Get the free Commercial Solar Energy Program Rebate Guidelines - anaheim

Show details

This document outlines the guidelines for the Commercial Solar Energy Program in Anaheim, providing information on application steps, energy efficiency requirements, and rebate processes for businesses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial solar energy program

Edit your commercial solar energy program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial solar energy program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial solar energy program online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commercial solar energy program. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial solar energy program

How to fill out Commercial Solar Energy Program Rebate Guidelines

01

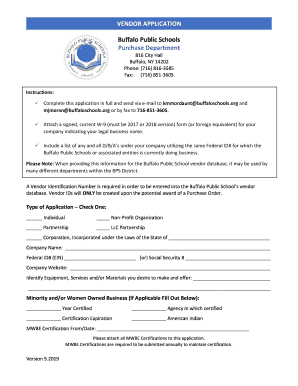

Obtain the Commercial Solar Energy Program application form from the official website.

02

Review the eligibility requirements to ensure your business qualifies.

03

Gather necessary documents such as proof of ownership, energy bills, and previous solar system installation records.

04

Complete the application form, filling in all required fields accurately.

05

Calculate the expected energy savings and potential rebate amount based on your solar system size.

06

Submit the completed application form along with all collected documents by the deadline.

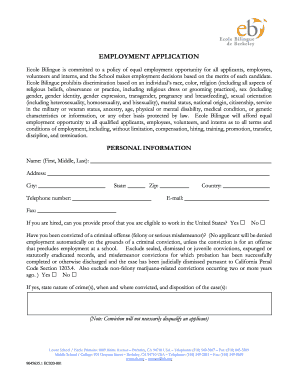

Who needs Commercial Solar Energy Program Rebate Guidelines?

01

Businesses looking to install solar energy systems for commercial purposes.

02

Commercial property owners aiming to reduce their energy costs.

03

Organizations seeking financial incentives for renewable energy investments.

Fill

form

: Try Risk Free

People Also Ask about

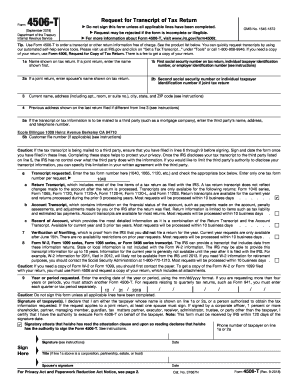

How to claim 30% solar tax credit?

How to Claim Your Solar Investment Tax Credit Keep your solar project receipts. Download a free version of IRS Form 5695. Enter the total cost of your PV system. Use that amount to calculate the 30% credit. Apply that 30% credit to your tax liability, on your typical IRS Form 1040.

What are the federal incentives for commercial solar systems?

Solar panel systems that are placed in service in 2022 or later and begin construction before 2033 are eligible for a 30% ITC or a 2.6 ¢/kWh PTC if they meet labor requirements issued by the Treasury Department or are under 1 megawatt (MW) in size.

What is the solar system rebate act?

Receive a $2,500 rebate after a solar installation and another $2,500 rebate after installation of a reverse cycle air conditioning system or a hot water heat pump.

Can an S-corporation claim a solar tax credit?

For tax years beginning after January 1, 2024, eligible filers can claim the clean electricity investment credit under section 48e in Part V. Note: This applies primarily to fiscal-year filers with tax years ending in 2025 (e.g., partnerships and S corporations filing Form 1065 or 1120-S).

How does the 30% solar tax credit work?

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034.

Can a business claim a solar tax credit?

Solar systems that are placed in service in 2022 or later and begin construction before 2034 are eligible for a 30% ITC or a 2.75 ¢/kWh5 PTC if they meet labor requirements issued by the Treasury Department6 or are under 1 megawatt (MW)7 in size.

How to claim solar tax credit for business?

Claiming the Commercial Solar Tax Credit To claim the Inflation Reduction Act solar panel tax credit, a business must file IRS Form 3468 with its annual tax return. To be eligible for the credit in a given year, a business must have commenced construction of its solar PV system before year-end.

What is the form for business solar tax credit?

A taxpayer claims the energy investment credit on Form 3468 with a timely filed (including extensions) federal income tax return for the tax year the energy property is placed in service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial Solar Energy Program Rebate Guidelines?

The Commercial Solar Energy Program Rebate Guidelines provide detailed information on the processes, requirements, and criteria for businesses to qualify for rebates when installing commercial solar energy systems.

Who is required to file Commercial Solar Energy Program Rebate Guidelines?

Businesses or entities that are implementing solar energy systems and wish to receive financial rebates through the program are required to file the Commercial Solar Energy Program Rebate Guidelines.

How to fill out Commercial Solar Energy Program Rebate Guidelines?

To fill out the Commercial Solar Energy Program Rebate Guidelines, applicants need to complete the application form accurately, provide necessary documentation related to the solar installation, and meet all specified eligibility criteria.

What is the purpose of Commercial Solar Energy Program Rebate Guidelines?

The purpose of the Commercial Solar Energy Program Rebate Guidelines is to incentivize the adoption of solar energy technologies in commercial settings, reduce overall installation costs, and promote sustainable energy practices.

What information must be reported on Commercial Solar Energy Program Rebate Guidelines?

The information that must be reported includes project details such as installation costs, equipment specifications, project timeline, expected energy generation, and compliance with regulatory standards.

Fill out your commercial solar energy program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Solar Energy Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.