Get the free GIFT AID DECLARATION FORM

Show details

This form is used to allow donors to declare their donations as Gift Aid, enabling the charity to reclaim tax on those donations, thus increasing the total amount received by the charity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift aid declaration form

Edit your gift aid declaration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift aid declaration form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift aid declaration form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift aid declaration form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift aid declaration form

How to fill out GIFT AID DECLARATION FORM

01

Obtain the GIFT AID DECLARATION FORM from your charity or download it from their website.

02

Fill in your personal details, including your name and address.

03

Include your postcode to help the charity verify your details.

04

Confirm that you are a UK taxpayer by marking the appropriate box.

05

State which donations you want to apply the Gift Aid to, whether it's for one-off donations or regular payments.

06

Sign and date the form to confirm your agreement.

Who needs GIFT AID DECLARATION FORM?

01

Individuals who are UK taxpayers and wish to donate to charity.

02

Anyone who makes a donation to a charity that is registered for Gift Aid.

03

Donors who want their charity donations to be increased by 25% at no extra cost.

Fill

form

: Try Risk Free

People Also Ask about

How to complete gift aid form?

Completing a Gift Aid Declaration To fill out the form, you'll need to provide basic personal details such as your full name, home address, and postcode. It's also essential to include the date, which confirms when the declaration is made. The declaration form typically includes: The donor's full name.

How do you process Gift Aid?

In order to claim online you need to: Get recognised as a charity or CASC by HMRC (if you haven't already) Check you have the right information from the donor(s) Register for Charities Online. Compile a spreadsheet with details of donations. Submit your claim.

What if I forgot to add Gift Aid?

That's okay, if your donation is eligible for Gift Aid and you contact us within two weeks of a donation we can happily add your claim.

How do sponsorship forms work?

A sponsorship form is essential when holding a charity event or participating in one. It's a good way of collating donations and keeping track of who's pledged money to support. If you're hosting a charity event, like a sponsored 5K run, then you should provide runners with these forms months in advance.

Can you claim gift aid on Legacies?

No. Gift Aid is restricted to gifts out of income and a legacy is paid out of the estate which is considered to be capital not income.

How do you calculate Gift Aid?

To do this, you need to use a 'grossing up' fraction. Take a £100 donation as an example. The fraction applied to calculate Gift Aid is 100 x 20/80.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GIFT AID DECLARATION FORM?

The GIFT AID DECLARATION FORM is a document used by charities in the UK to claim additional funds from the government through tax relief on donations made by individuals.

Who is required to file GIFT AID DECLARATION FORM?

Individuals who make donations to registered charities and wish for the charity to reclaim tax on their donations are required to file a GIFT AID DECLARATION FORM.

How to fill out GIFT AID DECLARATION FORM?

To fill out the GIFT AID DECLARATION FORM, provide your personal details, including name and address, confirm that you are a UK taxpayer, and specify which donations the declaration covers.

What is the purpose of GIFT AID DECLARATION FORM?

The purpose of the GIFT AID DECLARATION FORM is to enable charities to claim back 25p for every £1 donated by taxpayers, enhancing the value of donations without additional cost to the donor.

What information must be reported on GIFT AID DECLARATION FORM?

The information required on the GIFT AID DECLARATION FORM includes the donor's name, address, confirmation of taxpayer status, the charity's name, and details of the donations made or to be made.

Fill out your gift aid declaration form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Aid Declaration Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

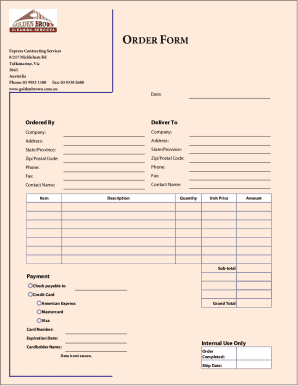

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.