Get the free GUARANTOR REFERENCING APPLICATION

Show details

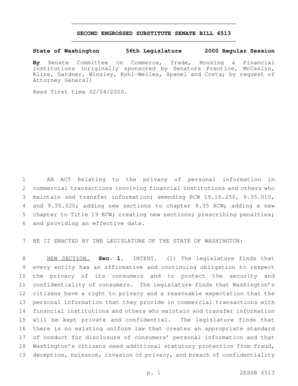

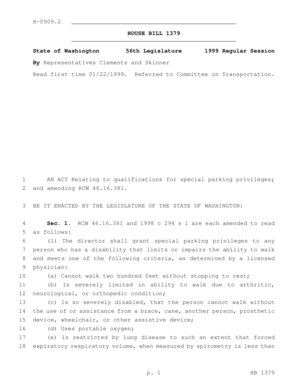

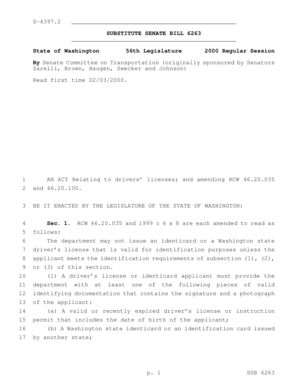

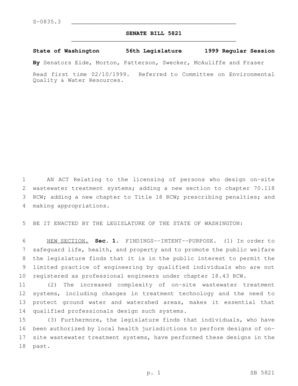

This document is designed for individuals to act as guarantors for tenants, collecting necessary personal and financial information to facilitate referencing by HomeLet.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guarantor referencing application

Edit your guarantor referencing application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guarantor referencing application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guarantor referencing application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guarantor referencing application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guarantor referencing application

How to fill out GUARANTOR REFERENCING APPLICATION

01

Gather necessary documents such as ID and proof of income.

02

Fill in your personal details including name, address, and contact information.

03

Provide details of your employment, including your job title, company name, and length of employment.

04

Enter your financial information, including your monthly income and any existing financial commitments.

05

Complete the section about your relationship to the tenant.

06

Sign and date the application to confirm the information is accurate.

07

Submit the application along with any required documents to the landlord or letting agent.

Who needs GUARANTOR REFERENCING APPLICATION?

01

Anyone who is acting as a guarantor for a tenant renting a property needs to complete a Guarantor Referencing Application.

Fill

form

: Try Risk Free

People Also Ask about

How do I provide proof of guarantor?

Guarantors usually need to provide proof of income (pay stubs, tax returns), a current credit report, identification (driver's license or passport), and sometimes references. These documents verify their ability to fulfill the lease obligations if necessary.

How to show proof of guarantor?

This often includes: Providing proof of financial standing by linking a bank or payroll account, or submitting documents like paystubs and/or bank statements. Undergoing a credit check to ensure they have strong credit history. Signing a guarantor agreement that legally binds them to cover any missed rent payments.

What is a guarantor referee?

Using a guarantor If the tenant returns a poor reference, you could utilise a guarantor instead. A guarantor is someone who will take responsibility for the tenant's obligations if the tenant is unable to fulfil them, including the payment of rent. This is particularly common with student tenants.

What does the guarantor need to provide?

A guarantor promises to step in and repay a loan if a borrower can't (or won't) make their repayments. By making this promise – known as a guarantee – a guarantor helps a borrower secure credit and get their loan approved.

What do you need to prove to be a guarantor?

There's no set figure for this – the lender just needs to be satisfied that you have the ability to cover the repayments on behalf of the borrower. Some lenders may ask for proof that you earn over a certain amount or have sufficient savings or assets (such as a property) to cover the loan repayment.

How do I reference a guarantor?

HOW DO YOU REFERENCE A GUARANTOR? A full credit check, including searches for any County Court Judgements (CCJs), bankruptcies or insolvencies. Proof of address, how long they've been there, and confirmation of whether they own the property and how much their monthly mortgage payments are.

What is the proof of guarantor?

What documents does a guarantor need to provide? Guarantors usually need to provide proof of income (pay stubs, tax returns), a current credit report, identification (driver's license or passport), and sometimes references. These documents verify their ability to fulfill the lease obligations if necessary.

What should a guarantor letter say?

A guarantor letter for rent is a formal document that outlines the guarantor's agreement to cover the rent if the tenant defaults. This letter should include: The guarantor's personal and contact information. A statement of commitment to cover the rent and any related costs if the tenant fails to pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GUARANTOR REFERENCING APPLICATION?

The Guarantor Referencing Application is a process used by landlords and letting agents to assess the financial suitability of a guarantor who agrees to guarantee a tenant's obligations under a lease or rental agreement.

Who is required to file GUARANTOR REFERENCING APPLICATION?

Typically, individuals acting as guarantors for tenants are required to file the Guarantor Referencing Application. This includes friends, family members, or others who may back the financial responsibilities of the tenant.

How to fill out GUARANTOR REFERENCING APPLICATION?

To fill out a Guarantor Referencing Application, one must provide personal information such as name, address, contact details, income, employment status, and sometimes a credit check authorization, often in a provided form or online platform.

What is the purpose of GUARANTOR REFERENCING APPLICATION?

The purpose of the Guarantor Referencing Application is to verify the guarantor's financial stability and creditworthiness, ensuring they have the means to cover the tenant's obligations if necessary.

What information must be reported on GUARANTOR REFERENCING APPLICATION?

The information that must be reported includes the guarantor's full name, address, date of birth, employment details, income, and any other relevant financial information that helps assess their ability to fulfill the guarantor's role.

Fill out your guarantor referencing application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guarantor Referencing Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.