IRS 3210 2010-2025 free printable template

Show details

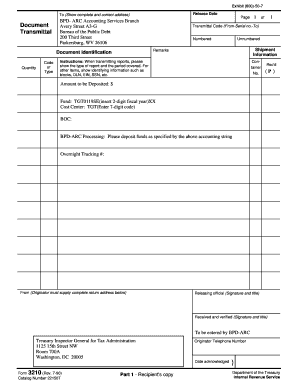

To (Show complete and correct address) Document Transmittal Release Date Department of the Treasury Internal Revenue Service Cincinnati, OH 45999 Transmittal Code (From-Serial no.-To) Numbered Quantity

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 3210 letter template form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 3210 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3210 form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 3210 irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3210 form

How to fill out IRS 3210

01

Obtain Form IRS 3210 from the IRS website or your local IRS office.

02

Enter your name, address, and taxpayer identification number in the appropriate fields.

03

Complete the 'Request for Special Enrollment Examination' section, specifying the reason for the request.

04

Fill out the details about previous enrollment or any applicable Certifications.

05

Review the 'Declaration' section and sign the form.

06

Submit the completed form to the designated IRS address provided in the form instructions.

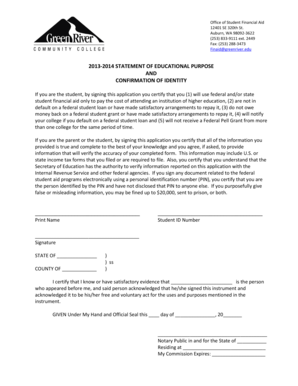

Who needs IRS 3210?

01

Individuals who want to request a special enrollment examination.

02

Tax professionals seeking to renew or validate their enrollment to practice before the IRS.

Fill

how do i edit irs internet connected device with pdffiller

: Try Risk Free

People Also Ask about how to fill out irs request a special enrollment examination

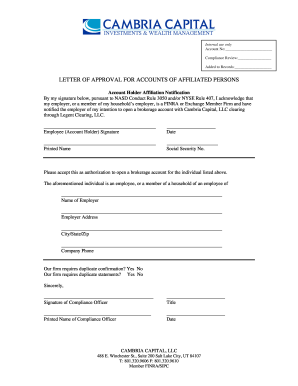

Does FINRA rule 3210 apply to registered investment advisors?

The requirement under FINRA Rule 3210 is relatively straightforward: All registered investment advisors must declare their outside accounts to their member firm and notify their member firm in writing when they intend to open any new account.

What is a 3210 form?

A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Firms can also request to receive duplicate account statements so that they can see the securities held in a member's personal investment accounts.

What is FINRA Rule 3210 consent letter?

The FINRA 3210 Letter Rule 3210 requires financial advisors to make a request and obtain consent from the FINRA member firm they work for to keep their accounts somewhere else. It also requires a disclosure letter to the outside firm when a securities industry professional opens an account.

Who does Rule 3210 apply to?

Rule 3210 governs accounts opened by members at firms other than where they work. All employees must declare their intent and obtain their employers' consent if they wish to open or maintain an investment account at any other financial institution.

What is Rule 3210 threshold?

Rule 32101 Where, for five consecutive settlement days, there are aggregate fails to deliver at a registered clearing agency of 10,000 shares or more and the reported last sale during normal market hours would value the aggregate fail to deliver position at $50,000 or more.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 3210 letter in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing irs form 3210 pdf and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit form 3210 document transmittal straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing what is form 3210.

How do I edit 3210 letter finra on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share finra 3210 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

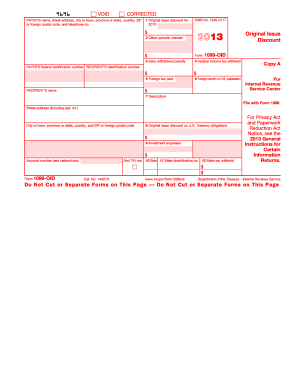

What is IRS 3210?

IRS Form 3210 is a document used by businesses and organizations to report and pay certain taxes related to the federal tax system.

Who is required to file IRS 3210?

Generally, any business or organization that is liable for specific federal taxes is required to file IRS Form 3210.

How to fill out IRS 3210?

To fill out IRS Form 3210, you need to provide information such as your organization name, Employer Identification Number (EIN), the tax period, and the tax amounts owed. Detailed instructions can be found on the IRS website.

What is the purpose of IRS 3210?

The purpose of IRS Form 3210 is to ensure that businesses and organizations correctly report and remit their tax liabilities to the IRS.

What information must be reported on IRS 3210?

IRS Form 3210 requires reporting information such as the organization’s name, address, EIN, and details of the tax liabilities being reported.

Fill out your IRS 3210 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is A 3210 Letter is not the form you're looking for?Search for another form here.

Keywords relevant to rule 3210 letter

Related to 3210 rule

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.