Get the free Small Business Rate Relief Application

Show details

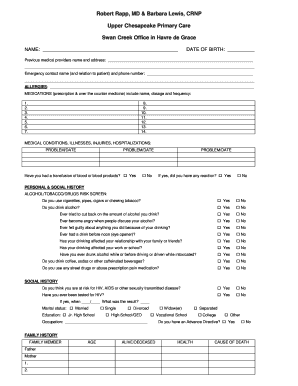

This document is an application form for small businesses seeking relief from non-domestic rates in respect of a property they occupy. It outlines eligibility, required details for submission, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business rate relief

Edit your small business rate relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business rate relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business rate relief online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit small business rate relief. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business rate relief

How to fill out Small Business Rate Relief Application

01

Obtain the Small Business Rate Relief Application form from your local council's website or office.

02

Fill in your business details, including the name, address, and contact information.

03

Provide information about the property for which you are claiming relief, including its use and rateable value.

04

Include details of any other business premises that you own or occupy.

05

Declare the number of employees working at the business.

06

Sign and date the application form to certify that the information provided is accurate.

07

Submit the completed application form to your local council, either online or by mail.

Who needs Small Business Rate Relief Application?

01

Small Business Rate Relief Application is needed by small businesses that occupy a single property with a rateable value under a certain threshold, typically helping to reduce their business rates.

Fill

form

: Try Risk Free

People Also Ask about

What is the small business rate relief for Argyll and Bute?

Small Business Transitional Relief The increase in your rates bill, compared to what you paid on 31st March 2023, will be capped per property at: £600 in 2023/24. £1,200 in 2024/25. £1,800 in 2025/26.

What is the small business rate relief in Sheffield?

Eligible businesses with a rateable value of below £12,000 will receive 100% relief commencing on 1st April 2023. This relief will decrease on a sliding scale of 1% for every £30 of rateable value over £12,000 up to £14,999.

What is the small business rate relief in Brent Council?

Small Business Rate Relief A percentage reduction in the amount payable: Rateable value up to £12,000 – no rates payable. Rateable value between £12,001 and £15,000 – tapered relief between 100% and 0%

What is the small business bonus scheme?

You can get up to 100% non-domestic rates relief through the Small Business Bonus Scheme if all of these are true: the combined rateable value of all your business premises is £35,000 or less. the rateable values of individual premises are £20,000 or less. the property is actively occupied.

What is the small works grant in Brent?

- Small works grant – up to £7,000 in any three year period for repairs to existing adaptations or for works that will deliver significant health gains in homes occupied by vulnerable people including disabled people.

What is the small business rate relief in Brent?

Small Business Rate Relief A percentage reduction in the amount payable: Rateable value up to £12,000 – no rates payable. Rateable value between £12,001 and £15,000 – tapered relief between 100% and 0%

What is the small business rate relief in Birmingham?

Following the 2023 revaluation, the threshold for Small Business Rates relief remained at £12,000. This means that all businesses that are classified as small businesses, that occupy commercial property with a rateable value of £12,000 or less, are eligible to pay no business rates.

What is business rate relief in the UK?

Some businesses in England are eligible for a reduction in their business rates bill. This is called 'business rates relief'. The rules for business rates relief are different if your property is in Scotland, your property is in Wales or your property is in Northern Ireland.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Small Business Rate Relief Application?

Small Business Rate Relief Application is a form that eligible small businesses fill out to apply for a reduction in their business rates, which can lead to significant savings on their annual costs.

Who is required to file Small Business Rate Relief Application?

Small businesses that occupy premises with a rateable value below a certain threshold must file the Small Business Rate Relief Application to receive potential relief on their business rates.

How to fill out Small Business Rate Relief Application?

To fill out the Small Business Rate Relief Application, businesses need to provide details such as their business name, address, rateable value of the property, and any other relevant financial information required by the local council.

What is the purpose of Small Business Rate Relief Application?

The purpose of the Small Business Rate Relief Application is to assist small businesses by reducing their business rates, thereby alleviating financial pressure and promoting business growth.

What information must be reported on Small Business Rate Relief Application?

The application must include information such as the business's name, contact details, rateable value of the property, details of any other properties occupied, and declaration of eligibility for the relief.

Fill out your small business rate relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Rate Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.