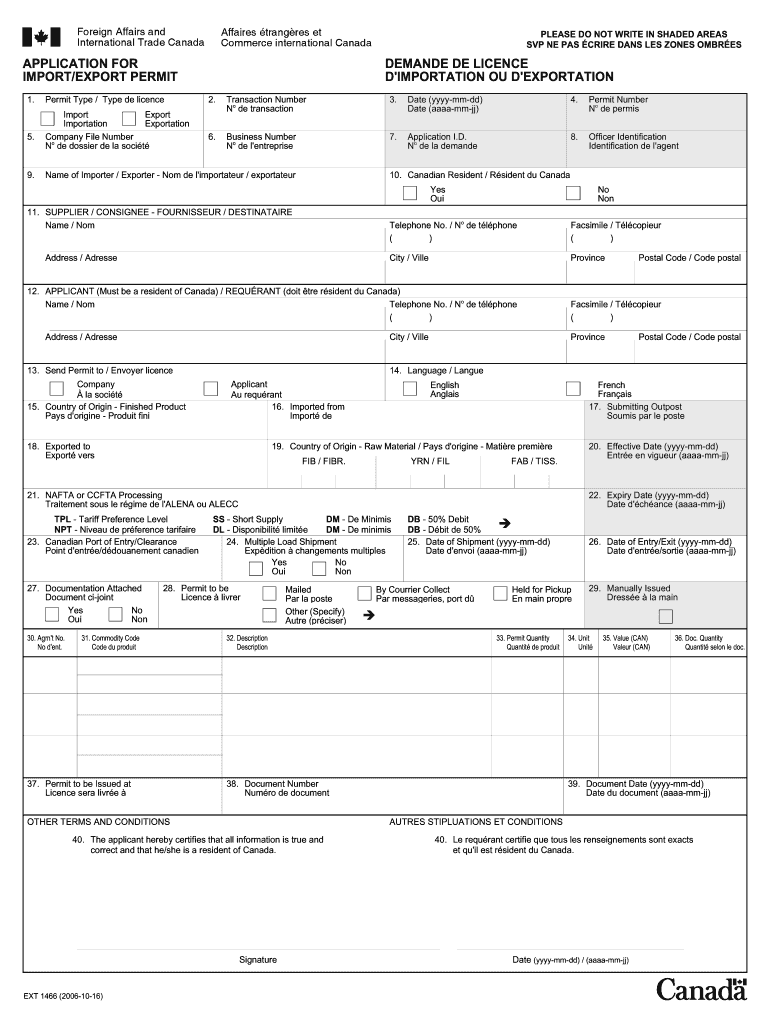

PLEASE DO NOT WRITE IN SHADED AREAS SVP NE PAS CRIME DAYS LES ZONES OMAR ES APPLICATION FOR IMPORT/EXPORT PERMIT 1. 5. 9. Permit Type / Type DE license Export Import Exportation Importation Company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Form EXT 1466

Edit your Canada Form EXT 1466 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Form EXT 1466 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada Form EXT 1466 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada Form EXT 1466. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Canada Form EXT 1466

How to fill out Canada Form EXT 1466

01

Gather all necessary documents, including identification and supporting information.

02

Obtain a copy of Canada Form EXT 1466 from the official website or local office.

03

Start filling out the personal information section with your name, address, and contact details.

04

Provide your date of birth and any relevant identification numbers.

05

Complete the sections related to your legal status in Canada, including visa or residency information.

06

If applicable, include details about your employment or study status.

07

Review all entered information for accuracy and completeness.

08

Sign the form where indicated to certify the information provided.

09

Submit the form as instructed, either electronically or by mail, along with any required documents.

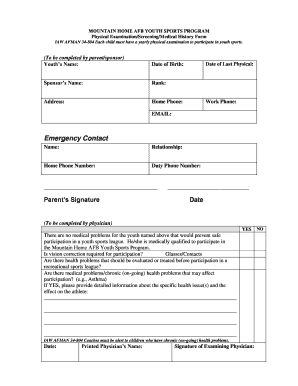

Who needs Canada Form EXT 1466?

01

Individuals applying for an extension of their stay in Canada.

02

Students who require additional time to complete their studies.

03

Workers needing to extend their work permit.

04

Anyone seeking to change their status or apply for a different type of permit while in Canada.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS stockpiling rule?

(2) after official acceptance to participate in IRS e-file (EFIN has been approved by the IRS), stockpiling refers to waiting more than three calendar days to submit the return to the IRS once the ERO has all necessary informaton for origination (of the return).

Can I use SSN as TIN?

As the withholding agent, you must generally request that the payee provide you with its U.S. taxpayer identification number (TIN). You must include the payee's TIN on forms, statements, and other tax documents. The payee's TIN may be any of the following. An individual may have a Social Security number (SSN).

What does publication 1345 require?

To reduce the likelihood of identity theft and fraud, Publication 1345 requires that in a remote transaction, the software provider and the ERO must verify the taxpayer's identity through third-party knowledge-based authentication (KBA).

What is form 822?

NA 822 (7/16) - Notice Of Action - Transportation Change (Required Form - Substitute Permitted)

What is form 1345?

Publication 1345, Handbook for Authorized IRS e-file Providers of Individual Income Tax Returns, provides rules and requirements for participation in IRS e-file of individual income tax returns and related forms and schedules.

What is form 4506 used for?

Use Form 4506 to: Request a copy of your tax return, or. Designate a third party to receive the tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the Canada Form EXT 1466 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your Canada Form EXT 1466.

Can I edit Canada Form EXT 1466 on an iOS device?

Create, modify, and share Canada Form EXT 1466 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit Canada Form EXT 1466 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Canada Form EXT 1466 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Canada Form EXT 1466?

Canada Form EXT 1466 is a form used by taxpayers to report certain information to the Canada Revenue Agency (CRA) regarding their foreign income, ownership in foreign entities, and other foreign-related financial information.

Who is required to file Canada Form EXT 1466?

Individuals and corporations that have foreign income, assets, or ownership in foreign entities and meet the specific thresholds set by the CRA are required to file Canada Form EXT 1466.

How to fill out Canada Form EXT 1466?

To fill out Canada Form EXT 1466, taxpayers must provide accurate financial information regarding their foreign income, assets, and related entities, ensuring all sections are completed according to the guidelines provided by the CRA.

What is the purpose of Canada Form EXT 1466?

The purpose of Canada Form EXT 1466 is to ensure that Canadian taxpayers disclose their foreign income and holdings, thereby enabling the CRA to monitor and enforce compliance with Canadian tax laws.

What information must be reported on Canada Form EXT 1466?

The information that must be reported on Canada Form EXT 1466 includes details of foreign income, ownership interests in foreign corporations and partnerships, foreign holdings, and any other relevant financial information as specified by the CRA.

Fill out your Canada Form EXT 1466 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Form EXT 1466 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.