UK HMRC VAT1614G 2008 free printable template

Show details

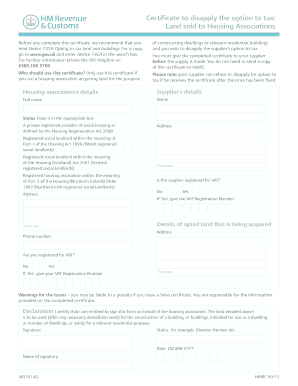

Certificate to misapply the option to tax: Land sold to Housing Associations Before you complete this certificate, we recommend that you read Notice 742A Opting to tax land and buildings. And you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK HMRC VAT1614G

Edit your UK HMRC VAT1614G form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC VAT1614G form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC VAT1614G online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK HMRC VAT1614G. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC VAT1614G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC VAT1614G

How to fill out UK HMRC VAT1614G

01

Download the UK HMRC VAT1614G form from the HMRC website.

02

Ensure you have your VAT registration number at hand.

03

Fill out the business details section, providing your name, address, and contact information.

04

Indicate the period for which the VAT refund is being claimed.

05

Complete the section detailing the VAT amount you are claiming back.

06

Attach any necessary supporting documentation, such as invoices and receipts.

07

Review the filled form for accuracy and completeness.

08

Submit the form to HMRC via post or through the online portal if available.

Who needs UK HMRC VAT1614G?

01

Businesses that are registered for VAT in the UK and wish to reclaim VAT paid on certain goods and services.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a VAT number for my company in UK?

You can usually register for VAT online. You need a Government Gateway user ID and password to register for VAT . If you do not already have a user ID you can create one when you sign in for the first time. Registering for VAT also creates a VAT online account.

How do I get a VAT number UK?

You can usually register for VAT online. You need a Government Gateway user ID and password to register for VAT . If you do not already have a user ID you can create one when you sign in for the first time. Registering for VAT also creates a VAT online account.

How do I know my VAT number UK?

You can locate your VAT number on the VAT registration certificate issued by HMRC. Your VAT number will contain nine digits, with the first two digits indicating the country code ('GB' for UK businesses). You can locate your VAT number on the VAT registration certificate issued by HMRC.

What is a VAT number for companies?

What is a company VAT number? VAT number stands for value added tax identification number. Having a VAT number means that a business will add VAT to the price of products or services that they sell. Companies are then able to claim back the VAT that they paid when buying their goods.

Why do I need a VAT number?

A VAT number is a unique identification number that's assigned to every business registered for VAT. Learn more about VAT invoices and when you need to issue them. VAT numbers are used for tax purposes and are only given to businesses that are registered for VAT.

What is a VAT number for UK company?

A VAT number is a unique ID that HMRC provides to businesses when they register for VAT. In the UK, VAT numbers are nine digits long and always have the prefix 'GB'. If you're dealing with a supplier in another EU country then its VAT number will follow a different format, with its own unique country code.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my UK HMRC VAT1614G directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign UK HMRC VAT1614G and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send UK HMRC VAT1614G to be eSigned by others?

Once your UK HMRC VAT1614G is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the UK HMRC VAT1614G in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your UK HMRC VAT1614G right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is UK HMRC VAT1614G?

UK HMRC VAT1614G is a form used by VAT-registered businesses in the UK to request a repayment of VAT overpaid on goods or services.

Who is required to file UK HMRC VAT1614G?

Any VAT-registered business that has overpaid VAT on purchases or services can file UK HMRC VAT1614G to reclaim the overpaid amount.

How to fill out UK HMRC VAT1614G?

To fill out UK HMRC VAT1614G, you need to provide details such as your VAT registration number, the amount of VAT overpaid, and descriptions of the goods or services involved in the claim.

What is the purpose of UK HMRC VAT1614G?

The purpose of UK HMRC VAT1614G is to formally request a refund of VAT that a business believes has been overcharged or incorrectly paid.

What information must be reported on UK HMRC VAT1614G?

The information that must be reported includes the VAT registration number, contact details, details of the overpaid VAT, and supporting documents or evidence for the claim.

Fill out your UK HMRC VAT1614G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC vat1614g is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.