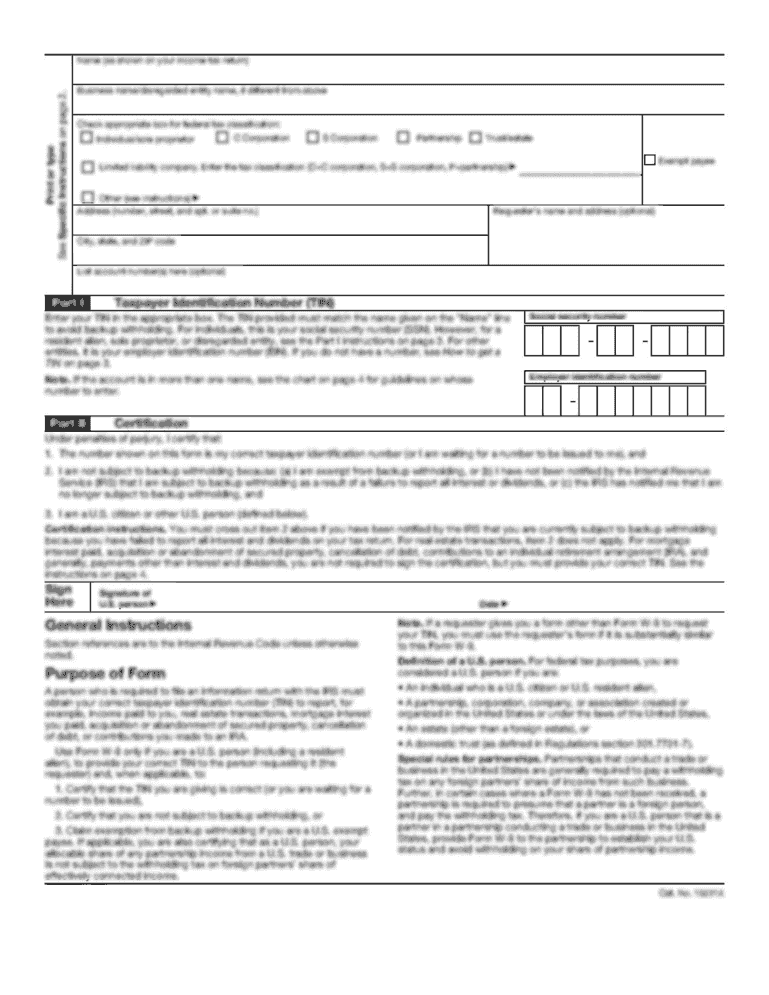

) A company employee will change contact information and fax this form to your supervisor or payroll and finance officer for review by the appropriate person. See the “Frequently Asked Questions” page for additional information about this form; please read section A(4). Please be sure to complete all sections under D and A, for example, “Other information such as change dates or requests for a specific change”. If you would like to request a particular change from your supervisor, you will need to file the appropriate change request form. The supervisor or payroll and finance officer or manager who has final authority shall mail and return the change request form to: PO BOX 97905

PO Box 897905 Phoenix, AZ 85 Please keep all the required forms on file. If a change is requested for someone not covered by the Form SS-5 or Form SS-7, you must file a Change of Address on Form SS7 with the appropriate office and include a copy of the Form SS-5 or Form SS-7 and a copy of the employee's latest pay stub and payroll deduction, if applicable. Fax the completed Form SS-7 and Form SS-5 to the Tax Administration Center: PO BOX 2201

PO BOX 90909

WASHINGTON, DC 20. Tax professionals are prohibited from assisting in a change of address by fax. A change of address is not always required. Some employees may voluntarily change their addresses. See “How Do I Get Started?” below for exceptions. If you have not requested a change of address, and you receive the change of address form from a supervisor, the supervisor must complete it for you and return it to you with any required fees or documents. If a request has been made with a supervisor, you are not required to file a Form SS-7 when the supervisor provides this form. If a request is made by an employee on his or her own, the employee should request these forms and pay any filing fees to the Tax Administration Center at PO Box 97905. If you receive an official change of address through the postal system you should obtain a copy of the official records to confirm that the address is correct. The taxpayer may request a correction of a record by following the instructions for Form SS-7, Request for Correction of Records and include with the request any required fees or documents.

Get the free businessnetkporg form

Show details

Small Business Accounts Employee Change Form Fax number: 1-800-369-8010 Please see page 3 for detailed instructions on filling out this form. Fill in all areas below using black ink. A. Customer information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your businessnetkporg form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your businessnetkporg form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing businessnetkporg form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit businessnetkporg form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is businessnetkporg form?

The businessnetkporg form is a financial reporting form used by businesses to document their financial activities and provide information about their income, expenses, assets, and liabilities.

Who is required to file businessnetkporg form?

All businesses, including corporations, partnerships, and sole proprietorships, are required to file the businessnetkporg form if they meet certain income or asset thresholds set by the tax authorities.

How to fill out businessnetkporg form?

To fill out the businessnetkporg form, businesses need to gather their financial records, such as bank statements, invoices, and receipts. They must then accurately report their income, expenses, assets, and liabilities according to the form's instructions.

What is the purpose of businessnetkporg form?

The purpose of the businessnetkporg form is to provide the tax authorities with an overview of a business's financial activities, ensuring compliance with tax laws and facilitating accurate tax assessment.

What information must be reported on businessnetkporg form?

The businessnetkporg form requires businesses to report their total income, deductions, net profit or loss, assets, liabilities, and certain financial ratios as per the provided guidelines.

When is the deadline to file businessnetkporg form in 2023?

The deadline to file the businessnetkporg form in 2023 will be determined by the tax authorities and will be announced closer to the tax year-end. Businesses should stay updated with the official notifications and requirements.

What is the penalty for the late filing of businessnetkporg form?

The penalty for the late filing of the businessnetkporg form will vary depending on the jurisdiction and the specific circumstances. It is important for businesses to file their forms on time to avoid potential penalties and interest charges.

How can I send businessnetkporg form to be eSigned by others?

Once you are ready to share your businessnetkporg form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I fill out businessnetkporg form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your businessnetkporg form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out businessnetkporg form on an Android device?

On Android, use the pdfFiller mobile app to finish your businessnetkporg form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your businessnetkporg form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.