Get the free Cash ISA Conversion Application Form

Show details

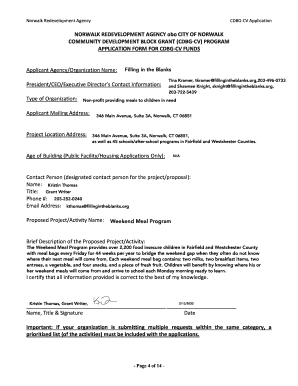

This document is an application form for converting a Cash ISA Plus or Cash ISA TESSA Funds account to an Ulster Bank Cash ISA.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash isa conversion application

Edit your cash isa conversion application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash isa conversion application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cash isa conversion application online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cash isa conversion application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash isa conversion application

How to fill out Cash ISA Conversion Application Form

01

Obtain the Cash ISA Conversion Application Form from your bank or financial institution.

02

Fill in your personal details, including your name, address, and contact information.

03

Indicate the amount you wish to convert from your current Cash ISA to a new Cash ISA.

04

Provide your existing Cash ISA account details, including the account number and the institution holding it.

05

Review the terms and conditions associated with the conversion and agree to them.

06

Sign and date the form to authorize the conversion process.

07

Submit the completed form to your bank or financial institution either online or by post.

Who needs Cash ISA Conversion Application Form?

01

Individuals who want to convert their existing Cash ISA to another Cash ISA account.

02

People looking to take advantage of a better interest rate or features offered by a different Cash ISA provider.

03

Those who have reached their annual subscription limit and wish to transfer their funds without affecting their new ISA allowance.

Fill

form

: Try Risk Free

People Also Ask about

How do I transfer my cash ISA to another bank?

Contact the provider of the Cash ISA you want to transfer to. Complete the ISA transfer form they provide you with (this is either a paper form or online form).

Which cash ISAs does Martin Lewis recommend?

MoneySavingExpert (MSE), Martin Lewis' renowned website, currently ranks Chip as the top choice for an easy access Cash ISA, boasting an attractive 5% return, which includes a bonus of 0.68% for the first six months. Other notable rates include Tembo's 4.8%, and Trading212's competitive 4.78% Cash ISA.

What is an ISA declaration form?

What is an ISA Declaration? An ISA Declaration is how you confirm you're eligible for all the benefits that come with a cash ISA.

Is there an ISA for over 60s?

“A cash ISA is a popular option for anyone over 60 as it's a safe way to save money and it has the added bonus of tax-free interest up to £20,000.

Is it worth having a cash ISA now?

For short-term goals such as an emergency fund or a holiday, ISAs and savings accounts can still be a good place to save up. For long-term savings such as retirement, however, you should consider investing to help your money grow over time.

What is an ISA transfer form?

When you move your savings from one ISA account to another, it's called an ISA transfer. That might mean moving an ISA from one bank or building society to a different one, or just moving your savings from one kind of ISA to another one - say moving savings from a cash ISA to a stocks and shares ISA.

What does Martin Lewis say about cash ISAs?

"For me, if you want more people to invest, we should be doing a proper national education programme about what investing is and how you do it, and improving people's capability on it; not just cutting the cash ISA limit, which I think, personally, will probably just mean many savers will pay more tax on their savings.

Why should you ditch cash ISA?

Normal savings beat cash ISAs for most. If you won't make this much interest, you won't pay any tax, so should focus on moving your money to the highest interest rate, which is usually in a Top Savings Account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cash ISA Conversion Application Form?

The Cash ISA Conversion Application Form is a document that allows account holders to convert their existing Cash Individual Savings Account (ISA) to a different type of ISA, such as a Stocks and Shares ISA, under the rules set by the UK government.

Who is required to file Cash ISA Conversion Application Form?

Individuals who wish to convert their existing Cash ISA to another type of ISA must file the Cash ISA Conversion Application Form. This includes those who have met the annual contribution limits and wish to transfer their funds to a different ISA provider.

How to fill out Cash ISA Conversion Application Form?

To fill out the Cash ISA Conversion Application Form, provide personal details such as your name, address, and National Insurance number. Then, specify the details of the existing Cash ISA and the type of ISA you wish to convert to. Finally, sign and date the form to authorize the conversion.

What is the purpose of Cash ISA Conversion Application Form?

The purpose of the Cash ISA Conversion Application Form is to facilitate the process of transferring funds from a Cash ISA to another type of ISA, allowing individuals to manage their savings more effectively and take advantage of different investment options.

What information must be reported on Cash ISA Conversion Application Form?

The Cash ISA Conversion Application Form must report personal information of the account holder, details of the current Cash ISA, the desired type of ISA for conversion, and authorization for the conversion process.

Fill out your cash isa conversion application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Isa Conversion Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.