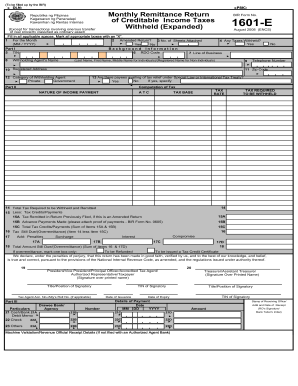

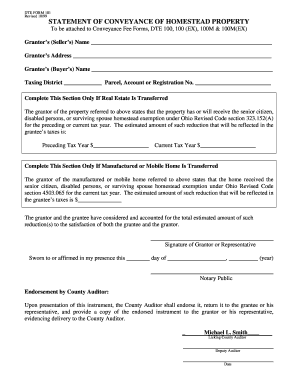

Who needs a BIR 1600 Form?

There is a wide range of subjects using a BIR 1600 Form. Those include government offices, agencies, bureaus, instrumentalities, government controlled corporations, government owned corporations, mayors to non-residents, those who pay to Value-added tax registered taxpayers etc.

What is BIR 1600 Form Used for?

A BIR 1600 Form is used for withheld tax return.

Is a BIR 1600 Form Accompanied by other Forms?

A BIR 1600 Form is self content document, and it is not accompanied by other forms.

What information should be provided in BIR 1600 Form?

Taxpayer contributes the following information:

-

Month and year

-

Amended return

-

Information about whether any taxes withheld during the accounting period

-

Withholding agent’s name

-

Tax Identification Number

-

DO code

-

Line of business

-

Withholding agent’s telephone number

-

Withholding agent’s zip code

-

Withholding agent’s address

-

Category of withholding agent

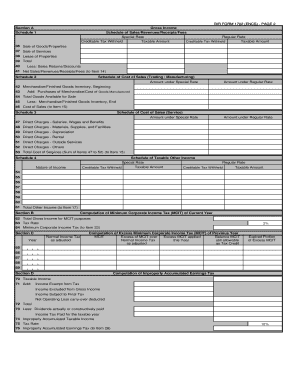

The main part is a table. It should be filled out by the mayor as well. There are special categories. If some of them fit the mayor, a tax base and tax required to be withheld are written in the adjacent cells.

When is BIR 1600 Form due?

This Form is filed on or before the 10th (tenth) day of the month that follows withholding tax was made.

Where do I send BIR 1600 Form?

Taxpayer can file a BIR 1600 Form in two ways. Those are Electronic and Non-Electronic.

Electronic Filing is made through the official Bureau of Internal Revenue website.

Non-Electronic Filing is completed either with the Revenue District Office or with the concerned Regional Consular Office under the same Revenue District Office depending on the taxpayer’s type.