Get the free revolving credit mortgage forms for florida

Show details

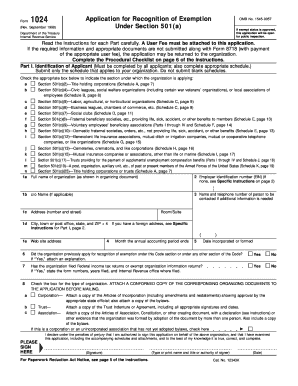

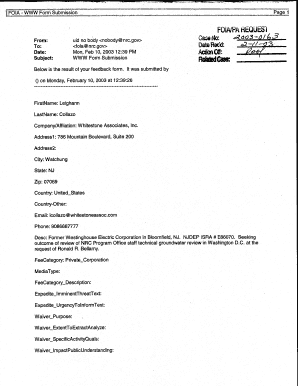

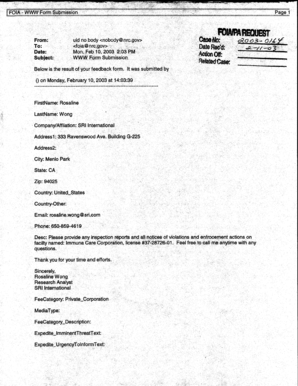

FOR RECORDING PURPOSES Remove stub at perforation and staple form in upper left corner. REVOLVING CREDIT MORTGAGE WHEN RECORDED MAIL TO PARCEL ID NUMBER SPACE ABOVE THIS LINE FOR RECORDER S USE THIS MORTGAGE CONTAINS A DUE-ON-SALE PROVISION AND SECURES INDEBTEDNESS UNDER A CREDIT AGREEMENT WHICH PROVIDES FOR A REVOLVING LINE OF CREDIT AND MAY CONTAIN A VARIABLE RATE OF INTEREST. Lender has agreed to make advances to Borrower under the terms of th...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revolving credit mortgage forms

Edit your revolving credit mortgage forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revolving credit mortgage forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revolving credit mortgage forms online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit revolving credit mortgage forms. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revolving credit mortgage forms

How to fill out revolving credit mortgage forms:

01

Start by gathering all the necessary documents, such as your identification, income statements, and bank statements.

02

Carefully read through the instructions provided on the forms. Make sure to understand the terms and requirements of the revolving credit mortgage.

03

Begin filling out the personal information section first. This includes your name, address, contact information, and social security number. Double-check for accuracy and legibility.

04

Fill in the financial information section next. This includes your employment details, income sources, and any existing debts or liabilities. Be honest and provide accurate information.

05

Proceed to the property information section. Here, you will need to provide details about the property you are using as collateral for the revolving credit mortgage. This includes the address, property value, and any existing mortgages or liens.

06

Supplement the forms with any additional necessary documentation, such as proof of income, tax returns, or legal documents related to the property.

07

Review the completed forms to ensure accuracy and completeness. Double-check all the information provided, making sure there are no mistakes or missing fields.

08

Sign and date the forms where required. If you have a co-applicant, they will also need to sign and provide their information.

Who needs revolving credit mortgage forms:

01

Individuals or families who are looking for a line of credit secured against their property may need to fill out revolving credit mortgage forms.

02

Those who require flexible access to funds for various expenses, such as home improvements, debt consolidation, or emergency situations, may benefit from a revolving credit mortgage.

03

Homeowners who have built up equity in their property may find revolving credit mortgage forms useful, as they can leverage this equity to obtain a line of credit with potentially favorable terms.

Fill

form

: Try Risk Free

People Also Ask about

How do I use a revolving line of credit to pay off my mortgage?

Alongside making minimum mortgage repayments, you start putting any and all spare cash into your revolving credit – to pay it down quickly. If you stick to the plan you'll pay off the revolving credit and use that money to make a lump-sum payment off your mortgage.

Is it good to have revolving credit?

Revolving credit can boost your credit score if you use it responsibly. To get the most out of revolving credit, make your minimum payments on time. Try to make more than the minimum payment or pay off your balances in full each month to avoid interest charges. And aim to keep your credit utilization ration below 30%.

What does revolving payment mean?

If you're wondering what revolving credit is, you may be more familiar with it than you think. Revolving credit is a type of loan that's automatically renewed as debt is paid. It helps to give cardmembers access to money up to a preset amount, also known as the credit limit.

What is a revolving credit agreement?

Revolving credit is a line of credit that remains open even as you make payments. You can access money up to a preset amount, known as the credit limit. When you pay down a balance on the revolving credit, that money is once again available for use, minus the interest charges and any fees.

What is a revolving 90 day note?

A short-term loan with a maximum maturity of 90 days that carries a different interest rate from the first option.

What does revolving credit mean mortgage?

Revolving credit allows a borrower to spend the money they have borrowed, repay it, and borrow again as needed. Credit cards and credit lines are examples of revolving credit. Examples of installment loans include mortgages, auto loans, student loans, and personal loans.

What is an example of a revolving credit?

Two of the most common types of revolving credit come in the form of credit cards and personal lines of credit.

How does a revolving loan work?

A revolving loan facility is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations.

What is a revolving note?

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

What does a 90-day note mean?

Station Overview. The Notice of Deficiency IRS Letters 3219 and 531 (also referred to as 90-Day Letters), are a taxpayer's legal notice that the IRS is proposing a deficiency (balance due). This notice or letter may include additional topics that have not yet been covered here.

What is a revolving credit mortgage?

A revolving credit mortgage lets you borrow up to your agreed limit whenever you want to. The main advantage it has over other loans is the interest rate. You'll only be charged the variable mortgage rate, which is usually much less than you'd pay for a personal loan or retail finance, such as a car dealer loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get revolving credit mortgage forms?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific revolving credit mortgage forms and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete revolving credit mortgage forms online?

With pdfFiller, you may easily complete and sign revolving credit mortgage forms online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my revolving credit mortgage forms in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your revolving credit mortgage forms and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is revolving credit mortgage forms?

Revolving credit mortgage forms are legal documents used to record and manage revolving credit mortgages, which are loans secured by real estate that allow borrowers to withdraw funds as needed up to a specified credit limit.

Who is required to file revolving credit mortgage forms?

Both lenders and borrowers are required to file revolving credit mortgage forms as part of the loan agreement and documentation process.

How to fill out revolving credit mortgage forms?

To fill out revolving credit mortgage forms, you typically need to provide information about the borrower, property details, loan terms, credit limit, and any specific conditions or requirements of the revolving credit mortgage.

What is the purpose of revolving credit mortgage forms?

The purpose of revolving credit mortgage forms is to establish the terms, conditions, and legal obligations of a revolving credit mortgage loan, as well as to provide a record of the loan agreement.

What information must be reported on revolving credit mortgage forms?

Revolving credit mortgage forms typically require reporting of borrower information, property details, loan terms, credit limit, interest rates, fees, repayment schedules, and any collateral or security requirements.

Fill out your revolving credit mortgage forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revolving Credit Mortgage Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.