Get the free Entry Form 2010

Show details

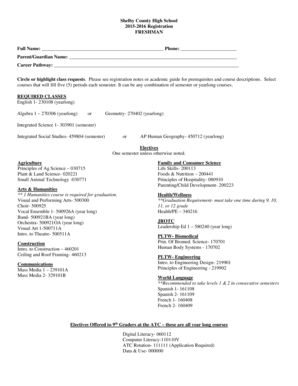

This document is a registration form for participants of the Little Britain Challenge Cup 2010, detailing the registration process, required fees, and event participation guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign entry form 2010

Edit your entry form 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your entry form 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing entry form 2010 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit entry form 2010. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out entry form 2010

How to fill out Entry Form 2010

01

Obtain a copy of the Entry Form 2010 from the appropriate source.

02

Read the instructions carefully to understand the required information.

03

Fill out personal details such as name, address, and contact information.

04

Provide any necessary identification or reference numbers as requested.

05

Complete the specific sections related to your entry, including category and description.

06

Review your completed form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the form by the specified method, whether online or via mail.

Who needs Entry Form 2010?

01

Individuals or organizations entering a competition or event.

02

Participants applying for specific programs or grants that require this form.

03

Anyone required to register their details for record-keeping purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is form 2210 used for?

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish to include the penalty on your return.

How do I skip form 2210 on TurboTax?

You can delete the Form 2210 by selecting "Delete Form" when you have the form open. To avoid having TurboTax calculate the penalty, you could go to the Underpayment Penalties section under Other Tax Situations, Additional Tax Payments, and start or update the questionnaire.

Can the IRS waive the penalty for underpayment?

The law allows the IRS to waive the penalty if: You didn't make a required payment because of a casualty event, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or.

What is the personal exemption for 2010?

For 2010, each personal exemption you can claim is worth $3,650, the same as in 2009. For 2010, the Standard Deduction for married taxpayers filing a joint return is $11,400, the same as in 2009. For Single filers, the amount is $5,700 in 2010, up by $250 over 2009.

Why is TurboTax asking me for form 2210?

Key Takeaways You may need to file Form 2210 as part of your tax return if your federal tax withholdings and timely payments are not equal to 90% of your current year tax or 100% of the total tax from the prior year (whichever is less).

What if I don't have a form 2210?

You are not required to file Form 2210 if you underpaid taxes during the tax year. Completing the form will recalculate your amount owed to include your underpayment penalty. However, If you do not complete the form, the IRS will send you a letter detailing your underpayment penalties after your return is processed.

Is form 2210 necessary?

For most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the prior year (whichever is less), then you may need to complete Form 2210 to determine if you are required to pay an underpayment penalty.

What triggers an underpayment penalty from the IRS?

You'll face an underpayment penalty if you: Didn't pay at least 90% of the tax on your current-year return or 100% of the tax shown on the prior year's return. Paid your estimated taxes late.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Entry Form 2010?

Entry Form 2010 is a specific document required for reporting certain information to regulatory authorities, typically related to financial disclosures or compliance.

Who is required to file Entry Form 2010?

Organizations and individuals who meet specific criteria set by the regulatory body overseeing the filing process are required to file Entry Form 2010.

How to fill out Entry Form 2010?

To fill out Entry Form 2010, individuals or organizations must provide accurate information as requested on the form, usually including identification details, financial data, and any other relevant disclosures.

What is the purpose of Entry Form 2010?

The purpose of Entry Form 2010 is to ensure transparency and compliance with regulatory requirements by collecting necessary information from filers.

What information must be reported on Entry Form 2010?

The information that must be reported on Entry Form 2010 generally includes identification details, financial statements, and any specific disclosures required by the regulatory authority.

Fill out your entry form 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Entry Form 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.