Get the free Capped Drawdown Transfer Application Form

Show details

Este documento es un formulario de solicitud para la transferencia de un esquema de pensiones a un SmartSIPP, que incluye secciones para detallar la información personal del inversor, la sección

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capped drawdown transfer application

Edit your capped drawdown transfer application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capped drawdown transfer application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit capped drawdown transfer application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit capped drawdown transfer application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capped drawdown transfer application

How to fill out Capped Drawdown Transfer Application Form

01

Start by downloading the Capped Drawdown Transfer Application Form from the official website or your financial institution.

02

Read through the introduction and instructions carefully to understand the requirements.

03

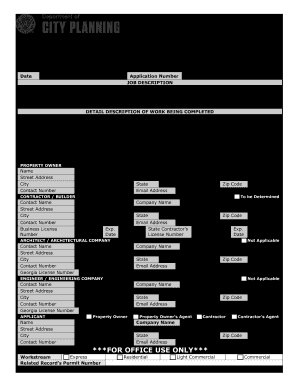

Fill in your personal details, including your name, address, date of birth, and National Insurance number in the designated sections.

04

Provide information about your current pension scheme, including the name of the scheme and your member number.

05

Specify the amount you wish to transfer and the name of the receiving pension provider.

06

Complete any additional sections regarding investment choice and drawdown strategy as specified.

07

Read and sign the declaration at the end of the form, confirming that the information provided is accurate.

08

Gather any required supporting documents, such as identification proof or current pension statements.

09

Submit the completed form and any supporting documents to your current pension provider for processing.

Who needs Capped Drawdown Transfer Application Form?

01

Individuals who are looking to transfer their existing pension funds into a capped drawdown arrangement.

02

People who wish to access their pension savings while still aiming to receive a guaranteed income.

03

Those who have reached retirement age but want to preserve the potential growth of their pension assets.

Fill

form

: Try Risk Free

People Also Ask about

What is the 4 rule for pension drawdown?

The rule states that retirees should take 4% of their fund in the first year of withdrawals, and the same monetary amount (adjusted for the rate of inflation) each year. For example, if your pension pot is worth £500,000, you could withdraw £20,000 in the first year of your retirement.

Can you take tax-free cash from capped drawdown?

Capped drawdown (for schemes in place before 6 April 2015) lets clients take a tax-free lump sum, then continue to invest the remainder within a crystallised pension. A 'capped' (limited) income can be withdrawn from the fund.

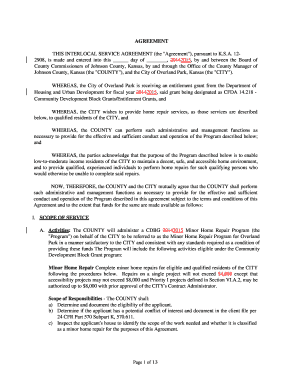

Can you transfer a capped drawdown pension?

Capped drawdown funds can be transferred to a new capped drawdown arrangement in another pension scheme that is willing to accept a capped drawdown transfer. The transfer must be on a 'like for like' basis so the current maximum income limit and review cycle will carry over to the new arrangement.

What are the disadvantages of a drawdown pension?

You could run out of money if you withdraw too much, your investments don't perform as you'd hoped or you live longer than expected. Income isn't secure, it could fall or even stop completely. It's possible you'll get back less than you originally invested, as all investments can fall as well as rise in value.

What is the risk of drawdown?

Risk of Drawdowns The primary risk associated with drawdowns is the uptick in share price needed to overcome that drawdown. If a fund's historical performance shows drawdowns of 1% or less, the price would only need to increase by at most 1.01% to recover to its peak.

What is the average return on a drawdown pension?

The drawdown investor only makes a long-term average return of 3.9% p.a., 4.1% less each year compared to the lump sum investor and 6.7% less each year than the regular saver.

Which is better, an annuity or drawdown?

Which is better – annuity or drawdown? That depends on what's most important to you. As a rule, people choose drawdown products for their flexibility and annuities for their predictability. And it doesn't have to be an either/or pension drawdown vs annuity choice.

Is capped drawdown still available?

Key facts. Since 6 April 2015 it hasn't been possible to take out a new capped drawdown plan. The plan will automatically convert to a flexi-access drawdown plan if income exceeds the maximum amount. Reviews must take place at least every three years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Capped Drawdown Transfer Application Form?

The Capped Drawdown Transfer Application Form is a document used by individuals to request the transfer of their pension benefits from one provider to another under a capped drawdown arrangement.

Who is required to file Capped Drawdown Transfer Application Form?

Individuals who wish to transfer their pension benefits into a capped drawdown product must file this form.

How to fill out Capped Drawdown Transfer Application Form?

To fill out the Capped Drawdown Transfer Application Form, individuals should provide their personal details, details of their existing pension plan, and specify the details of the new pension provider. They may also need to sign to authorize the transfer.

What is the purpose of Capped Drawdown Transfer Application Form?

The purpose of the Capped Drawdown Transfer Application Form is to facilitate the orderly transfer of pension funds from one provider to another while ensuring compliance with regulations governing capped drawdown arrangements.

What information must be reported on Capped Drawdown Transfer Application Form?

The information that must be reported on the Capped Drawdown Transfer Application Form includes the individual's personal information, existing pension details, new pension provider details, and any relevant identification information.

Fill out your capped drawdown transfer application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capped Drawdown Transfer Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.