Get the free uk discretionary trusts and form w 8ben

Show details

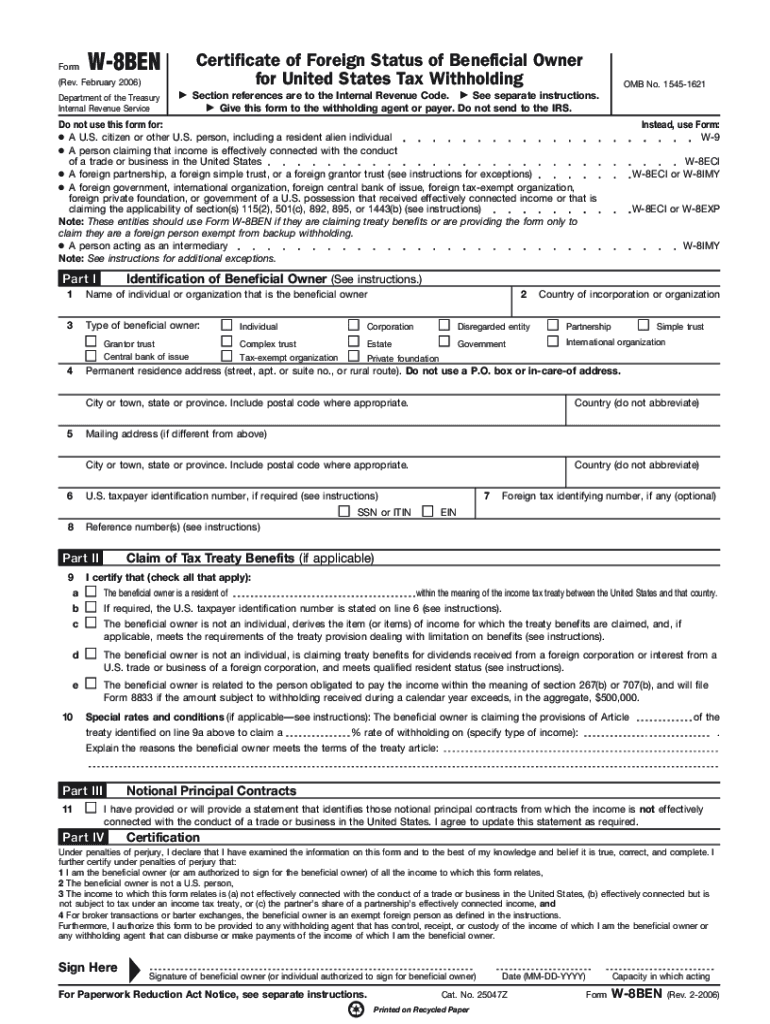

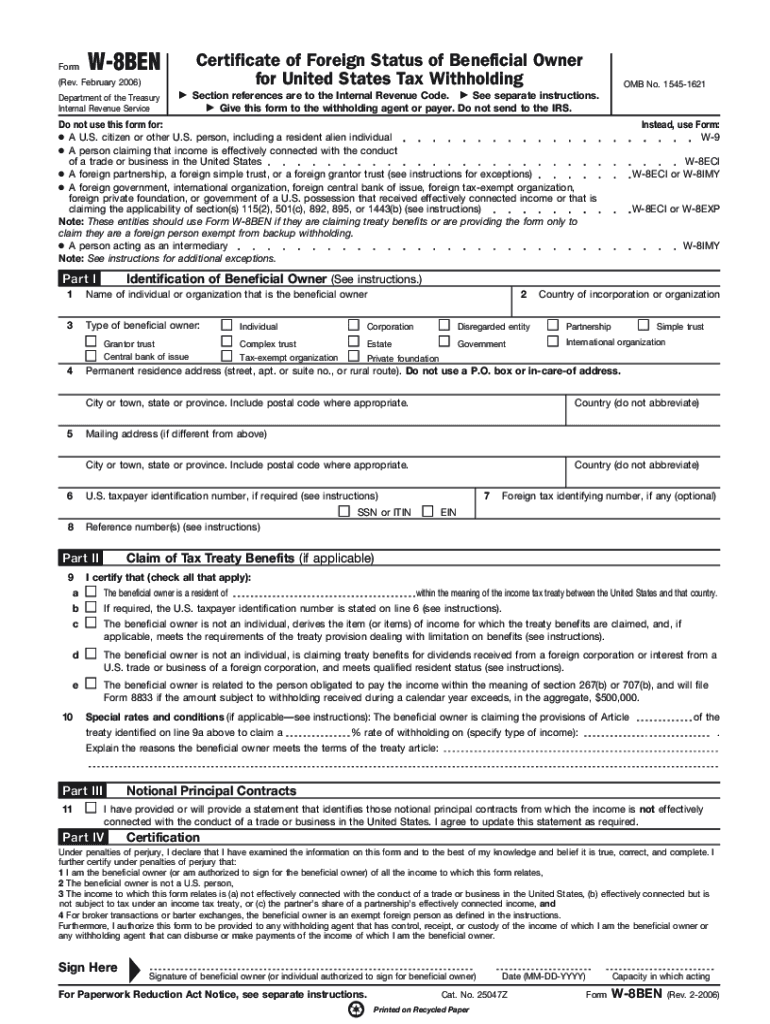

Step by Step completing a W-8beN form for a Complex trust discretionary trust will trust inheritance trust etc. Please complete this form to buy shares listed in the United States and to receive dividends and interest from US and Canadian shares at reduced rates of tax. This form is for UK investors if you are not resident in the UK please see www. hl.co. uk/usshares for further information. Your W8-BEN form is valid for three calendar years afte...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uk discretionary trusts and

Edit your uk discretionary trusts and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uk discretionary trusts and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uk discretionary trusts and online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit uk discretionary trusts and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is a UK company W8 form?

The W-8BEN-E – is an application for your company to be exempted from US tax on trading income under the US:UK tax treaty. This is given to your US customer and held by them on file. It is never sent to the IRS unless requested during a compliance visit.

Who needs to fill out a W8BEN form?

Form W-8BEN is required to be filed with withholding agents, payers, and FFIs by non-resident alien individuals who may be subject to withholding of U.S. taxes at a 30% tax rate on payment amounts received from U.S. sources, regardless of their ability to claim a withholding exemption.

Do foreign companies need to fill out a W8?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

Do UK companies need to complete a w8 form?

If the foreign entity comes from a country within a US tax treaty, such as the UK, they can fill out and submit a W-8BEN-E form. This will exempt them from the US's 30% withholding tax law. Form W-8BEN-E is also called a Certificate of Foreign Status of Beneficial Owner for US Tax Withholding.

What is a W8BEN form for UK residents?

