UK Millennium Investments Form A03 2010-2025 free printable template

Show details

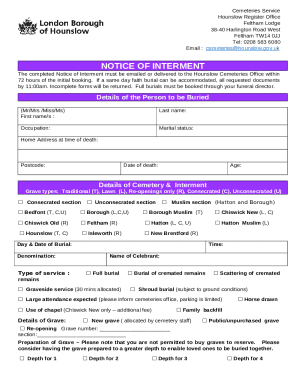

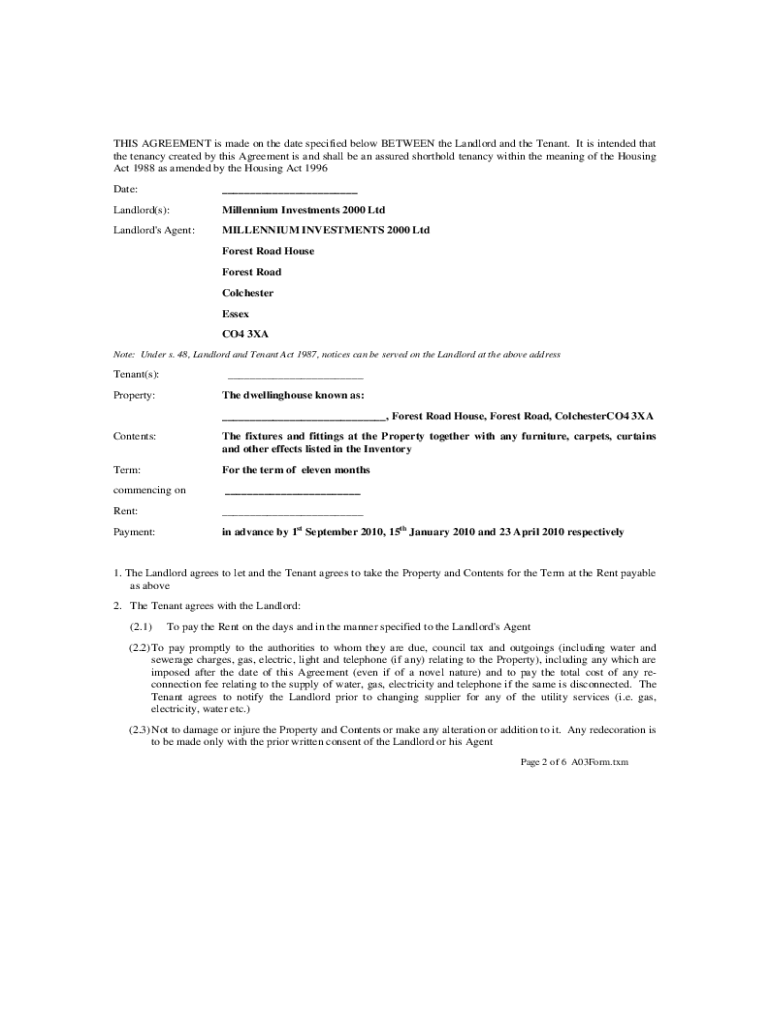

ASSURED SHORTHAND TENANCY AGREEMENT for letting residential dwelling house General Notes 1. This tenancy agreement is for letting furnished or unfurnished residential accommodation on an assured short

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uk shorthold tenancy agreement form

Edit your united kingdom tenancy agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united kingdom tenancy agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit united kingdom tenancy agreement online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit united kingdom tenancy agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out united kingdom tenancy agreement

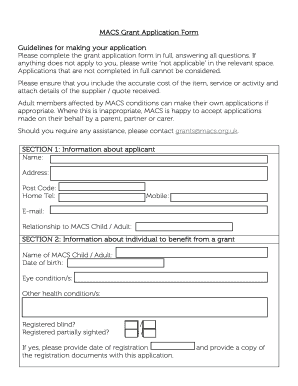

How to fill out UK Millennium Investments Form A03

01

Obtain the UK Millennium Investments Form A03 from the official website or authorized distributor.

02

Carefully read the instructions provided at the beginning of the form.

03

Fill out your personal details in the designated fields, including your full name, address, and contact information.

04

Provide your financial information, including income sources and investment goals.

05

Complete any applicable sections regarding your financial history and experience with investments.

06

Review all the information entered to ensure accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form according to the provided submission guidelines, either electronically or via mail.

Who needs UK Millennium Investments Form A03?

01

Individuals interested in investing through UK Millennium Investments.

02

Potential clients needing to establish their investment profile with the firm.

03

Anyone wishing to participate in investment opportunities offered by UK Millennium Investments.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an assured shorthold tenancy?

An assured shorthold tenancy was created if it had a fixed term of at least six months, no break clause and a landlord served a notice in the prescribed form.

What happens at the end of an assured shorthold tenancy?

Many private tenancies start as fixed term assured shorthold tenancies. Your 3 options at the end of a fixed term are: sign a renewal agreement for a new fixed term. let it become a rolling or periodic tenancy.

What is the difference between tenancy agreement and assured shorthold tenancy?

An assured shorthold tenancy is the most common tenancy if you rent from a private landlord or letting agent. The main feature that makes an AST different from other tenancies is your landlord can evict you without a reason. They must follow the correct procedure to do this.

What makes an assured shorthold tenancy?

What is an assured shorthold tenancy? An assured shorthold tenancy is the most common tenancy if you rent from a private landlord or letting agent. The main feature that makes an AST different from other tenancies is your landlord can evict you without a reason. They must follow the correct procedure to do this.

How do I know if I have an assured shorthold tenancy?

Assured shorthold tenancies ( ASTs ) A tenancy can be an AST if all of the following apply: you're a private landlord or housing association. the tenancy started on or after 15 January 1989. the property is your tenants' main accommodation.

How does a tenant end an assured shorthold tenancy?

A notice to quit must be in writing. The notice period must be at least four weeks, or equivalent to the period of the tenancy if this is longer. The tenant might need to give a longer period of notice if they have a contractual periodic tenancy and this is specified in the contract.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my united kingdom tenancy agreement directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign united kingdom tenancy agreement and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute united kingdom tenancy agreement online?

pdfFiller makes it easy to finish and sign united kingdom tenancy agreement online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit united kingdom tenancy agreement on an iOS device?

Use the pdfFiller mobile app to create, edit, and share united kingdom tenancy agreement from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is UK Millennium Investments Form A03?

UK Millennium Investments Form A03 is a regulatory document used for reporting specific investment activities in the UK to ensure compliance with legal and financial regulations.

Who is required to file UK Millennium Investments Form A03?

Entities and individuals engaged in certain investment activities that fall under the purview of UK financial regulations are required to file UK Millennium Investments Form A03.

How to fill out UK Millennium Investments Form A03?

To fill out UK Millennium Investments Form A03, provide accurate information as required in each section of the form, including personal or entity details, investment activities, and supporting documentation, and ensure to review the form for completeness before submission.

What is the purpose of UK Millennium Investments Form A03?

The purpose of UK Millennium Investments Form A03 is to collect data on investment activities to promote transparency and regulatory compliance in the financial market.

What information must be reported on UK Millennium Investments Form A03?

The information that must be reported on UK Millennium Investments Form A03 includes personal or entity identification details, descriptions of investment activities, financial data related to investments, and any relevant disclosures as mandated by UK regulations.

Fill out your united kingdom tenancy agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

United Kingdom Tenancy Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.