Get the free FORM EL101 2012 MARYLAND

Show details

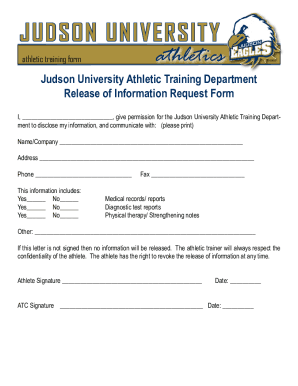

FORM EL101 2012 MARYLAND e-File DECLARATION FOR ELECTRONIC FILING Keep this form for your records. Do not send this form to the State of Maryland unless requested to do so. See Instructions on Page

We are not affiliated with any brand or entity on this form

Instructions and Help about form el maryland

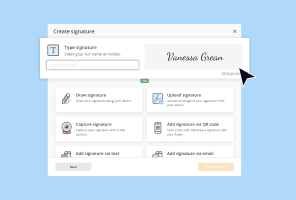

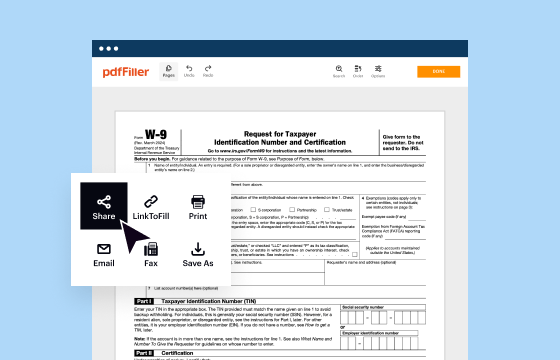

How to edit form el maryland

How to fill out form el maryland

Instructions and Help about form el maryland

How to edit form el maryland

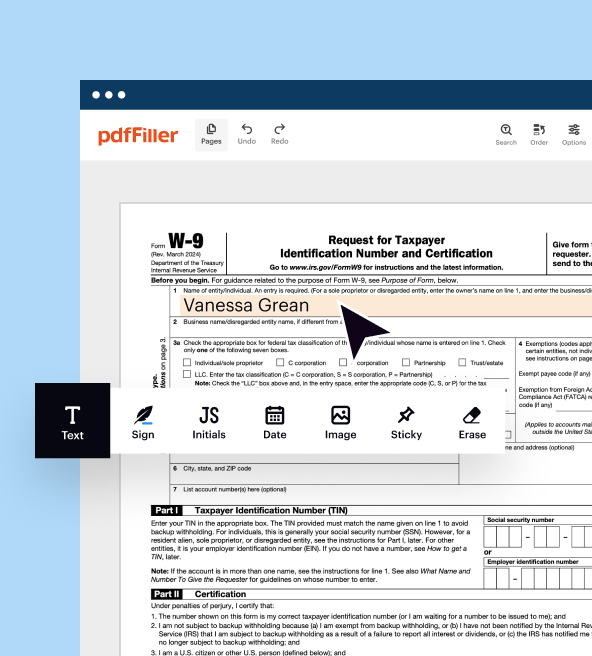

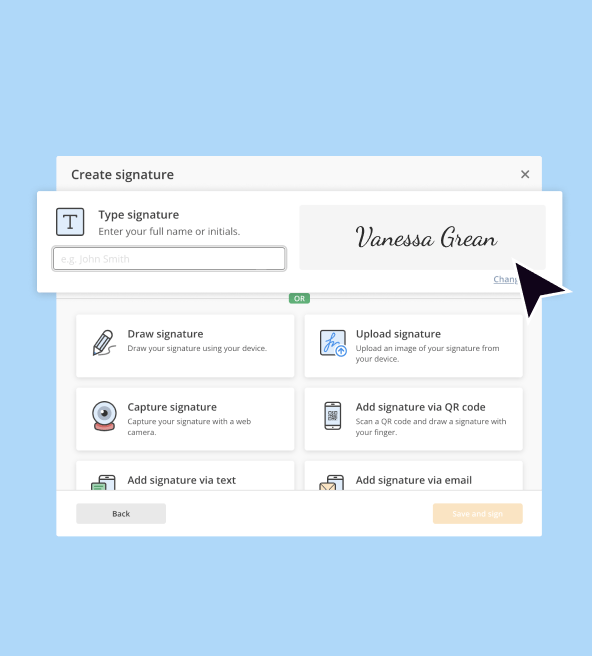

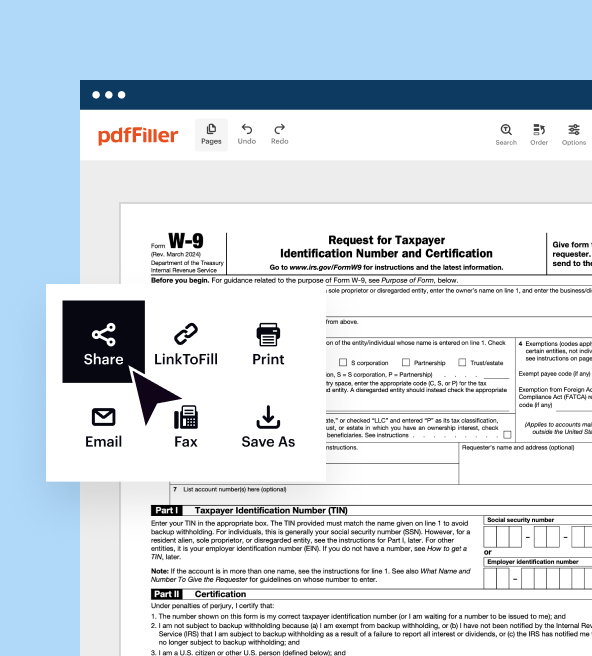

To edit form el maryland, you can utilize online tools such as pdfFiller. Begin by uploading your form to the platform, where you can easily adjust any information or add necessary annotations. Ensure that all changes are accurate before proceeding with submission. Save your edited form in the desired format for your records.

How to fill out form el maryland

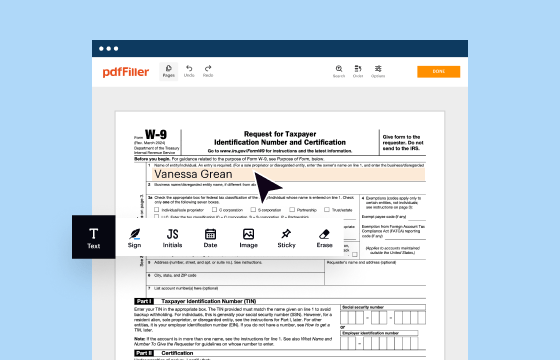

To fill out form el maryland, gather the required information such as your name, address, and tax identification number. Ensure you complete all relevant sections and double-check the accuracy of the entered data. Use the guidelines provided with the form to ensure compliance with all requirements. Once filled out, the form can be printed and submitted according to the instructions.

Latest updates to form el maryland

Latest updates to form el maryland

Updates for form el maryland may include changes to tax regulations or filing procedures. It is crucial to review the Maryland state tax website or consult with a tax professional for the most current information each tax season.

All You Need to Know About form el maryland

What is form el maryland?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form el maryland

What is form el maryland?

Form el maryland is a tax form utilized by entities in Maryland to report specific financial information. This form assists in fulfilling state reporting requirements and ensures that the tax authority has the necessary information for processing.

What is the purpose of this form?

The purpose of form el maryland is to collect information on transactions that meet certain criteria under Maryland tax law. This reporting helps the state in tracking and managing tax liabilities effectively.

Who needs the form?

Individuals and businesses that engage in specific financial activities within Maryland may need to file form el maryland. This includes those who have made certain payments or purchases that fall under the state income tax regulations.

When am I exempt from filling out this form?

You may be exempt from filling out form el maryland if your financial transactions do not meet the thresholds established by Maryland tax law. Certain entities may also qualify for exemptions based on their tax status or nature of business.

