Get the free Money Laundering (Private Individual) Confirmation of Verification of Identity

Show details

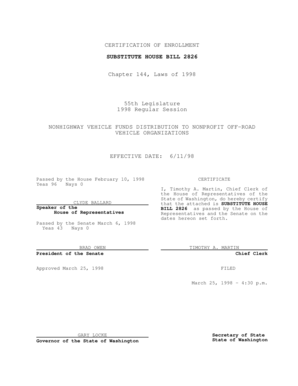

This document outlines the procedures and requirements for verifying the identity of individuals in compliance with UK Money Laundering Regulations as part of the opening of bank accounts and new

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money laundering private individual

Edit your money laundering private individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money laundering private individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing money laundering private individual online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit money laundering private individual. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money laundering private individual

How to fill out Money Laundering (Private Individual) Confirmation of Verification of Identity

01

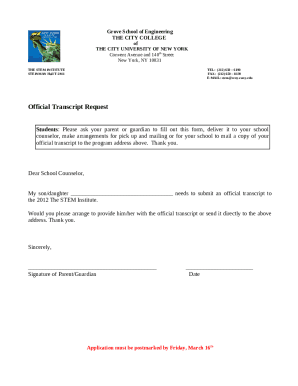

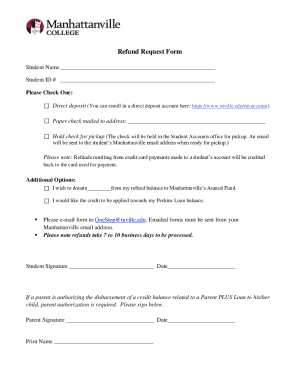

Obtain the Money Laundering (Private Individual) Confirmation of Verification of Identity form.

02

Fill in your personal details, including your full name, date of birth, and address.

03

Provide identification documents, such as a passport or driver's license, and ensure they are valid.

04

Include any additional required documentation that supports your identity verification, like utility bills or bank statements.

05

Review the information you have entered to ensure accuracy and completeness.

06

Submit the completed form and accompanying documents to the relevant authority or organization.

Who needs Money Laundering (Private Individual) Confirmation of Verification of Identity?

01

Individuals who are opening bank accounts or financial services

02

Individuals involved in real estate transactions

03

Individuals seeking to set up trusts or investments

04

Professionals in regulated sectors needing to verify clients’ identities.

Fill

form

: Try Risk Free

People Also Ask about

How to pass KYC verification?

Keep accurate and detailed records. Record-keeping is a cornerstone of AML compliance. As a compliance manager, you need to ensure that your company maintains accurate, up-to-date records of customer information, risk assessment, and any suspicious activities.

How to pass AML verification?

This process involves several key steps to ensure compliance with regulatory requirements and protect the integrity of the financial system. Identity Verification. The first step in conducting AML checks is to verify the identity of customers. Sanctions and PEP Screening. Transaction Monitoring and Analysis.

What are the 5 main indicators of money laundering?

Trust and company formation secretive or suspicious behaviour by the client. formation of a shell company in an offshore jurisdiction without a legitimate commercial purpose. interposition of an entity in a transaction without any clear need. unnecessarily complex corporate structures.

What is the method used to verify the identity of an individual?

Identity verification is the process of confirming an individual's identity and is crucial for preventing fraud and ensuring trust. Methods for identity verification include document-based verification, biometric verification, knowledge-based verification, and two-factor authentication.

How to do AML verification?

Depending on the circumstances, other types of information may also need to be checked, such as: Purpose and intended nature of the relationship. Details of customer's business/employment. Source/origin of funds. Relationships between signatories and any beneficial owners. Expected type and level of activity.

What are the three methods to verify an individual's identity?

Individuals Government-issued photo identification method. Credit file method. Dual process method. Virtual verification with authentication method. Using an agent method.

What shows up on an AML check?

AML Checks as Part of Perpetual KYC They involve verifying the identity of customers, reviewing their transactions for suspicious activity or patterns and assessing the risk associated with them. This helps companies ensure that they are compliant with laws and regulations as per the AML officer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Money Laundering (Private Individual) Confirmation of Verification of Identity?

Money Laundering (Private Individual) Confirmation of Verification of Identity is a process used to confirm the identity of individuals in order to prevent financial crimes such as money laundering and terrorism financing. It involves verifying personal information to ensure that individuals are who they claim to be.

Who is required to file Money Laundering (Private Individual) Confirmation of Verification of Identity?

Entities that are required to file this confirmation include financial institutions, real estate agents, legal professionals, and other businesses involved in transactions that may involve significant monetary amounts. This requirement is part of regulatory measures to combat money laundering.

How to fill out Money Laundering (Private Individual) Confirmation of Verification of Identity?

To fill out the confirmation, individuals must provide personal information such as their full name, address, date of birth, identification number, and sometimes additional documentation that verifies their identity, such as a government-issued ID or utility bill.

What is the purpose of Money Laundering (Private Individual) Confirmation of Verification of Identity?

The purpose is to ensure compliance with anti-money laundering regulations by verifying the identities of individuals involved in financial transactions, thereby reducing the risk of illegal activities and enhancing the integrity of the financial system.

What information must be reported on Money Laundering (Private Individual) Confirmation of Verification of Identity?

The information reported includes the individual's full name, address, date of birth, identification number (such as a social security number or national ID), and the source of funds. This information helps in forming a comprehensive profile for due diligence.

Fill out your money laundering private individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Laundering Private Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.