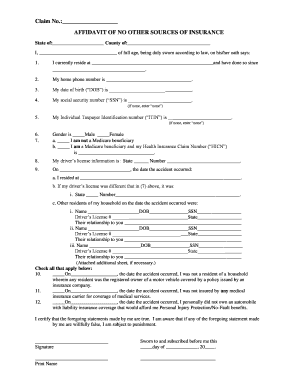

Get the free affidavit of no car insurance sample

Show details

Decision Point Review & Recertification Requirements IMPORTANT NOTICE INTRODUCTION At GEICO, we understand that when you purchase an automobile insurance policy, you are buying protection and peace

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit of no insurance sample form

Edit your affidavit of no excess insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit of no excess insurance sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit of no insurance online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit affidavit of no excess insurance form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit of no car

How to fill out affidavit of no insurance:

01

Obtain a copy of the affidavit form from the appropriate authority or download it from their website.

02

Carefully read the instructions provided on the form to ensure understanding of the requirements and legal obligations.

03

Fill in your personal information accurately, including your full name, address, and contact details.

04

Provide any relevant identification numbers, such as your driver's license or social security number, if required.

05

Declare under oath that you currently do not have any insurance coverage by signing and dating the affidavit.

06

Depending on the specific requirements, you may need to provide additional supporting documents, such as a letter from an insurance company confirming the cancellation of your policy.

07

Review the completed form for any errors or omissions before submitting it.

Who needs affidavit of no insurance:

01

Individuals involved in legal proceedings who are required to provide evidence of their insurance status.

02

Applicants for certain licenses or permits that require documentation of insurance coverage.

03

Parties involved in accidents or incidents where insurance information is necessary for a claim or legal dispute.

04

Some government agencies may require individuals to submit an affidavit of no insurance for specific purposes, such as when applying for public benefits or assistance programs.

05

The specific requirements may vary depending on the jurisdiction and the purpose for which the affidavit is required.

Fill

form

: Try Risk Free

People Also Ask about

What does non owner mean?

non·own·er ˌnän-ˈō-nər. plural nonowners. : one who is not the owner of something.

Do you need insurance if you have a license but no car in Florida?

Every state except New Hampshire and Virginia mandates a minimum amount of liability insurance you need to have to drive your car. You can't own and operate a vehicle without insurance. But, if you don't have a car, you have no vehicle to insure.

What is a non driver on GEICO insurance?

Non-owner car insurance, also known in the industry as non-driver insurance, offers liability coverage when you're driving a car you don't own and you cause an accident. Just like regular liability insurance, non-owner car insurance covers vehicle repairs and medical care for the other driver involved in the accident.

What is the declaration page for car insurance GEICO?

What is a declaration page for car insurance? An important component of a car insurance policy is a standard declarations (or "dec") page that provides the most important information about your personal insurance policy, for example: The named insured (i.e. the main policyholder) and any additional insureds.

How do I get a letter of experience from GEICO?

All you have to do to get a letter of experience is ask your insurance company. Don't worry if you haven't been insured for a couple of years. You can still call your last insurance company and ask for one.

How do I submit documents to GEICO?

You can always go online or through the mobile app to upload your report. Just log into your claim, select documents or paperwork and easily upload the report to your claim file.

Where do I find the declaration page on GEICO?

Click on the 'Manage Policy' button. On the top right, click on 'Policy Documents. ' Within “Other Documents,” you should see a line for the “Declaration Page.”

Where can I find declaration pages?

The declaration page is usually the first page of your policy, and you should receive a new declaration page for each renewal period. If you don't have a declaration page, request a new one from your agent or look at your insurance company's online insurance portal for a copy.

How long does GEICO take to investigate claims?

You're working with GEICO now! We can't pretend that the car insurance claims process is fun, but we can promise you we'll make it as hassle-free as possible. In fact, your claim may be settled in as little as 48 hours. We're proud to offer you personal attention around the clock.

How do I receive money from Geico?

Receive your claim payment fast in a few easy steps. Step 1 Verify Your Identity. Step 2 Select Payment Option. Step 3 Provide Account Information. Step 4 Confirm Payment Selection. Step 5 View Payment Confirmation.

What is the grace period for Geico?

Geico has a nine-day grace period if you can't make your payment on time. After that, your policy might be canceled. Geico does not have a late payment fee, but if you miss a payment, they will send a formal cancellation notice within 14 days of the original due date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send affidavit of no car for eSignature?

Once your affidavit of no car is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete affidavit of no car online?

Completing and signing affidavit of no car online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete affidavit of no car on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your affidavit of no car by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is affidavit of no insurance?

An affidavit of no insurance is a legal document that states an individual or entity does not have any insurance coverage for a specific period of time or for a specific purpose.

Who is required to file affidavit of no insurance?

Typically, individuals or businesses that are required to provide proof of insurance but do not have any coverage at the time are required to file an affidavit of no insurance.

How to fill out affidavit of no insurance?

To fill out an affidavit of no insurance, one must provide personal information, clearly state that no insurance coverage exists, and sign the document in the presence of a notary public.

What is the purpose of affidavit of no insurance?

The purpose of the affidavit of no insurance is to provide a formal declaration that an individual or entity does not currently hold an insurance policy, often required for legal or official purposes.

What information must be reported on affidavit of no insurance?

The affidavit must include the individual's or business's name, address, a statement confirming no insurance coverage, dates of the period without insurance, and the signer’s signature and date.

Fill out your affidavit of no car online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Of No Car is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.