Get the free Decline-in-Value Reassessment Application (Prop. 8) - fidelitytitle

Show details

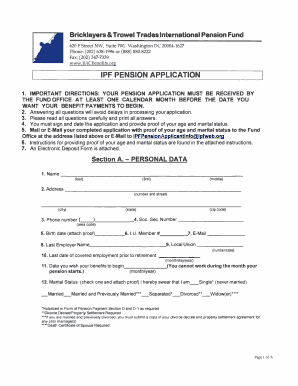

This document is used to apply for a temporary reduction in assessed property value due to a decline in market value as of January 1, 2009.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign decline-in-value reassessment application prop

Edit your decline-in-value reassessment application prop form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your decline-in-value reassessment application prop form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit decline-in-value reassessment application prop online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit decline-in-value reassessment application prop. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out decline-in-value reassessment application prop

How to fill out Decline-in-Value Reassessment Application (Prop. 8)

01

Obtain the Decline-in-Value Reassessment Application form from your local assessor's office or website.

02

Fill out your property information including the address, parcel number, and owner details.

03

Provide details of the assessed value of the property as of the lien date.

04

Document the current market value and any supporting evidence to justify the decline (e.g., recent sales, market trends).

05

Sign and date the application form.

06

Submit the completed application to your local assessor's office before the deadline, which is usually within a specified time frame after the tax bill is issued.

Who needs Decline-in-Value Reassessment Application (Prop. 8)?

01

Property owners who believe their property's current market value has decreased significantly from its assessed value.

02

Homeowners facing financial difficulty due to declining property values.

03

Investors or property owners looking to adjust their tax assessments based on market conditions.

Fill

form

: Try Risk Free

People Also Ask about

What triggers a reassessment in property taxes in California?

Transfers that will trigger a reassessment: Change in Ownership: Purchases and non-primary residence transfers among friends or family.

How to transfer property without reassessment in California?

A Qualified Personal Residence Trust (QPRT) offers California homeowners a strategic way to transfer property while potentially avoiding immediate tax reassessment. This estate planning tool allows homeowners to place their primary residence or second home into an irrevocable trust for a set period.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

Why is the assessed value of my house so low?

In many counties throughout the U.S., assessed value is a portion of the market value, calculated as a percentage of the market value of the property. As a result, the assessed value of a property is typically lower than appraised market value.

How to avoid property tax reassessment in California remodel?

Under California law, repairs or basic remodeling work are generally not considered subject to reassessment (e.g. fixing a roof, carpeting, cabinets, windows, or countertops), assuming no new square footage or fixtures are added.

How do I avoid real property tax reassessment in California?

Transferring property into or out of a revocable living trust, so long as the trustor and deed grantor are the same. Refinancing, as long as the title remains the same. Routine maintenance or repairs to the property like a new roof or plumbing won't lead to reassessment.

How are property taxes assessed on a new construction home in California?

New construction is generally assessable and may increase the taxable value of a property. The impact on a property tax assessment varies depending on the work being performed. Upon completion of the new construction, the assessor determines its fair market value and a base year value is established.

What triggers a property reassessment in a California remodel?

Transfers that will trigger a reassessment: New Construction: New buildings or additions, with only the new construction value added to the assessment. Remodels: Adding square footage or new features like a spa/pool, and complete kitchen or bath upgrades.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Decline-in-Value Reassessment Application (Prop. 8)?

The Decline-in-Value Reassessment Application (Prop. 8) is a form that property owners can file to request a reassessment of their property value if they believe it has declined below its current assessed value.

Who is required to file Decline-in-Value Reassessment Application (Prop. 8)?

Property owners who believe their property's market value has declined below the assessed value as of January 1st of the current year are required to file the Decline-in-Value Reassessment Application (Prop. 8).

How to fill out Decline-in-Value Reassessment Application (Prop. 8)?

To fill out the Decline-in-Value Reassessment Application (Prop. 8), property owners should complete the provided form with details about their property, including its assessed value, the reason for the reassessment request, and any supporting documentation.

What is the purpose of Decline-in-Value Reassessment Application (Prop. 8)?

The purpose of the Decline-in-Value Reassessment Application (Prop. 8) is to provide a mechanism for property owners to contest the assessed value of their property and to ensure that property taxes reflect the current market value.

What information must be reported on Decline-in-Value Reassessment Application (Prop. 8)?

The information that must be reported includes the property's address, the assessed value, the claim of decline in value, any relevant evidence of market value such as sales data, and the owner's contact information.

Fill out your decline-in-value reassessment application prop online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Decline-In-Value Reassessment Application Prop is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.