Get the free Internet banking application

Show details

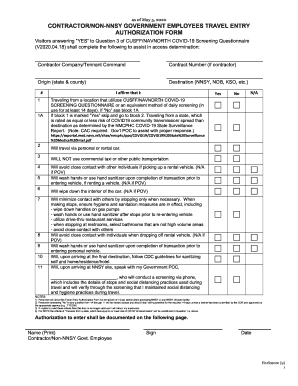

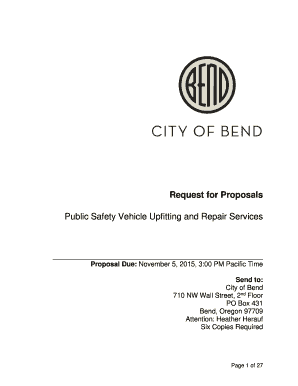

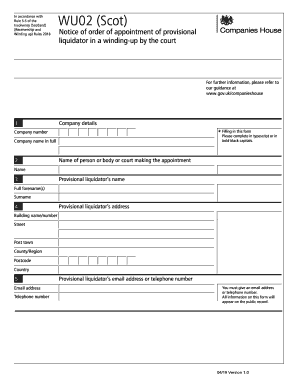

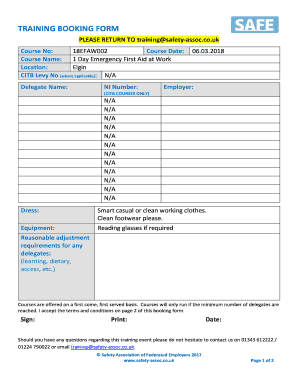

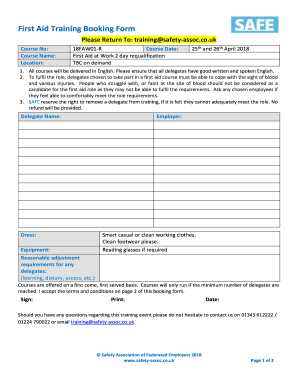

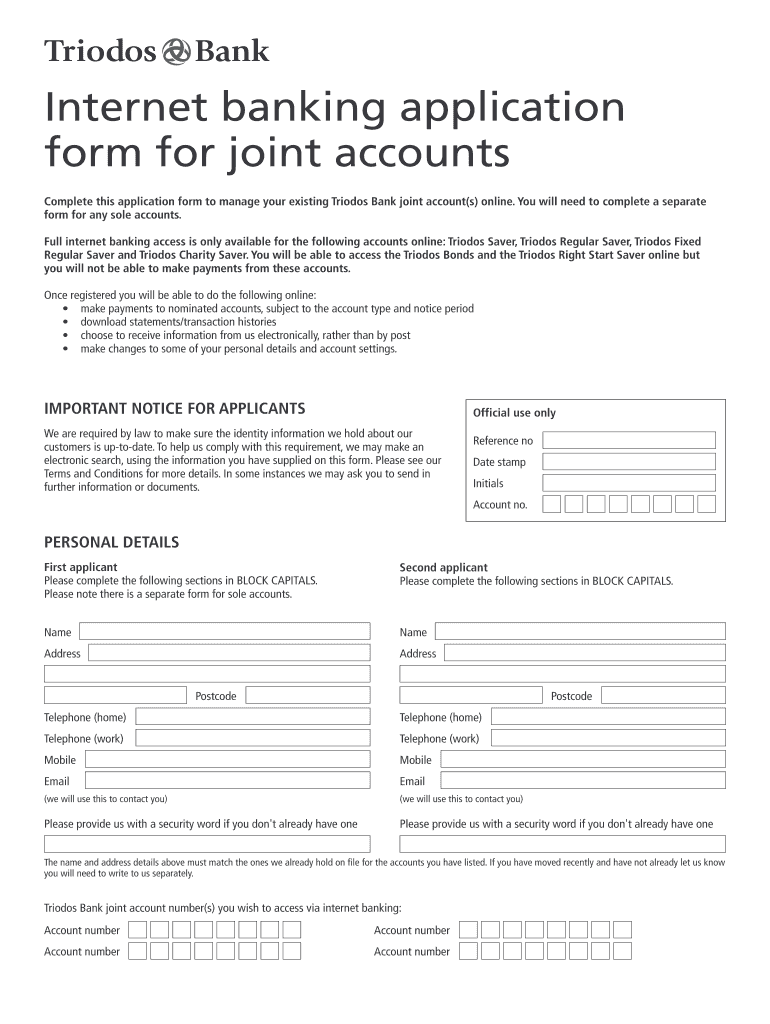

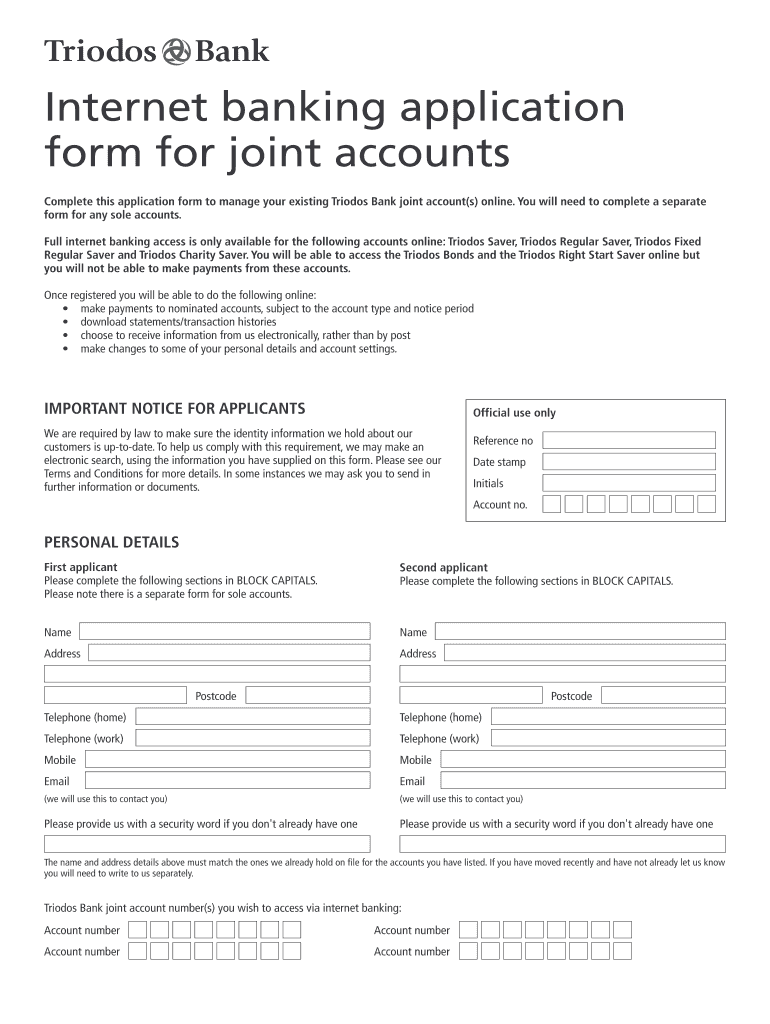

Complete this application form to manage your existing Triodos Bank joint account(s) online, including accessing internet banking services and providing necessary personal details for joint account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internet banking application

Edit your internet banking application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internet banking application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit internet banking application online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit internet banking application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internet banking application

How to fill out Internet banking application

01

Obtain the Internet banking application form from your bank's website or branch.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide your account number and type of account you wish to access online.

04

Create a username and password that comply with the bank's security standards.

05

Answer any security questions as required by the bank.

06

Review the terms and conditions related to Internet banking and read them carefully.

07

Sign the application form to confirm your agreement to the terms.

08

Submit the completed application form either online or at your bank's branch.

09

Wait for the bank to process your application and provide confirmation.

Who needs Internet banking application?

01

Individuals who manage their finances online and want easy access to their bank accounts.

02

Small business owners who require online banking services for transactions.

03

Frequent travelers who need to access their bank accounts remotely.

04

Anyone who prefers the convenience of banking without visiting a physical branch.

Fill

form

: Try Risk Free

People Also Ask about

Is there a downside to internet banking?

However, depositing cash is downright cumbersome at many online banks. So it's worth checking the bank's policy if this is something you plan to do frequently. International transactions may also be more difficult, or even impossible, with some direct banks.

Which is safer, internet banking or mobile banking?

Q: Which is safer: online banking or mobile banking? A: Both are secure when proper security measures are in place. However, mobile banking apps often have additional security layers like biometrics (fingerprint or facial recognition), which can make them slightly more secure if used correctly.

What is the difference between online banking and internet banking?

Internet banking (also known as online banking, net banking, or e-banking) is a facility offered by banks that allows customers to use banking services over the Internet instead of visiting the bank for every small service.