The W-8BEN form lets you benefit from the US Internal Revenue Service (IRS) treaty rate with the UK. This lowers the withholding tax for qualifying dividends and interest from US shares from 30% to 15%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify uk discretionary trusts and without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including uk discretionary trusts and, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get uk discretionary trusts and?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the uk discretionary trusts and in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute uk discretionary trusts and online?

pdfFiller has made filling out and eSigning uk discretionary trusts and easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is uk discretionary trusts and?

UK discretionary trusts are a type of trust arrangement commonly used in the United Kingdom. Unlike other types of trusts, discretionary trusts give the trustees the power to decide how the trust assets are to be distributed among the beneficiaries.

Who is required to file uk discretionary trusts and?

In the United Kingdom, the trustees of a discretionary trust are required to file a UK discretionary trust tax return if the trust has any tax liabilities or income and gains that need to be reported to HM Revenue and Customs (HMRC).

How to fill out uk discretionary trusts and?

To fill out the UK discretionary trust tax return, the trustees must gather all the necessary information regarding the trust's income, gains, and expenses. They must then complete the relevant sections of the tax return form provided by HMRC and submit it along with any required supporting documents.

What is the purpose of uk discretionary trusts and?

The purpose of UK discretionary trusts is to provide a flexible and efficient way of managing and distributing assets. These trusts allow the trustees to have discretion over how and when the beneficiaries receive distributions, which can be particularly useful in mitigating tax liabilities and protecting assets.

What information must be reported on uk discretionary trusts and?

The information that must be reported on a UK discretionary trust tax return includes details of the trust's income, gains, and expenses, as well as information about the beneficiaries, settlor, and trustees. Additionally, any changes to the trust's structure or beneficiaries must also be reported.

Fill out your uk discretionary trusts and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uk Discretionary Trusts And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.