Components of the form

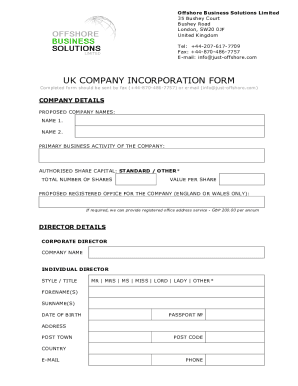

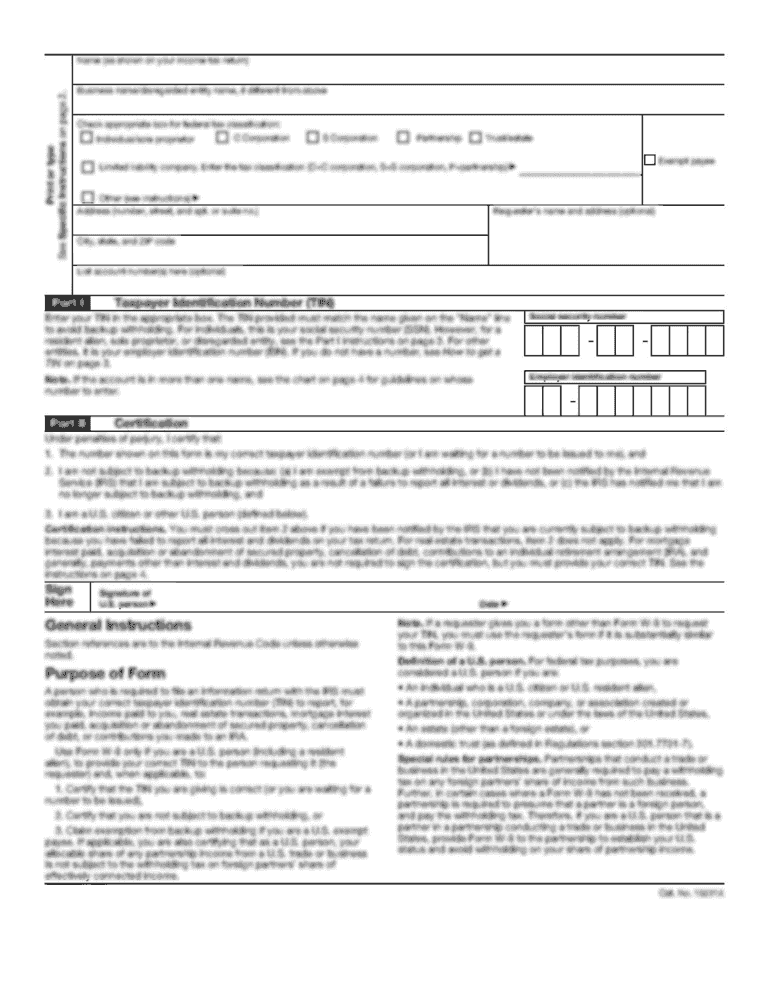

Form el maryland generally includes several key components such as identification information, transaction details, and space for signatures. Each section is designed to gather specific information necessary for tax compliance.

Due date

The due date for filing form el maryland typically aligns with Maryland's annual tax filing deadlines. It is essential to check the Maryland State Department of Assessments and Taxation website for the specific due date relevant to the current tax year.

What are the penalties for not issuing the form?

Failure to issue form el maryland when required may result in penalties imposed by the state tax authority. These penalties can include fines and interest on unpaid taxes, aimed at encouraging timely compliance with reporting obligations.

What information do you need when you file the form?

When filing form el maryland, you will need crucial information such as your taxpayer identification number, details of transactions made, and personal identification information including name and address. Accurate records should be maintained to support the reported information.

Is the form accompanied by other forms?

Form el maryland may need to be accompanied by other relevant forms depending on the nature of your submission. It is advisable to consult the filing instructions or a tax professional to ensure that all necessary documentation is submitted.

Where do I send the form?

Form el maryland should be submitted to the designated office outlined in the filing instructions. Typically, this is the Maryland State Department of Assessments and Taxation or the appropriate local tax authority. Ensure to send the form to the correct address to avoid processing delays.

See what our users say