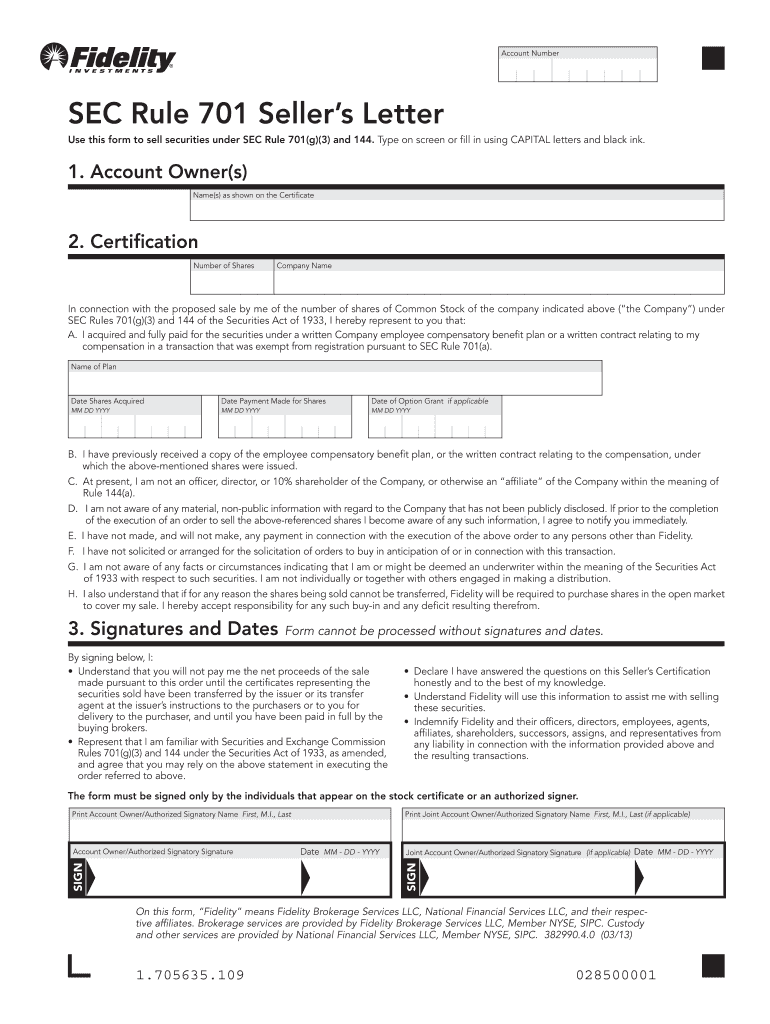

Get the free SEC Rule 701 Seller’s Letter

Show details

This form is used for selling securities under SEC Rule 701(g)(3) and 144, requiring specific certifications from the account owner regarding their ownership and the nature of the securities being

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sec rule 701 sellers

Edit your sec rule 701 sellers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sec rule 701 sellers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sec rule 701 sellers online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sec rule 701 sellers. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sec rule 701 sellers

How to fill out SEC Rule 701 Seller’s Letter

01

Start with your information: Include your name and address at the top of the letter.

02

State the purpose: Clearly mention that the letter is concerning SEC Rule 701.

03

Describe the relationship: Explain your relationship with the company giving you the equity compensation.

04

List the securities: Provide details about the securities you are selling or plan to sell.

05

Confirm eligibility: Affirm that you meet the eligibility criteria under Rule 701.

06

Sign and date: Make sure to sign and date the letter before submission.

Who needs SEC Rule 701 Seller’s Letter?

01

Individuals who are employees, directors, or consultants of a private company that plans to offer stock options or equity under SEC Rule 701.

Fill

form

: Try Risk Free

People Also Ask about

What is the SEC Rule 477?

Securities and Exchange Commission Rule 477 (17 CFR 230.477) under the Securities Act of 1933 (15 U.S.C. 77a et seq.) sets forth procedures for withdrawing a registration statement, including any amendments or exhibits to the registration statement.

What is the rule 477 withdrawal?

Securities Act Rule 477 provides automatic effectiveness for any application to withdraw an entire registration statement before it becomes effective unless the Commission objects within 15 days after the issuer files that application.

What are the five exempt transactions under the Securities Act of 1933?

Exempt transactions are securities transactions that are exempt from the registration requirements of the 1933 Securities Act. Four typical examples of transaction exemptions in the United States include 1) Regulation A Offerings, 2) Regulation D Offerings, 3) Intrastate Offerings, and 4) Rule 144 Offerings.

How many days do withdrawals from state registration become effective?

Withdrawal of a Registration A broker dealer, investment adviser, or an agent may request that their registration with the state be withdrawn. The withdrawal will become effective 30 days after the administrator receives the request if no revocation or suspension proceedings are in process.

What is sec rule 701?

Rule 701 is a federal regulatory exemption under the Securities Act of 1933 that allows private companies to issue equity compensation, like stock options and other securities, to employees, consultants, service providers, and advisors without registering the securities with the SEC.

Can you withdraw a form D filing?

Amendments and Withdrawals: If there are material changes to the information provided in Form D, an amendment must be filed with the SEC. If the offering is canceled or terminated, a notice of withdrawal must be filed with the SEC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SEC Rule 701 Seller’s Letter?

SEC Rule 701 Seller's Letter is a document used in connection with the issuance of securities by a company to its employees or other qualifying persons under Rule 701 of the Securities Act, which provides an exemption from the registration requirements for certain compensatory offerings.

Who is required to file SEC Rule 701 Seller’s Letter?

The company issuing securities under Rule 701 is required to provide a Seller's Letter to confirm compliance with the requirements of the rule, typically when the aggregate sales amount exceeds certain thresholds.

How to fill out SEC Rule 701 Seller’s Letter?

The Seller's Letter should be filled out with details such as the name of the issuing company, the names and addresses of the sellers, the specific securities being offered, and a representation concerning compliance with the rules. It may also require signatures from the sellers.

What is the purpose of SEC Rule 701 Seller’s Letter?

The purpose of the SEC Rule 701 Seller's Letter is to provide necessary disclosures and assurances to the SEC and investors regarding the compliance of the offering with regulatory requirements, ensuring that the securities are issued legally without triggering registration.

What information must be reported on SEC Rule 701 Seller’s Letter?

The information required includes details about the offering amounts, the recipients of the securities, a brief description of the compensation arrangements, and a confirmation of compliance with the SEC's eligibility requirements under Rule 701.

Fill out your sec rule 701 sellers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sec Rule 701 Sellers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.