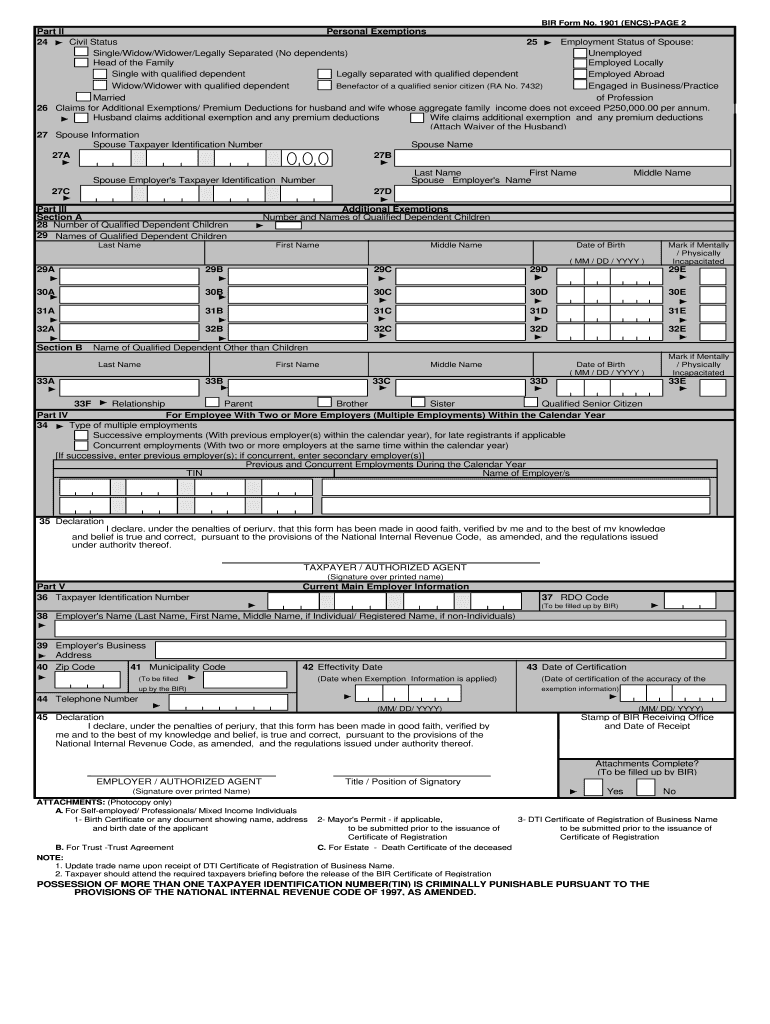

PH BIR 1901 Part II free printable template

Fill out, sign, and share forms from a single PDF platform

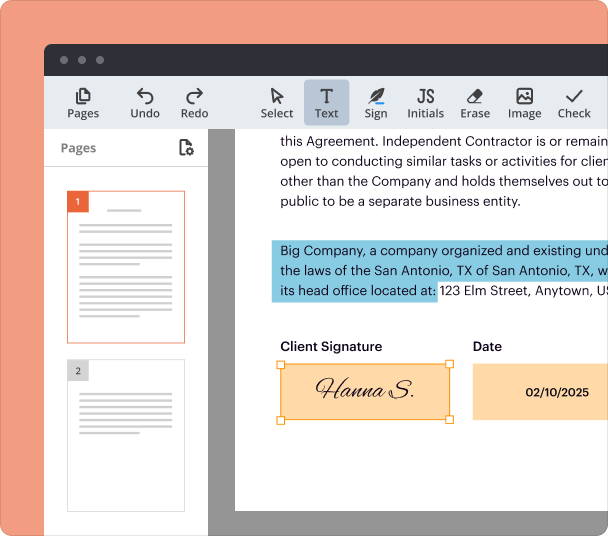

Edit and sign in one place

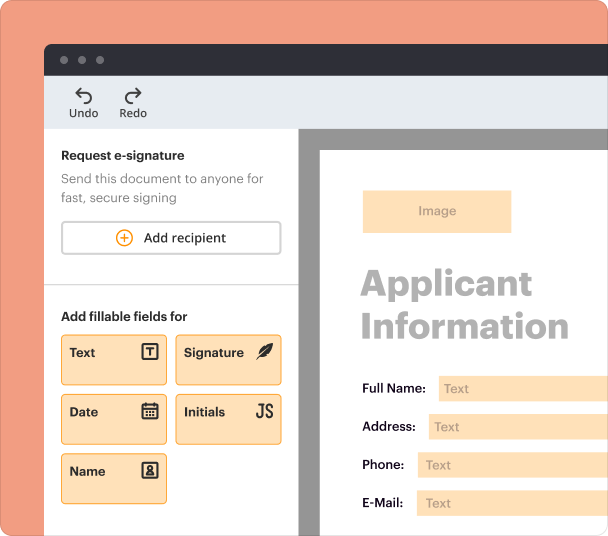

Create professional forms

Simplify data collection

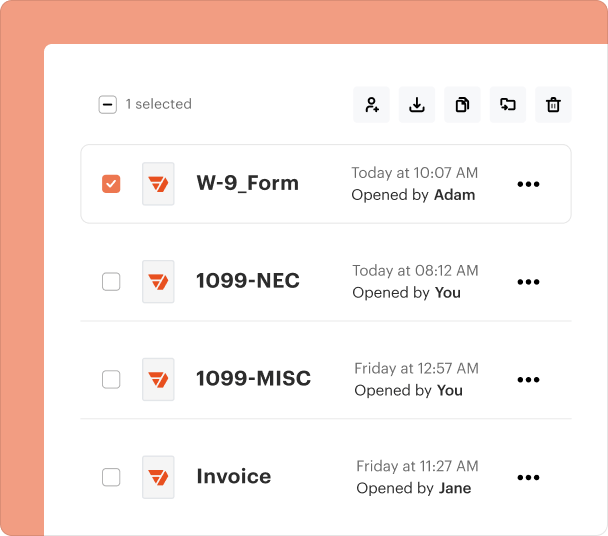

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

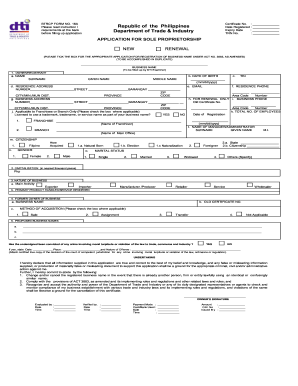

Detailed Guide to BIR Form 1901: Registration for Freelancers in the Philippines

How to fill out a BIR Form 1901?

Filling out the BIR Form 1901 is crucial for freelancers in the Philippines to ensure compliance with tax obligations. This form serves as the application for registration with the Bureau of Internal Revenue (BIR) and is essential for obtaining a Taxpayer Identification Number (TIN) and fulfilling other tax obligations. For a streamlined process, consider using pdfFiller to edit and manage your forms effectively.

Understanding your freelance classification

In the Philippines, a freelancer is defined as an individual who offers services to clients without being an employee of any company. There are various categories of freelancers recognized by the BIR, which falls under the self-employed classification. Choosing the right classification affects your tax obligations, so understanding this can help you make informed decisions.

-

Definition of a Freelancer - It refers to independent workers providing services on a contractual basis.

-

BIR Categories - Freelancers may be classified as professional practitioners, self-employed individuals, or sole proprietorships.

-

Implications of Classification - Your chosen classification will determine your tax responsibilities and reporting requirements.

Essential requirements for registration

Before filling out BIR Form 1901, you need to gather essential documents and information. Securing the necessary documents ensures a smoother registration process and compliance with the BIR's requirements.

-

Taxpayer Identification Number (TIN) - Required for all tax-related transactions in the Philippines.

-

Occupational Tax Receipt - A document proving you’re allowed to operate your freelance business.

-

Valid ID - Ensure that you have the proper identification, which may include government-issued IDs.

-

BIR Form 1901 - This is the application form you need to fill out for registration.

-

Annual Registration Fee - A fee required to maintain your registration on an annual basis, often fulfilled with BIR Form 0605.

-

Authority to Print Receipts - You must apply for BIR Form 1906 to legally print official receipts for your services.

-

Registration of Books of Accounts - Maintain records as required by BIR, typically documented in Form 1905.

