Get the free 2nd Mortgage Application - usffa

Show details

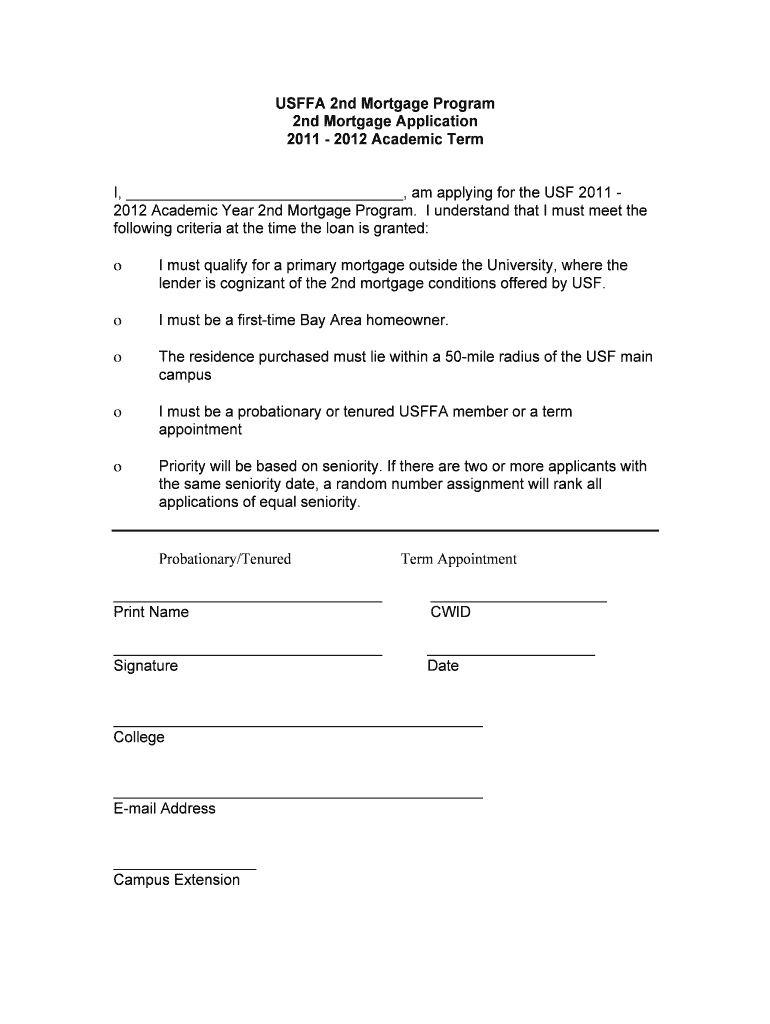

This document serves as an application for the USF 2011-2012 Academic Year 2nd Mortgage Program, outlining eligibility criteria and submission instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2nd mortgage application

Edit your 2nd mortgage application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2nd mortgage application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2nd mortgage application online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2nd mortgage application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2nd mortgage application

How to fill out 2nd Mortgage Application

01

Gather required documents, including proof of income, tax returns, and current mortgage details.

02

Complete the mortgage application form, ensuring all sections are filled out accurately.

03

Provide information about the property, including its value and the reasons for seeking a second mortgage.

04

Submit the application along with any required fees to the lender.

05

Await approval and respond promptly to any requests for additional information from the lender.

Who needs 2nd Mortgage Application?

01

Homeowners looking to access the equity in their property for major repairs or renovations.

02

Individuals wanting to consolidate debt by using the funds from a second mortgage.

03

People financing a significant expense, such as education costs or medical bills.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for a 2nd mortgage?

Qualifications for second mortgages vary, but many lenders prefer that you have at least 15 percent to 20 percent equity in your home. You can typically borrow up to 85 percent of your home's value minus your current mortgage debts.

Are second charge mortgages a good idea?

You might benefit from taking out a second mortgage if: You'll face big early repayment charges (ERCs) or penalties for switching away from your current mortgage deal. You're on a particularly good deal already, and remortgaging would mean paying a new higher interest rate across the whole borrowing amount.

Do you get taxed on a second mortgage?

Mortgage interest on a second home is tax deductible within the same limits as the mortgage on your first home. Property taxes paid on additional homes can also be tax deductible, regardless of the number of homes you own.

What is the downside of a second mortgage?

Risk of foreclosure This is one of the biggest risks of second mortgages. With a second mortgage, you're using your home as collateral. That means if you don't make your payments, your lender can foreclose on your house to pay off the balance.

Is taking out a second mortgage a good idea?

Honestly, nothing is bad per se about taking on a second mortgage. A second mortgage can help you get rid of high-interest debt and improve your credit score. But second mortgages are also widely used to help with a whole range of other financial needs.

Is it difficult to get approved for a second mortgage?

Qualifying for a second mortgage is not a given, however. It requires careful preparation and a strong financial profile. Lenders typically look for a solid credit score, a low debt-to-income ratio and sufficient equity in your current home before approving a second mortgage.

What income do you need for a second mortgage?

There are no specific second home mortgage requirements for the minimum income to buy a second home. However, you must make enough money to qualify based on your debt-to-income ratio. Having a higher income and lower monthly expenses improves your ability to get approved for a new home loan.

Can you lose your house with a second mortgage?

A second mortgage in California is a type of loan that allows homeowners to borrow money using their home as collateral. This means that if you don't repay the loan, the lender can foreclose on your home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2nd Mortgage Application?

A 2nd Mortgage Application is a formal request for securing a second mortgage on a property, allowing homeowners to borrow against the equity they have built up in their home.

Who is required to file 2nd Mortgage Application?

Homeowners seeking additional financing through a second mortgage are required to file a 2nd Mortgage Application.

How to fill out 2nd Mortgage Application?

To fill out a 2nd Mortgage Application, individuals need to provide personal and financial information, including income, debt, property details, and the amount of the second mortgage they wish to apply for.

What is the purpose of 2nd Mortgage Application?

The purpose of a 2nd Mortgage Application is to allow homeowners to leverage the equity in their home for additional funds, which can be used for various purposes such as home improvements, debt consolidation, or other financial needs.

What information must be reported on 2nd Mortgage Application?

Information required on a 2nd Mortgage Application typically includes the borrower's personal information, employment and income details, existing debts, property evaluation, and purpose for the loan.

Fill out your 2nd mortgage application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2nd Mortgage Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.