Get the free RPD-41248 (2013)

Show details

RPD-41248 12 Rev. 9/25/2012 State of New Mexico Taxation and Revenue Department Application to be a Qualified Employer for Allocation of Nonresident Employee Income from Manufacturing Plants in New

We are not affiliated with any brand or entity on this form

Instructions and Help about rpd-4

How to edit rpd-4

How to fill out rpd-4

Instructions and Help about rpd-4

How to edit rpd-4

To edit rpd-4, download the form from the official IRS website. Once downloaded, you can use pdfFiller to open the file and make necessary changes, such as updating information or correcting errors. After editing, ensure you save the form properly before submission.

How to fill out rpd-4

Filling out rpd-4 requires careful attention to detail. First, gather all relevant financial documents and information needed for accurate completion. Then, follow these steps:

01

Enter your personal information including your name, address, and Social Security number.

02

Fill in the specific sections as outlined in the form instructions, ensuring all fields are completed accurately.

03

Review the form for any mistakes before submission.

Latest updates to rpd-4

Latest updates to rpd-4

As of October 2023, there have been no significant updates to rpd-4. However, tax regulations can change annually, so it is wise to check for any new guidance from the IRS that may affect how this form is completed or submitted.

All You Need to Know About rpd-4

What is rpd-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About rpd-4

What is rpd-4?

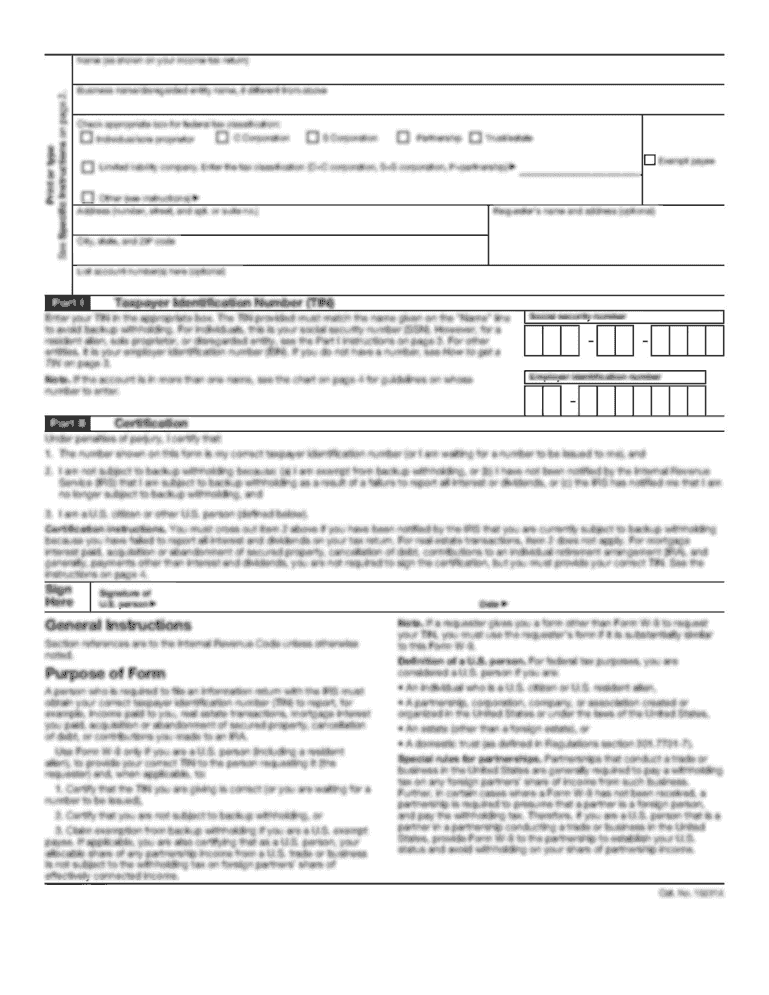

rpd-4 is an IRS form required for reporting specific financial transactions as mandated by U.S. tax law. This form assists in documenting income and expenses to ensure proper tax compliance.

What is the purpose of this form?

The purpose of rpd-4 is to provide the IRS with a detailed account of certain financial activities for the tax year. It helps the agency in assessing tax liabilities accurately while aiding taxpayers in keeping clear financial records.

Who needs the form?

Individuals and entities engaged in specific financial transactions must use rpd-4. Typically, this includes freelancers, contractors, and businesses that have made certain payments or received specific types of income throughout the tax year.

When am I exempt from filling out this form?

You are exempt from filing rpd-4 if your total payments or transactions fall below the threshold specified by the IRS for your category. Additionally, specific situations such as being classified as a tax-exempt entity may also render the form unnecessary.

Components of the form

rpd-4 is comprised of multiple sections, each designed to capture different financial data. Key components include personal identification information, details about the financial transactions, and signature lines for both the payer and payee. It is essential to fill in all parts of the form accurately to avoid penalties.

Due date

The due date for submitting rpd-4 typically aligns with the IRS filing deadlines. Be sure to check the IRS calendar for the specific deadline for the tax year in question to avoid late filing penalties.

What are the penalties for not issuing the form?

Failing to issue rpd-4 when required can result in significant penalties. The IRS may impose fines based on the number of forms that should have been filed and the duration of the delay. It is crucial to comply with all filing requirements to avoid additional costs.

What information do you need when you file the form?

When filing rpd-4, you will need several pieces of information including your taxpayer identification number, recipient's details, the amount of payments made, and the nature of the transaction. Gathering all necessary documentation beforehand can streamline the filing process.

Is the form accompanied by other forms?

rpd-4 may require the inclusion of supplementary documentation, particularly if you are submitting it as part of a larger tax return. Always verify with the IRS guidelines to ensure that you provide all necessary paperwork alongside the form.

Where do I send the form?

rpd-4 must be sent to the appropriate IRS processing center. The specific address can vary based on the taxpayer's state of residence. Consult the IRS website for the correct mailing address to ensure your form is processed timely.

See what our users say