-

8% Tax Option - An optional declaration that may simplify your tax obligations.

-

DTI Certificate - Necessary if you're operating under a business name registered with the Department of Trade and Industry.

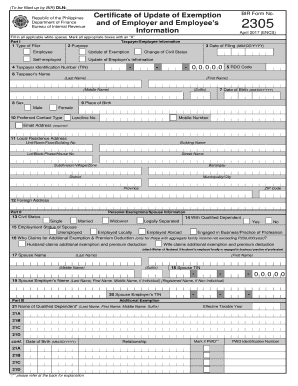

How to navigate BIR Form 1901 fields?

Understanding the fields in BIR Form 1901 is crucial for ensuring accurate information is provided. Several sections require specific details that impact how you’re taxed.

-

Personal Exemptions - This section covers deductions for dependents, which can reduce your taxable income.

-

Civil Status - Your marital status and the employment status of your spouse influence your exemptions.

-

Head of Family Exemption - Ensure you understand qualification for additional claims.

-

Qualified Dependent Children - List details of children you can claim as dependents.

-

Additional Dependents - Other dependents may also qualify for exemptions distinct from children.

-

Multiple Employment Scenarios - If applicable, report multiple employer details accurately to avoid discrepancies.

What tax deductions and exemptions apply?

Freelancers in the Philippines should be aware of the potential tax deductions available. Understanding these can lead to considerable savings and better financial planning.

-

Married Couples - You may be eligible for additional exemptions depending on your marital status.

-

Premium Deductions - Certain expenses, such as health insurance, can also be claimed.

-

Aggregate Family Income - Tax implications depend on your family’s total income.

-

Documentation - Keeping clear records of your deductions is vital for future claims and audits.

How long does the registration process take?

Once you've submitted your BIR Form 1901, it's important to be aware of the timeline for approval. Various factors may affect this duration, so managing expectations is key.

-

Typical Timeline - The registration process usually takes about 2 to 3 weeks from submission to approval.

-

Common Delays - Issues with incomplete documentation or incorrect information can significantly extend processing time.

-

Follow-up Procedures - Always have a plan for following up with the BIR to check the status of your application.

What are the costs associated with registration?

Freelancers must budget for the costs associated with BIR registration to avoid surprises. Being aware of these can strengthen your financial management.

-

Estimated Overall Costs - Many freelancers can expect to spend between PHP 1,000 to PHP 5,000 on registration, including fees.

-

Additional Fees - Professional assistance for tax registration may incur extra costs but can alleviate stress.

-

In-House vs. Professional - Weigh the pros and cons of doing it yourself versus hiring a professional.

How can pdfFiller simplify the document management process?

pdfFiller provides freelancers with robust tools to manage their BIR registration documents efficiently. With a cloud-based platform, users can easily edit and store their forms securely.

-

Completing Forms - You can use pdfFiller to fill out your BIR Form 1901 and related documents online.

-

Editing and Signing - Electronically sign documents and make edits anytime, saving time and effort.

-

Collaboration - Share registration forms with teammates or advisors for feedback before submission.

-

Secure Storage - With pdfFiller, you can access tax documents securely from anywhere at any time.

Frequently Asked Questions about editable form 1901

What is BIR Form 1901?

BIR Form 1901 is the application for registration for self-employed individuals and freelancers in the Philippines. It is essential for obtaining a Taxpayer Identification Number (TIN) and ensures compliance with tax regulations.

Who needs to file BIR Form 1901?

Freelancers and self-employed individuals in the Philippines must file BIR Form 1901 to register for tax purposes. If you provide services independently, this form is mandatory.

What happens if I don’t register with BIR?

Failure to register with the BIR may lead to penalties and fines. It may also inhibit your ability to issue official receipts, which is crucial for any professional service.

Can I use pdfFiller for other BIR forms?

Yes, pdfFiller supports various BIR forms and allows users to edit, sign, and manage all tax-related documents easily. This can streamline your overall tax compliance process.

How long does the registration process take?

Typically, the registration process for BIR Form 1901 takes about 2 to 3 weeks, depending on how complete and accurate your submission is. Be prepared to follow up for updates on your application.

pdfFiller scores top ratings on review platforms