How to write an application for internet banking?

I would like to make you a request to kindly activate net banking on my savings account no- 35452434 as it becoming a bit difficult for me to personally visit the branch for every transaction due to time constraint. Please consider into the matter and do the needful as soon as possible.

Which is better, internet banking or mobile banking?

The biggest difference between the two is their functionality. Internet Banking allows you to conduct online transactions through your PC or laptop and an internet connection. On the other hand, mobile banking can be done with or without internet. Many banks nowadays have their mobile apps for mobile banking.

Which app is best for online banking?

List of Top 10 Mobile Banking Applications in India in 2025 YONO Lite SBI. Axis Mobile. IDBI Bank GO Mobile+ Baroda M-Connect Plus. iMobile Pay by ICICI Bank. CANDI – Mobile Banking App! BOI Mobile. PNB ONE. PNB ONE is the official initiative of Punjab National Bank.

Are internet banking and online banking the same?

Online banking, also known as internet banking, virtual banking, web banking or home banking, is a system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website or mobile app.

What do you need to apply for online banking?

Enter your personal details and account options, take a photo of your Driver's License, Passport, Postal ID, SSS ID, or UMID, then take a selfie to verify your identity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Internet banking application?

An Internet banking application is a software platform that allows users to manage their bank accounts and perform various banking transactions online, such as checking balances, transferring funds, and paying bills.

Who is required to file Internet banking application?

Individuals or businesses who wish to access online banking services provided by their bank are typically required to file an Internet banking application.

How to fill out Internet banking application?

To fill out an Internet banking application, users should complete the application form provided by their bank, which generally includes personal information such as name, address, account number, and contact information, and submit it either online or in person.

What is the purpose of Internet banking application?

The purpose of an Internet banking application is to enable secure access to banking services and allow customers to manage their finances conveniently through the internet.

What information must be reported on Internet banking application?

The Internet banking application usually requires information such as the applicant's full name, address, contact details, account number, and any identification numbers required by the bank for verification.

Fill out your internet banking application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internet Banking Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.