Get the free Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests - ...

Show details

This form can be used to authorise a financial adviser firm to submit investment alteration requests on Pru Flexible Retirement Plans, allowing changes to investment strategy and instructions for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pru flexible retirement plan

Edit your pru flexible retirement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pru flexible retirement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pru flexible retirement plan online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pru flexible retirement plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pru flexible retirement plan

How to fill out Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests

01

Obtain the Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests form.

02

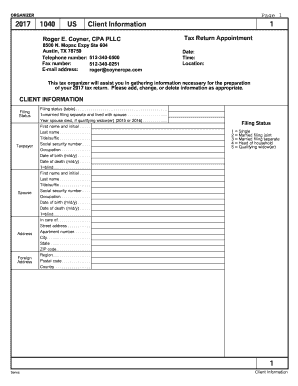

Fill in your details, including your full name, address, and contact information.

03

Provide your Pru Flexible Retirement Plan account number.

04

Specify the investments you want to alter, including any products or funds involved.

05

Clearly state the reason for the alteration request, providing any necessary context.

06

Include any additional documentation or information required for processing your request.

07

Review the completed form to ensure all information is accurate and complete.

08

Sign and date the form to authorize your request.

09

Submit the form to the relevant Pru department, either by mail or electronically, as instructed.

Who needs Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests?

01

Advisers managing Pru Flexible Retirement Plans on behalf of clients who wish to make changes to their investment allocations.

Fill

form

: Try Risk Free

People Also Ask about

What is a Prudential Flexible investment Plan?

The Prudential Investment Plan is an investment bond that lets your client invest their money in a range of different funds and to cash it in at any time.

What are the top 5 performing mutual funds?

Best-performing U.S. equity mutual funds TickerName5-Year Return (%) PRISX T. Rowe Price Financial Services 21.63% FNARX Fidelity Natural Resources Fund 21.41% FIDSX Fidelity Select Financials Port 21.35% FSHOX Fidelity Select Construction and Housing 21.29%4 more rows • May 29, 2025

Is Prudential Financial a good investment?

The Prudential Financial Inc stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock.

What is a prudential personal retirement plan?

The Prudential Personal Pension Plan is a pension arrangement which allows you to flexibly save for retirement in a tax- efficient way.

What is the best prudential fund to invest in?

Top Performing Prudential Pension Funds Pru Asia Pacific Pension Fund. Pru Dynamic Growth Pension Fund. Pru European Equity Pension Fund. Pru Japanese Pension Fund. Pru UK Equity Index Pension. Pru Managed Pension Fund. Pru PruFund Planet 5 Pension Fund. Pru Risk Managed Active 4 Pension Fund.

What is the best fund to invest in now?

List of Best Mutual Funds in India sorted by Returns ICICI Prudential Infrastructure Fund. EQUITY Sectoral-Infrastructure. Motilal Oswal Midcap Fund. EQUITY Mid Cap. SBI PSU Fund. Invesco India PSU Equity Fund. Bandhan Infrastructure Fund. Quant Small Cap Fund. Canara Robeco Infrastructure Fund. Franklin Build India Fund.

Which investment fund has highest return?

Top 10 Best-Performing Mutual Funds: 10-Year Analysis SymbolName10 Year Total NAV Returns (As of: January 31, 2025) FSELX Fidelity Select Semiconductors Portfolio 906.1% FELAX Fidelity Advisor Semiconductors Fund A 860.7% FADTX Fidelity Advisor Technology Fund A 598.6% FSPTX Fidelity Select Technology Portfolio 568.8%6 more rows • May 21, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

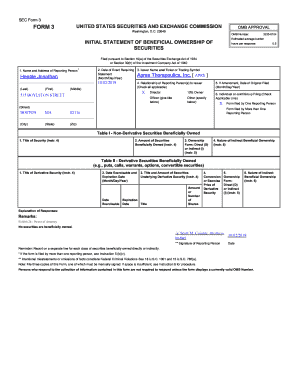

What is Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests?

The Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests is a document that grants financial advisers the authority to make changes to investment allocations within a client's retirement plan, allowing for adjustments tailored to the client's needs.

Who is required to file Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests?

Clients of the Pru Flexible Retirement Plan who wish to authorize their financial adviser to alter investment allocations or make changes on their behalf are required to file this request.

How to fill out Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests?

To fill out the Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests, clients must provide their personal information, the details of their financial adviser, and specify the alterations they wish to authorize. The form must be signed and dated by the client.

What is the purpose of Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests?

The purpose of the Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests is to formalize the client's consent for their adviser to manage and alter their investment choices in the plan, ensuring that the requests are duly documented and authorized.

What information must be reported on Pru Flexible Retirement Plan Adviser Authority for Investment Alteration Requests?

The information that must be reported includes the client's full name, account number, adviser's details, specific investment alterations being requested, and the client's signature to confirm the authorization.

Fill out your pru flexible retirement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pru Flexible Retirement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.