Get the free Systematic Withdrawal Program – Annuities

Show details

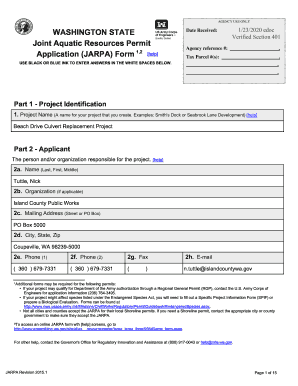

Use this form to establish, update, or delete a systematic withdrawal program for a Fidelity Personal Retirement Annuity or Fidelity Retirement Reserves Annuity contract.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign systematic withdrawal program annuities

Edit your systematic withdrawal program annuities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your systematic withdrawal program annuities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing systematic withdrawal program annuities online

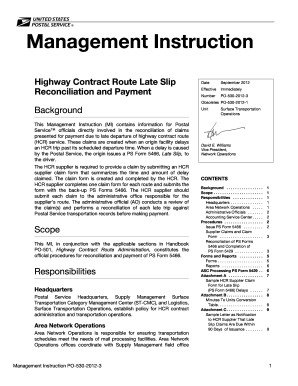

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit systematic withdrawal program annuities. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out systematic withdrawal program annuities

How to fill out Systematic Withdrawal Program – Annuities

01

Review your annuity contract to understand the terms and conditions of the Systematic Withdrawal Program.

02

Decide on the amount you wish to withdraw regularly from your annuity.

03

Select the frequency of the withdrawals (monthly, quarterly, annually, etc.).

04

Contact your annuity provider to request enrollment in the Systematic Withdrawal Program.

05

Complete any required forms or documentation as specified by your annuity provider.

06

Provide your banking information for direct deposit of the withdrawals if necessary.

07

Confirm the details of your withdrawals, including the amount and frequency, with your annuity provider.

08

Keep records of your withdrawals for tax purposes, as they may affect your taxable income.

Who needs Systematic Withdrawal Program – Annuities?

01

Individuals seeking a reliable income stream during retirement.

02

Those who need to manage cash flow for regular expenses.

03

Clients who prefer a structured withdrawal plan rather than a lump-sum withdrawal.

04

Investors looking for a way to access funds from their annuity without fully cashing it out.

05

People who want to maintain their investment while still accessing money for living expenses.

Fill

form

: Try Risk Free

People Also Ask about

What are the cons of systematic withdrawal plan?

What are disadvantages of SWP? Disadvantages of SWP include market risk, as returns are not guaranteed and depend on fund performance. There's also a potential for capital depletion if withdrawals exceed returns. Additionally, SWPs may incur exit loads and tax implications, which can impact overall returns.

What is a systematic withdrawal from an annuity?

The 4% rule is a popular guideline for retirees seeking to determine how much they can safely withdraw from their retirement savings each year. This rule suggests that withdrawing no more than 4% of your retirement corpus annually can help ensure your savings last throughout your retirement.

Does SWP have risk?

For example – Suppose, the initial investment is made in an Arbitrage fund and the capital appreciation is received regularly by way of SWP; the initial investment will remain at almost zero risk.

What are the disadvantages of systematic withdrawal plan?

Setting up an SWP can take time. Understanding your options and the processes involved can help you to more efficiently receive your income cash flows. Most investments offer a systematic withdrawal plan. You can make systematic withdrawals from mutual funds, annuities, brokerage accounts, 401k plans, and IRAs.

What is the 4 rule for SWP?

What are the disadvantages of SWP? The main disadvantage of SWP is that it can deplete your investment if withdrawals continue for a long period, especially if your returns are lower than expected. Additionally, if you withdraw a large portion of your corpus, it can impact the growth of your remaining investments.

Is SWP really worth it?

Whether one is better than the other depends upon your risk tolerance level, tax-saving objectives, and time period of investment. However, SWP has certain advantages over FDs. SWPs provide investors with more flexibility than fixed deposits. In addition, in the case of SWPs, the tax liabilities are significantly less.

What is the problem with SWP?

In an SWP the investments are generally quite liquid, meaning they can be sold if the principal sum is needed for an emergency or a large expense. The problem is that if you've made your income assumption based upon your total sum of assets, then withdrawing a large amount changes the future rate of return you'll need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Systematic Withdrawal Program – Annuities?

A Systematic Withdrawal Program (SWP) for annuities allows policyholders to withdraw a specified amount of funds from their annuity on a regular basis, providing a steady income stream while keeping the account active.

Who is required to file Systematic Withdrawal Program – Annuities?

Typically, the annuity contract holder or the beneficiary is required to file for a Systematic Withdrawal Program to initiate regular withdrawals from the annuity account.

How to fill out Systematic Withdrawal Program – Annuities?

To fill out the Systematic Withdrawal Program for annuities, you need to complete the application form provided by your annuity issuer, specifying the withdrawal amount, frequency, and account details. Ensure to review any associated fees or tax implications.

What is the purpose of Systematic Withdrawal Program – Annuities?

The purpose of a Systematic Withdrawal Program for annuities is to provide a reliable source of income during retirement or for specific financial needs, enabling individuals to withdraw pre-determined amounts instead of taking a lump sum.

What information must be reported on Systematic Withdrawal Program – Annuities?

Information that must be reported includes the annuity account number, the amount to be withdrawn, the scheduled frequency of withdrawals, recipient's details, and any tax withholding preferences.

Fill out your systematic withdrawal program annuities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Systematic Withdrawal Program Annuities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.