Get the free 2009 Tax-Exempt Income from Fidelity Funds

Show details

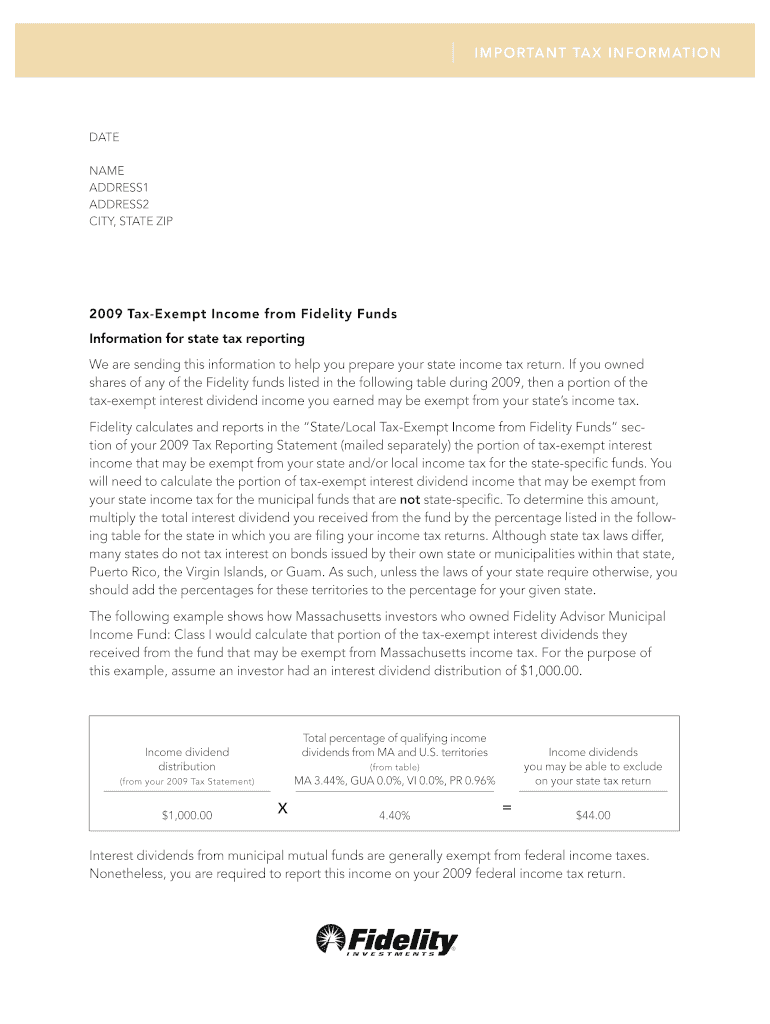

This document provides important tax information regarding state tax reporting for tax-exempt income earned from Fidelity Funds during the year 2009, including instructions for calculating state-specific

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 tax-exempt income from

Edit your 2009 tax-exempt income from form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 tax-exempt income from form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2009 tax-exempt income from online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2009 tax-exempt income from. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 tax-exempt income from

How to fill out 2009 Tax-Exempt Income from Fidelity Funds

01

Gather your 2009 tax documents and any relevant Fidelity Fund statements.

02

Locate the section on Tax-Exempt Income in your Fidelity Funds report.

03

Identify the total amount of tax-exempt interest earnings you received from your Fidelity Funds in 2009.

04

Fill out the appropriate line on your tax return form (usually on Schedule B) with the total tax-exempt income amount.

05

Keep accurate records of your tax-exempt interest for your records and future reference.

Who needs 2009 Tax-Exempt Income from Fidelity Funds?

01

Individuals who have invested in Fidelity Funds that generate tax-exempt income.

02

Taxpayers who are required to report tax-exempt interest on their income tax returns.

03

Investors seeking to understand their tax obligations and the benefits of their tax-exempt investments.

Fill

form

: Try Risk Free

People Also Ask about

Is SPAXX taxable at state level?

In contrast, the Schwab U.S. Treasury Money Fund (Symbol - SNSXX, and SUTXX for the Ultra share class) is typically more than 95% invested in state tax-free treasury bills. As such, most of the interest paid from this fund is exempt from state income tax if they are held in a taxable investment account.

Is Fidelity Government Money Market Fund taxable?

Core-Eligible Money Market Funds Any cash you transfer out of your Fidelity brokerage account will come out of the core position. The income earned in these funds is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year.

How do I know which state my exempt interest dividends are from Fidelity?

Information for state tax reporting Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state and/or local income tax for the state-specific funds in the “State/Local Tax- Exempt Income from Fidelity Funds” section of your 2024 Tax Reporting Statement.

Are treasury money market funds exempt from state taxes?

If you held, say, iShares Short Duration Bond Active ETF in 2024, which kicked off 22.8% of its 2024 income from Treasuries, the income wouldn't be tax-free in California, New York, and Connecticut because the fund's allocation to government obligations fell short of 50%.

Is Spaxx exempt from state income tax?

It is exempt from state and local taxes, but not federal income taxes. Repurchase agreements, as investments held by SPAXX and FZSXX are not exempt from state and local taxes.

Are US Treasury bonds exempt from state income tax?

Interest from corporate bonds and U.S. Treasury bonds interest is typically taxable at the federal level. U.S. Treasuries are exempt from state and local income taxes.

Are muni bonds exempt from state and local taxes?

Municipal bonds are generally referred to as tax-exempt bonds because the interest earned on the bonds often is excluded from gross income for federal income tax purposes and, in some cases, is also exempt from state and local income taxes.

What is a tax-exempt money fund?

Municipal (sometimes known as tax-exempt) Normally at least 80% of the fund's assets are invested in municipal securities whose interest is exempt from federal and state personal income taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 Tax-Exempt Income from Fidelity Funds?

2009 Tax-Exempt Income from Fidelity Funds refers to the income earned from municipal bonds and other tax-exempt securities held in Fidelity investment funds during the tax year 2009. This income is exempt from federal income tax.

Who is required to file 2009 Tax-Exempt Income from Fidelity Funds?

Individuals who received tax-exempt interest income from Fidelity Funds in 2009 are required to report this income on their tax returns, including those who may not owe federal taxes but still need to disclose such income.

How to fill out 2009 Tax-Exempt Income from Fidelity Funds?

To fill out the 2009 Tax-Exempt Income from Fidelity Funds, taxpayers should reference their Form 1099-INT or similar statement received from Fidelity, report the tax-exempt income in the appropriate section of their federal tax return, and include any other required tax forms.

What is the purpose of 2009 Tax-Exempt Income from Fidelity Funds?

The purpose of reporting 2009 Tax-Exempt Income from Fidelity Funds is to ensure that individuals acknowledge and properly disclose the tax-exempt income received, maintaining compliance with tax laws and regulations.

What information must be reported on 2009 Tax-Exempt Income from Fidelity Funds?

The information that must be reported includes the amount of tax-exempt interest income received, the source of that income (e.g., specific Fidelity funds), and any relevant account details provided on tax documents, such as Form 1099.

Fill out your 2009 tax-exempt income from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Tax-Exempt Income From is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.