Get the free Personal Assets Trust Zero Charge ISA Transfer Form

Show details

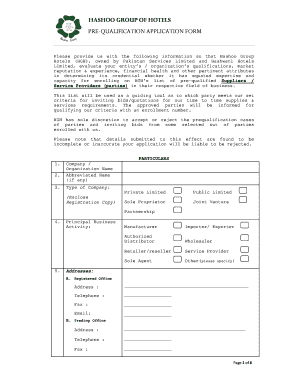

This form is intended for investors wishing to transfer their existing ISA from another manager to The Personal Assets Trust ISA. It requires personal details, information about the previous ISA manager,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal assets trust zero

Edit your personal assets trust zero form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal assets trust zero form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal assets trust zero online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal assets trust zero. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal assets trust zero

How to fill out Personal Assets Trust Zero Charge ISA Transfer Form

01

Obtain the Personal Assets Trust Zero Charge ISA Transfer Form from the official website or your financial advisor.

02

Fill in your personal details such as name, address, date of birth, and National Insurance number.

03

Provide details of your existing ISA account that you wish to transfer, including account number and provider's name.

04

Indicate the amount or types of ISA you wish to transfer (Cash ISA, Stocks and Shares ISA, etc.).

05

Read and agree to any terms and conditions stated in the form.

06

Sign and date the form to authorize the transfer.

07

Submit the completed form to your new ISA provider, who will handle the transfer process.

Who needs Personal Assets Trust Zero Charge ISA Transfer Form?

01

Individuals who want to transfer their existing ISA investments to the Personal Assets Trust Zero Charge ISA for potentially better management or lower fees.

02

People looking for a tax-efficient savings or investment option to grow their personal assets.

Fill

form

: Try Risk Free

People Also Ask about

What is an ISA transfer?

You can transfer all or part of the savings in your Individual Savings Account ( ISA ) from one provider to another at any time. It can be to a different type of ISA or the same type. The investment can have been made this year or in previous years.

What does an ISA stand for?

ISA stands for Individual Savings Account. ISAs are a tax-efficient way to save and invest your money.

What is an ISA form?

About. The Interdepartmental Service Agreement (ISA) is the contract that documents the business agreement (joint venture) between two Commonwealth departments within any branch of state government.

What is an ISA transfer form?

When you move your savings from one ISA account to another, it's called an ISA transfer. That might mean moving an ISA from one bank or building society to a different one, or just moving your savings from one kind of ISA to another one - say moving savings from a cash ISA to a stocks and shares ISA.

How to transfer from stocks and shares ISA to cash ISA?

How to transfer on the website Log in to your account. Select 'Stocks and Shares ISA'. Select the 'Cash' tab. Under 'Manage cash on your account' select 'Transfer money'. Next to HL Cash ISA, select 'Transfer money'. Enter the amount you wish to transfer and select 'Next'.

What is an ISA transfer authority form?

If you wish to transfer ISAs from different providers, you must complete an authority form for each transfer request. Transferring your Cash ISA from one institution to another can take up to 15 business days. Please note the transfer of Stocks & Shares ISAs may take longer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Assets Trust Zero Charge ISA Transfer Form?

The Personal Assets Trust Zero Charge ISA Transfer Form is a document used to initiate the transfer of an Individual Savings Account (ISA) from one provider to the Personal Assets Trust without incurring any fees.

Who is required to file Personal Assets Trust Zero Charge ISA Transfer Form?

Individuals who wish to transfer their existing ISA holdings to the Personal Assets Trust are required to file the Personal Assets Trust Zero Charge ISA Transfer Form.

How to fill out Personal Assets Trust Zero Charge ISA Transfer Form?

To fill out the form, applicants must provide personal information such as their name, address, National Insurance number, details of the ISA being transferred, and instructions for the transfer.

What is the purpose of Personal Assets Trust Zero Charge ISA Transfer Form?

The purpose of the form is to facilitate the transfer of ISA assets to the Personal Assets Trust while ensuring that the transfer is completed without any charges or penalties.

What information must be reported on Personal Assets Trust Zero Charge ISA Transfer Form?

The form must report the applicant's personal details, current ISA provider information, account numbers, and the amount or assets to be transferred.

Fill out your personal assets trust zero online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Assets Trust Zero is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.