WI Form 5 free printable template

Show details

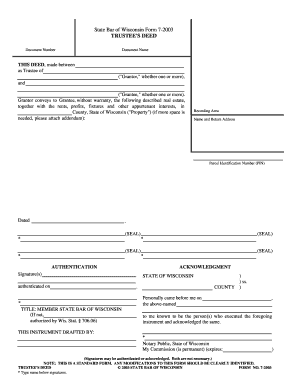

State Bar of Wisconsin Form 5-2003 PERSONAL REPRESENTATIVE S DEED Document Number Document Name THIS DEED, made between, as Personal Representative of the estate of (Decedent), (Granter, whether one

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign representative personal deed blank form

Edit your representative wisconsin deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin representative document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wisconsin form 5 2003 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit representative personal deed template form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out representative wisconsin form

How to fill out WI Form 5

01

Obtain the WI Form 5 from the relevant authority or website.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal details in the designated fields, including your name, address, and contact information.

04

Provide any relevant financial information as requested on the form.

05

Fill out sections pertaining to your specific situation or application purpose.

06

Review all the information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form according to the instructions provided, either online, by mail, or in person.

Who needs WI Form 5?

01

Individuals or businesses applying for specific permits or licenses in Wisconsin.

02

People seeking tax exemptions or benefits related to certain programs.

03

Any stakeholder needing to report information to the Wisconsin Department.

Fill

personal representative deed form 5 2003

: Try Risk Free

People Also Ask about wisconsin personal document

What are the disadvantages of a transfer on death deed?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

What is HT 110 form Wisconsin?

You must file a real estate transfer return at a Register of Deeds office when terminating a life estate or joint tenancy interest with a Termination of Decedent's Property Interest Form (HT-110). Filing this form meets the definition of a conveyance under state law (sec. 77.21, Wis. Stats.)

What is a personal representative deed in Wisconsin?

Personal representative by this deed does convey to GRANTEE all of the estate and interest in the property which the decedent had immediately prior to decedent's death, and all of the estate and interest in the property which the personal representative has since acquired.

How do you terminate a decedent's interest in Wisconsin?

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

Who can draft a deed in Wisconsin?

Legal instruments such as warranty deeds, quit claim deeds, etc., that convey title from one property owner to a new owner, are usually drafted by attorneys, or paralegals or legal secretaries under the supervision of an attorney.

How do I add someone to my deed in Wisconsin?

Use form 9400-623 if you are primary owner on record and you want to add or remove an owner to the certificate of title or if you want to add a lien (i.e. to request a lien notation). Form 9400-193.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my wisconsin 5 2003 deed in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your wi form 5 2003 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find authenticated expires wisconsin?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific representative form bar and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my wisconsin s deed in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your wisconsin form signatures and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is WI Form 5?

WI Form 5 is a specific tax form used in the state of Wisconsin for reporting income and calculating state tax liability.

Who is required to file WI Form 5?

Individuals or entities that have income requiring reporting to the Wisconsin Department of Revenue must file WI Form 5.

How to fill out WI Form 5?

To fill out WI Form 5, one needs to provide personal information, income details, deductions, and any credits applicable as per the instructions provided with the form.

What is the purpose of WI Form 5?

The purpose of WI Form 5 is to collect income information from residents for tax assessment and ensure compliance with state tax laws.

What information must be reported on WI Form 5?

Information that must be reported on WI Form 5 includes personal identification details, total income, deductions, credits, and tax liability calculations.

Fill out your form 5 2003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Deed Warranty Form is not the form you're looking for?Search for another form here.

Keywords relevant to form 5 2003 personal representative deed

Related to personal wisconsin authenticated

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.